From pennies to pounds: that has been the story of the Rolls-Royce (LSE: RR) share price in recent years.

Taking a slightly longer-term perspective, though, the tale has been from pounds to pennies (ouch!) and then back to pounds again.

For now, the Rolls-Royce share price is slightly over £4. So, what is most likely to come next – a fall of roughly 50% to £2, or a rise of around 50% to £6?

Nobody knows what will happen next in the stock market, but here is my opinion – and what I plan to do about it.

Getting to a £6 share price

First, what might it take for the Rolls-Royce share price to hit £6?

Ordinarily, a 50% increase in a share price would sound ambitious. But, even after putting in the strongest price rise of any FTSE 100 share last year, Rolls has moved up 39% so far this year.

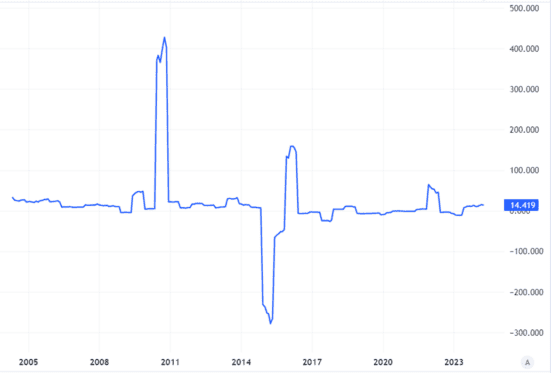

Yet despite that, the Rolls Royce share price-to-earnings (P/E) ratio is 14. That does not seem especially high and indeed is not dramatically higher than the long-term trend.

Source: TradingView

In fact, as seen above, although the shares have shot up, the P/E ratio is now lower than it was a couple of years ago. That is because the company’s earnings have grown.

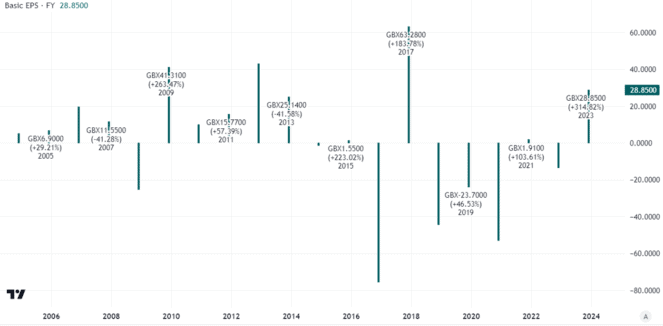

Indeed, last year’s basic earnings per share were the strongest in years.

On that basis, I think the current valuation does not look expensive.

I see room for it to grow – especially if the company further improves its earnings performance. Management has set out a series of medium-term targets that envisage a sharp improvement in operating income.

That is not the same as income (other costs can eat into operating income to produce a lower net income). But I expect it would also lead to higher net income and earnings per share. If that happens, I think the Rolls-Royce share price could hit £6.

But what about going back to £2?

The opposite also holds, in my opinion.

If management seems to be falling off course to deliver its ambitious growth targets, the Rolls-Royce share price could fall. I think the increase in recent months partly reflects the prospect of achieving those targets, which were unveiled last November.

Even worse, if business performance declines (as opposed to simply falling off track for reaching the targets, but remaining steady), I think that could push the share price further down.

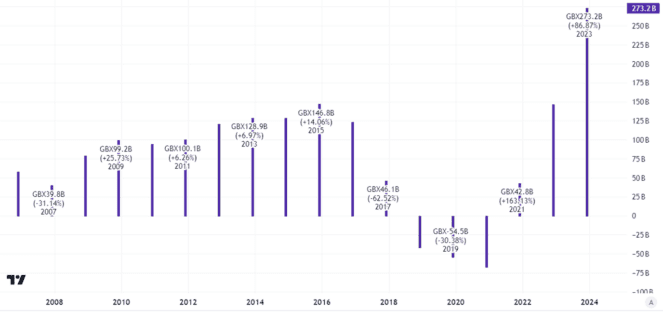

Rolls-Royce has advantages, including a large installed customer base, limited competition, and proprietary engine technology. But that has long been true – and yet its history of income even at the operating level has been inconsistent.

Other costs, like financing, have made the swings in net earnings even larger, as I explained above.

Triggers for such moves can include events outside Rolls’s control, like a terrorist attack grounding aircraft or pandemic laws shattering civil aviation demand.

In such scenarios, I could see the Rolls-Royce share price hitting £2 before it gets to £6.

If business momentum continues as it has lately and aviation demand holds up, I expect the shares to get to £6 first. But the risk of a sudden aviation demand collapse puts me off buying the shares for my portfolio.