There are a few things I like about online retailer Ocado (LSE: OCDO). It has a substantial customer base and well-regarded brand. As well as its own online operations, in which it partners with Marks & Spencer, the company has been offering its technology and logistics solutions to a raft of other retailers globally.

But although I see some strengths in the business, I would not touch Ocado shares with a bargepole.

Here are a couple of reasons why.

1. The business model remains unproven

We know that there is a huge market for online grocery shopping, in the UK as elsewhere. It also stands to reason that there is a substantial business opportunity for a firm that can help retailers set up and manage their online operations.

But good potential does not necessarily equate to a lucrative business model. For now, I regard the Ocado business model as unproven.

I think this is demonstrated by its track record on profitability.

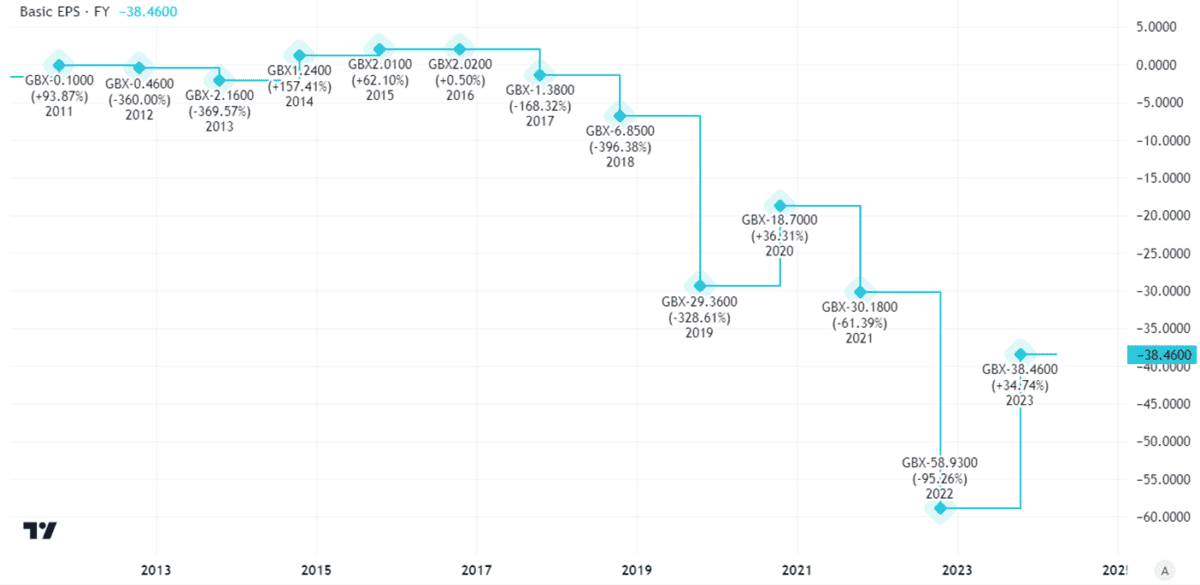

There have been several years in which Ocado turned a profit. Mostly, though, it has been spilling red ink – sometimes in large quantities.

A look at its basic earnings per share shows not only that the company has been heavily loss-making, but that its performance in that regard has got much worse over the past five years or so.

2. Capital expenditure is stubbornly high

During that period, the company has issued new shares to help raise funds, diluting existing shareholders in the process. Such moves are one reason I usually consider earnings per share when considering whether to invest in a company, not just total earnings. Earnings can go up, but if the share count goes up even faster, earnings per share can fall.

For now, though, earnings at Ocado seem a long way off.

If it just focussed on its UK retail operation, I think the company could potentially narrow or eliminate its losses. But selling its solutions to other retailers means it is likely to continue losing substantial amounts of money for the next several years at least, I reckon.

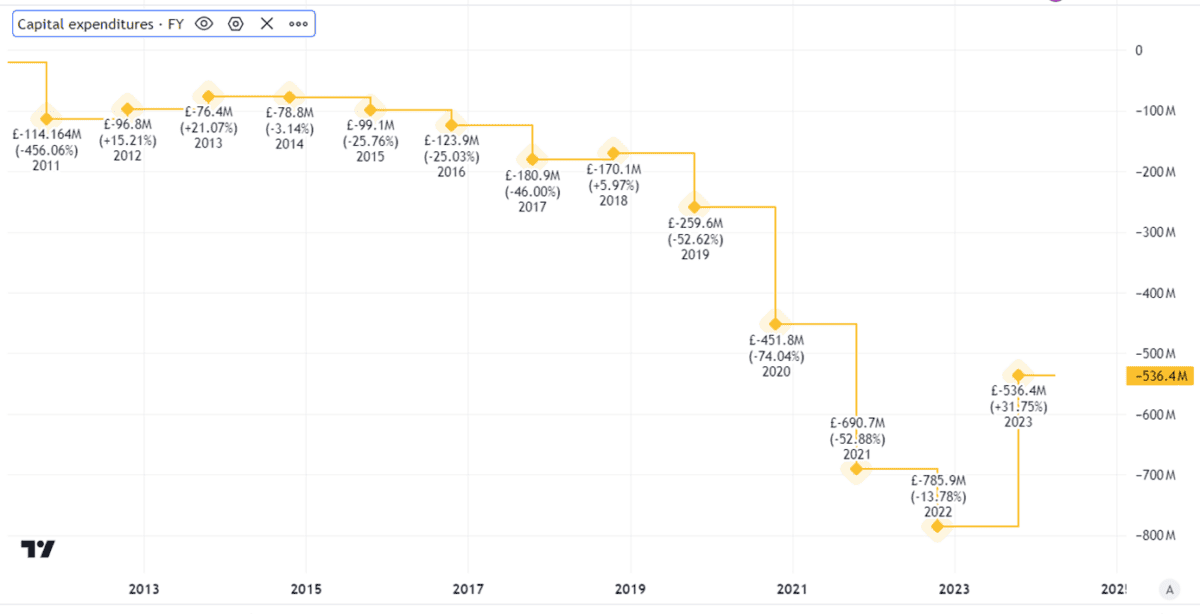

That is because the setup costs of such partnerships, such as building new warehouses, can be high. Capital expenditure has been sizeable in recent years at Ocado and I expect that to persist for several years at least.

In the long run, that may be money well spent. It could help Ocado establish a firm position in the market well ahead of rivals, allowing the costs to be more than covered in the decades that follow.

Whether that turns out to be the case, though, remains to be seen.

My concern is that high ongoing capital expenditure is a risk to profitability. Indeed I think that helps explain why Ocado shares have fallen 74% in the past five years.

Wait and see

Ocado could yet turn out well as a business. Whether it does so depends on getting the right balance between expenditure and income in years to come. For now I think it is unclear how likely that is to happen.

If things start to look more positive, Ocado shares may be more expensive to buy – but the risks could be lower at that point than they are now.

I have no plans to invest, for now.