Despite its crazy 490% rise in just over 18 months, I’m still bullish on the Rolls-Royce (LSE: RR) share price. The big turnaround under the new(ish) CEO still seems to have quite a way to go.

However, it’s important I don’t just see things through rose-tinted spectacles. There are risks to the bull case, and here I’ll consider three of them.

An earnings miss

The past 18 months have seen the FTSE 100 company breeze past earnings expectations set by City analysts. Guidance has been sunny and overall commentary from management very upbeat.

Consequently, the shares has surged higher and brokers have been busily upping their estimates and price targets. Meanwhile, net debt was £1.9bn at the end of 2023, down from £3.2bn the year before.

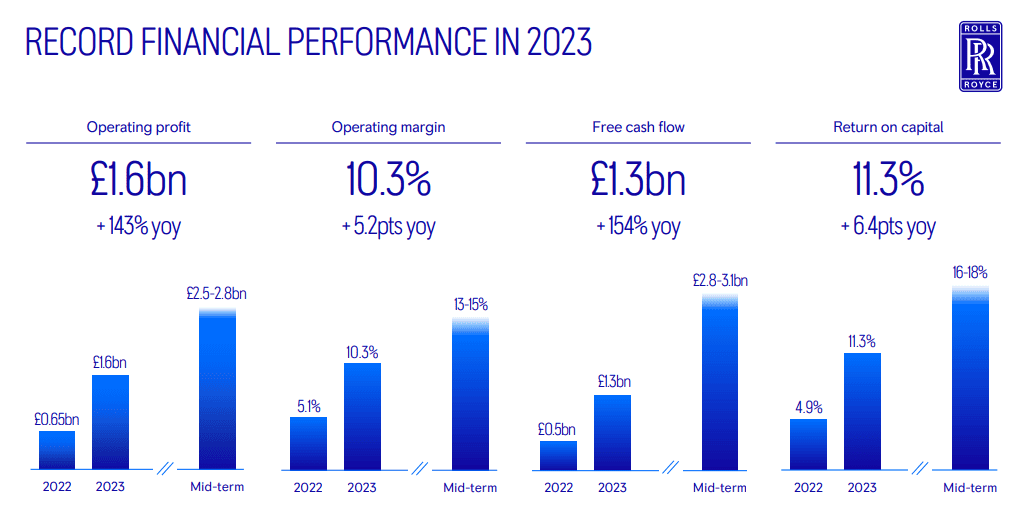

The image below shows how everything is progressing splendidly, with block chart numbers trending from the bottom left up to the top right. As a shareholder, that’s exactly what I want to see.

However, what if there is an earnings miss? Or mid-term guidance is revised downwards?

I don’t think this will happen given the tailwinds of a recovering global aviation market and increasing defence spending. But it’s not beyond the realms of possibility and could knock the share price badly.

As a reminder, the company expects underlying operating profit of £1.7bn-£2bn in 2024, with free cash flow rising to £1.7bn-£1.9bn. These are the key figures to watch.

Valuation risk

If there was an earnings miss, then I don’t think today’s valuation offers much margin of safety.

Why do I say this? Well, just going on the earnings per share (EPS) forecasts for the next couple of years, the stock appears fully valued to me.

We’re looking at forward price-to-earnings multiples of 28 and 23 for this year and next. That’s not exactly cheap.

Another pandemic

It’s no exaggeration to say that Rolls-Royce could have gone bust during the pandemic.

If push came to shove, I don’t think the government would have allowed that to happen given the company’s iconic status and storied history. But it was theoretically possible. That’s how bad things were.

Scientists are warning that deforestation is making it increasingly likely that a viral agent will jump from animals to humans and cause another global pandemic.

Research from 2022 found that in any year the chance of a Covid-like event is about 1 in 50. So this is still an ever-present risk, however left-field it may sound.

That said, the firm is making progress on becoming more resilient in order to weather the next outside shock that comes along.

My Foolish takeaway

Despite these risks, I’m still excited about Rolls-Royce’s future as it makes commercial progress on multiple fronts.

To take one example, Turkish Airlines placed a huge order for Airbus A350 aircraft. And this deal included an order for 120 of Rolls’ Trent XWB-84 engines and 40 Trent XWB-97 engines, excluding options and spares.

This makes Turkish Airlines the world’s largest operator of Trent XWB, which powers the Airbus A350.

First-half results are due in August, with a possible trading update before then. I’ll be interested to see how things are progressing. If I like what I hear, I may well buy more Rolls-Royce shares.