Oxford Nanopore Technologies (LSE: ONT) is a growth stock I’ve considered a couple of times for my Stocks and Shares ISA. One of my sticking points though has been its high valuation.

But now the share price has fallen around 51% in 2024, I’m taking another look.

Innovative tech

The company has developed the world’s only nanopore DNA and RNA sequencing platform. This involves passing genetic material through tiny holes called nanopores (hence the firm’s name).

Should you invest £1,000 in Dunelm right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Dunelm made the list?

As the substance passes through these, it produces electrical signals that are used to decipher the sequence of DNA and RNA. And this method can result in real-time data for rapid insights.

Its portable MinION device is significantly smaller than traditional sequencing machines, offering greater flexibility. Researchers can use them in remote locations, thereby expanding the firm’s total addressable market.

Strong growth

In 2023, underlying life science research tools revenue grew 39% year on year to £170m, excluding legacy Covid-related contracts. Its active customer accounts increased 11% to over 7,600.

This is important because 74% of its revenue came from consumables last year. In other words, it makes most of its money providing supplies after it has sold a device — that’s a ‘razor-and-blades’ business model.

I like this model as it can result in serious profits. However, not for Oxford Nanopore… yet. It reported a £154.5m total loss for the year (much wider than 2022’s £91m loss).

Moreover, it moved its adjusted EBITDA breakeven target from 2026 to the end of 2027. This has likely weakened investor sentiment.

Looking ahead though, management is guiding for 20%-30% underlying revenue growth this year. And greater than 30% in the medium term. Therefore, the growth story is intact here.

Comparing stocks

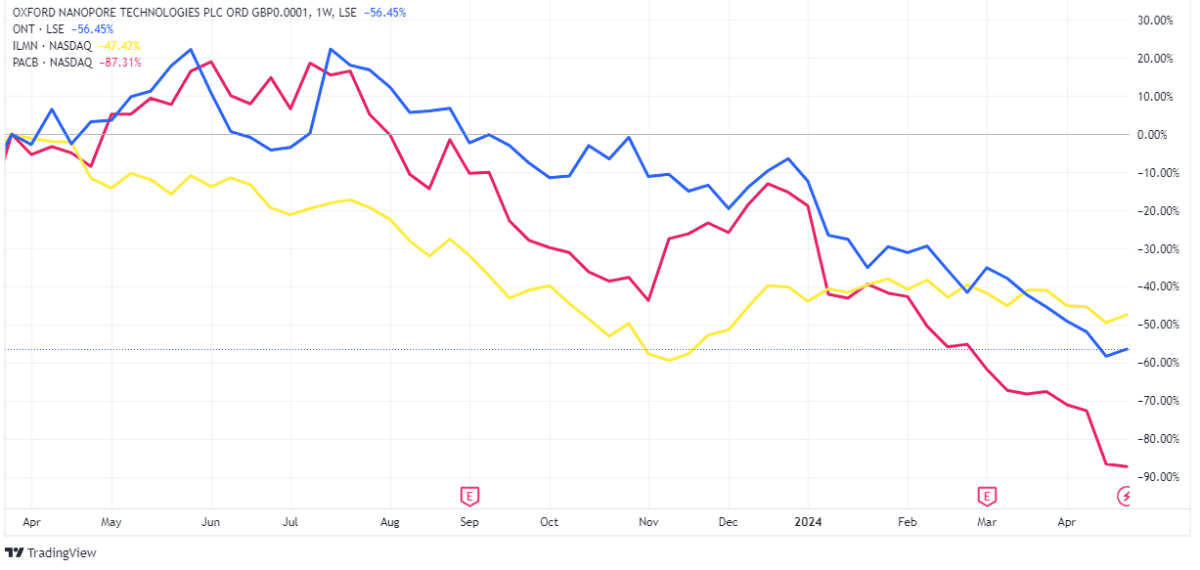

The performance of two of its rivals hasn’t been much better recently. Shares of Pacific Biosciences of California are down 87% in the last year, while Illumina has shed over 40% of its value.

These competitors aren’t expecting much (if any) top-line growth in 2024, which makes Oxford Nanopore’s forecast growth appear even more impressive.

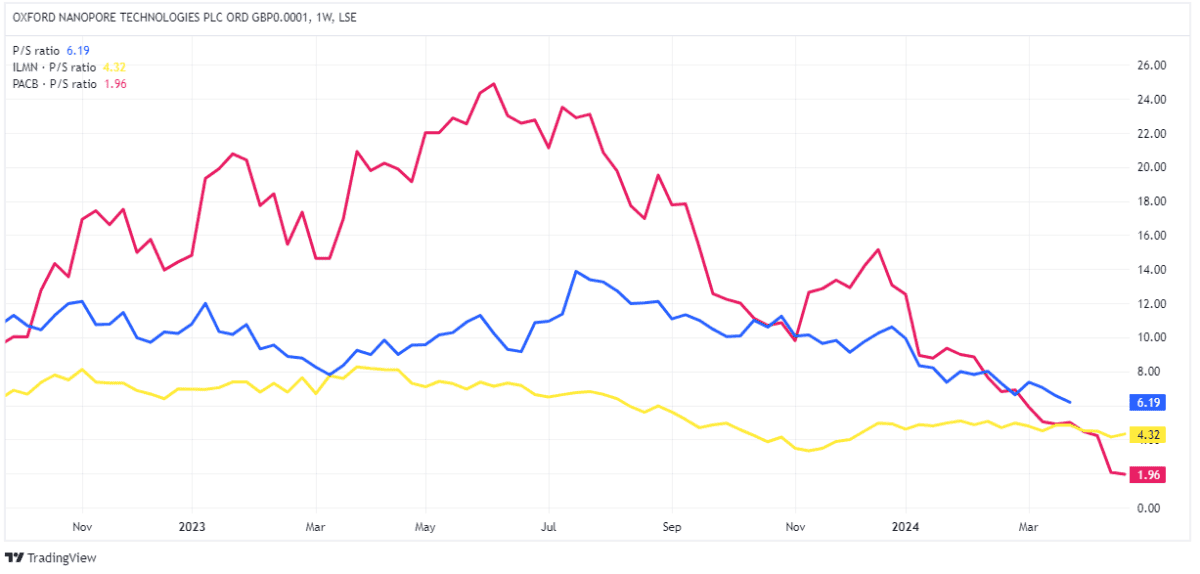

Looking at the price-to-sales (P/S) ratio though, the stock is more expensive (6.19) than these US peers.

That said, the forward-looking P/S multiple for 2024 drops to 4.9, which is more attractive.

Vultures circling

Unfortunately, investors today have little patience for firms with sales but only possible future profits. They want reliable profits now, and the business isn’t about to deliver this, so there’s a risk the shares drift even lower.

In this scenario, I think the company could become an acquisition target. It has world-class technology and a growing market opportunity.

We’ve just seen UK cybersecurity firm Darktrace snapped up. So we know private equity vultures are hovering.

Should I buy some shares?

I’ve had my fingers burnt lately investing in Moderna and Ginkgo Bioworks. They’re down between 30% and 50% so far for me. So I don’t have the stomach to invest in yet another loss-making healthcare stock.

However, if this wasn’t the case, I’d consider Oxford Nanopore stock after its 51% drop. It’s seeing increasing adoption of its devices across various research areas, while the market cap is just £833m.

The shares could rebound strongly if market sentiment changes or a bidder emerges — not that I’d ever buy purely on takeover speculation.