The past few years have been good ones for shareholders in NatWest Group (LSE: NWG) (the same cannot be said of some of the years before that!). The shares are up 18% over five years but have soared 186% since September 2020.

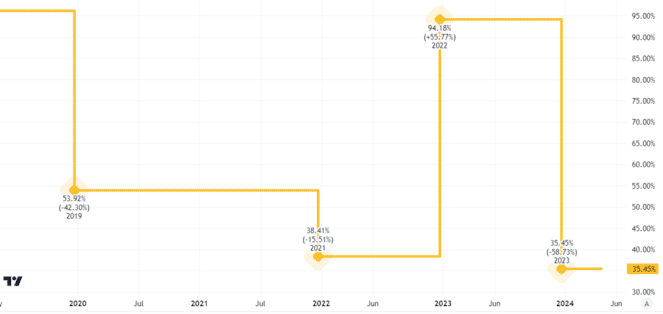

The NatWest dividend yield is 5.5% even at today’s price. If I had invested in September 2020, I could now be earning a 15.8% yield!

Investing in NatWest shares today could potentially help me set up sizeable passive income streams.

If I wanted to target £1,000 per year, here is how I might go about it.

Doing the maths

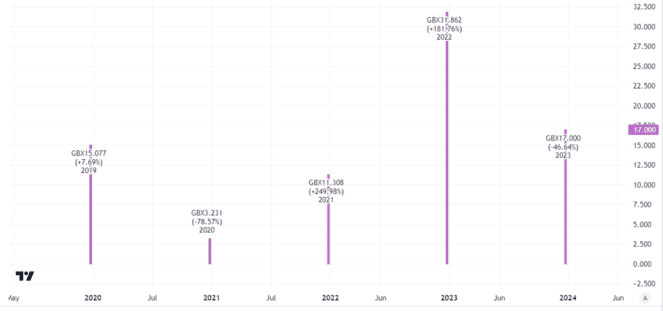

At the moment, the annual NatWest dividend per share is 17p.

So, to target £1,000 in passive income annually, I would need to buy 5,883 shares. At the current price, that would set me back around £18,064.

Dividends are never guaranteed

However, just buying the shares does not mean I will necessarily get the dividends.

I might get lucky and receive a special dividend (like the 16.8p per share special dividend paid for 2022). Then again, I might buy the shares only for the dividend to be cut or cancelled altogether, as the final payout for 2019 and 2020 interim were.

The total annual NatWest dividend per share has certainly moved about a fair bit in recent years.

So, how could I decide if this is the right sort of income share to add to my portfolio?

Solidly profitable

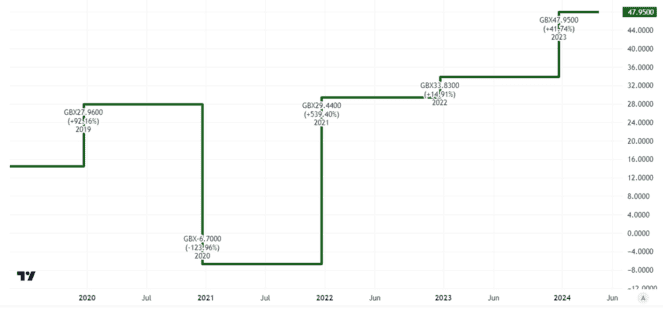

To pay dividends, a bank needs to generate money. Often we talk about earnings – and NatWest does well in this regard. In recent years, its earnings per share have been impressive.

In its first quarter trading statement this week, the bank reported that total earnings in the three-month period fell 26% compared to the same period last year. But they still came in at £987m.

Looking at cash flows

But while earnings are a useful accounting measure, it is cash flows that ultimately fund a dividend.

As an investor, though, free cash flows for a bank can have limited utility as an analytical tool. Banks are in the business of taking customers’ money in and lending it out, so it can be hard to disentangle cash flows in the ordinary course of their business from their own surplus capital generation.

Still, the Natwest dividend has been comfortably covered by earnings in recent years, even including the chunky special dividend I mentioned above.

Building income streams

So would I buy, if I wanted to add £1,000 to my passive income streams?

One concern is the risk of a regulator-mandated dividend cancellation, as we saw at NatWest and other UK banks in 2020. That strikes me as a bigger risk in the heavily regulated banking sector than in some other parts of the economy.

My other concern is whether banks like NatWest will do well in coming years.

A weak economy could lead to higher loan defaults, hurting profits, surplus capital generation, and therefore dividends. NatWest’s first quarter decline in earnings did not reassure me in this regard, so I will not be investing for now.