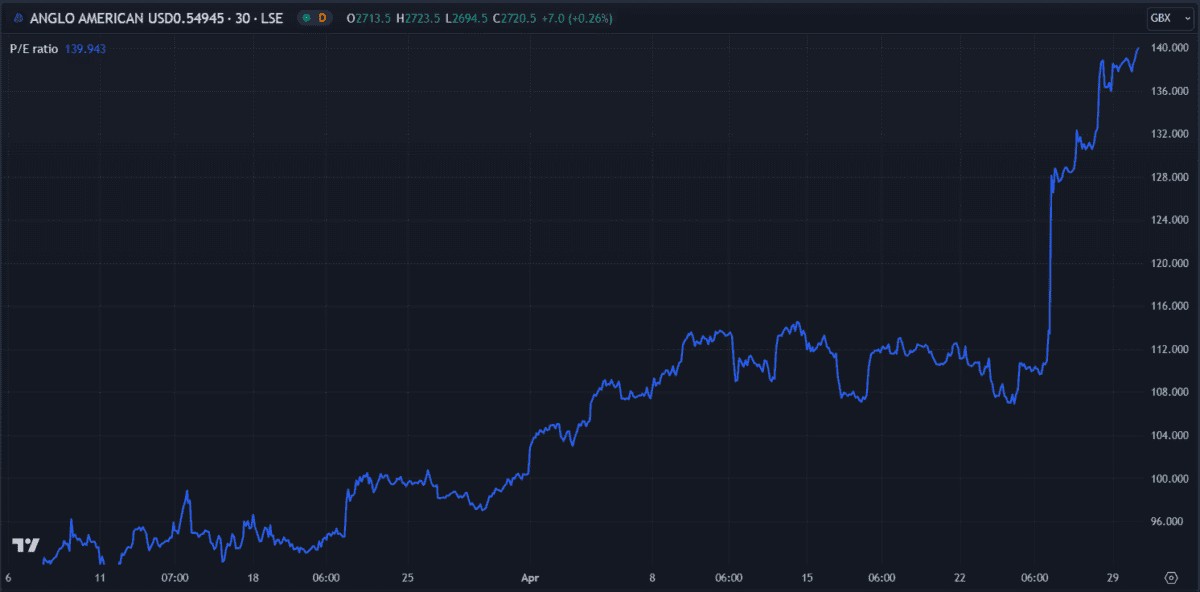

The UK stock market is having one of its best years to date as leading British companies continue to thrive. Popular mining firm Anglo American (LSE:AAL) rose 21% this past week, following one major bid rejection and news of other possible offers from Rio Tinto or Glencore.

NatWest Group was second-strongest to help drive the gains, climbing 11% in seven days and nearing a fresh five-year high. The high street bank has now recovered almost all the losses it incurred throughout last year – and in half the amount of time.

Barclays, Ashtead Group and AstraZeneca made up the rest of the top five weekly performers, each adding around 9.5%.

Should you invest £1,000 in Anglo American right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Anglo American made the list?

FTSE 100 taking the lead

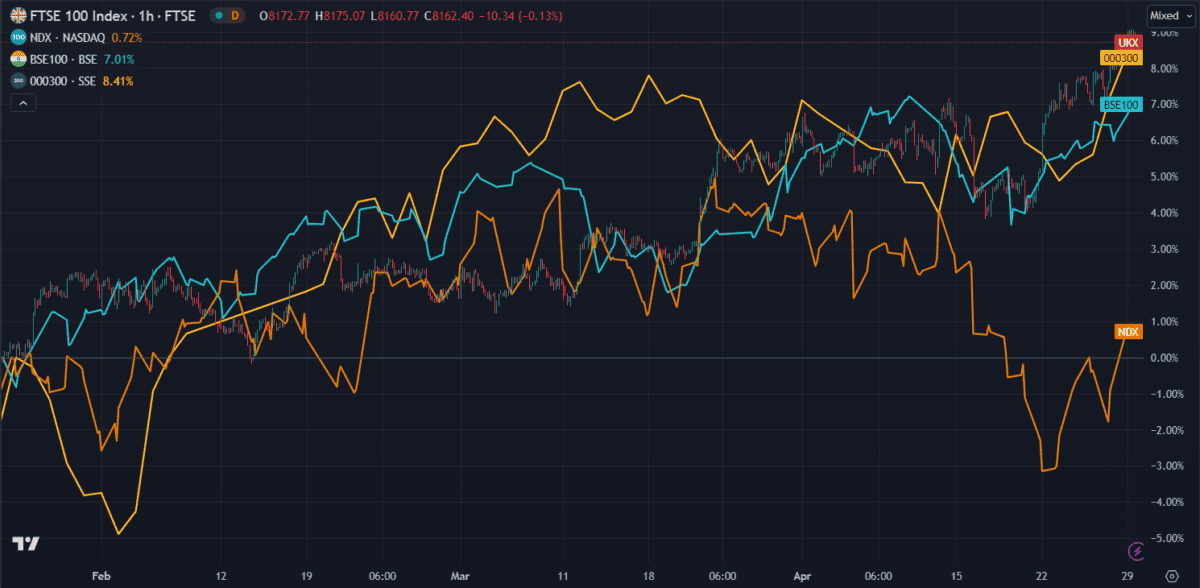

Reaching 8,189 points in late Monday trading, the FTSE 100 is making headlines globally. The sudden growth means the UK’s core index has outperformed several global indexes year-to-date.

The move didn’t go unnoticed by asset manager AJ Bell, stating: “Shifting 0.4% higher to 8,175, it means the FTSE 100’s year-to-date performance (+5.7%) is now better than the Nasdaq 100 in the US (+5.3%), the S&P BSE 100 in India (+5.2%) and the CSI 300 in China (+4.5%).“

With Anglo American leading the charge, let’s look at what’s driving the company’s fortunes.

Another day, another deal

Anglo appears to be in the crosshairs of several suitors lately, with news of potential buyouts coming in fast and furious. The latest was a £31bn bid from Melbourne-based BHP Group, which it rejected, claiming it “significantly undervalues the company“. The Australian mining giant is now considering countering with an improved bid.

Anglo is also considering selling its diamond unit De Beers. However, with diamond prices in the doldrums following the rise of lab-grown replicas, it might be difficult to offload. These not-easily-indistinguishable gems cost approximately one-fifth of natural stones.

What do the numbers say?

With Anglo’s share price now so high, its price-to-earnings (P/E) ratio has skyrocketed to 140. In the same period, earnings have declined, leaving the company with limited cash flow. This makes its dividend payments appear a little rocky. With earnings per share (EPS) at 23p, it brings into question how long the company can keep paying an annual dividend of 64p per share.

The bottom line

Earnings woes aside, Anglo still boasts a solid balance sheet. At £53bn, the value of its total assets rack up to almost double its liabilities. And with around £13.5bn in debt and over £25bn in equity, it has 12 times interest coverage and no immediate debt concerns.

However, while the Anglo share price is currently riding on the coattails of lucrative buyout offers, it may be primed for a correction soon. With earnings and revenue in decline, the consensus among analysts is an average 12 month price target of £23.40 – an 11% decline from current levels.

Of course, if it does accept a bid then some short-term growth would be expected. But losing Anglo American to a foreign competitor would be a big blow to the UK stock market, particularly with Shell already eyeing the NYSE.

Fortunately, the FTSE 100 is still enjoying strong support from homegrown heroes like Rolls-Royce, Barclays and NatWest.