The answer to the headline: InterContinental Hotels Group (LSE:IHG). Over the last decade, the stock’s up 182%, compared with a 21% increase for the FTSE 100.

This is the result of some strong growth from the underlying business. IHG has increased its revenues at an average of 12% a year and I think there could well be more to come.

Outperformance

It’s not just the last 10 years. Shares in InterContinental Hotels Group have been outperforming the index on a consistent basis.

| InterContinental Hotels Group | FTSE 100 | |

| Year-to-date | 5% | 13% |

| 1 year | 45% | 3% |

| 5 years | 62% | 9% |

| 10 years | 182% | 21% |

IHG has managed impressive revenue growth during that time. But there’s something far more important that explains why the stock’s performed so well.

InterContinental runs a franchise model. That means it doesn’t own the hotels in its network – it takes a fixed percentage of revenues in exchange for its marketing, know-how, and booking system.

There are two main advantages to this. The first is the business is protected from inflation since energy and staff costs are left to individual operators who own the properties.

The other is that it costs almost nothing to add new hotels to its network. This means the company can grow its revenues while using its free cash for shareholder returns.

Can it continue?

With 90% of the cash it generates available to shareholders, IHG has an attractive business model. But the stock isn’t cheap – the market-cap is £13bn for a company generating £650m in free cash.

That means there’s risk for shareholders. The firm’s going to have to keep growing in order to justify is current share price.

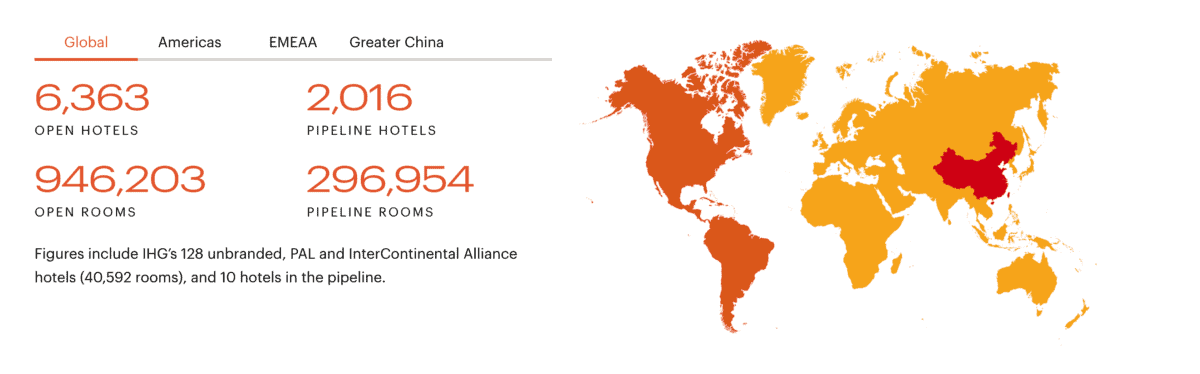

There’s reason to think the company has good growth prospects though. It currently has 2,016 hotels planned with 296,954 rooms in its pipeline.

For context, IHG’s network currently consists of 6,363 hotels with 946,203 rooms. So there’s a lot of scope for further growth to come online.

Source: InterContinental Hotels Group Investor Relations

As a result, I think the stock can keep doing what it’s been doing over the last decade – outperforming the FTSE 100 as the underlying business grows. And a high price tag doesn’t put me off that.

What this means for investors

There are three things to note about InterContinental Hotels Group. First, it’s an unusually good stock that has consistently outperformed the FTSE 100.

Second, the business has scope to keep growing in the way it has done over the last decade. That means it could well turn out to be a great investment, even after a 182% increase in its share price.

Third, the company’s success has been the result of an ability to grow without having to use the cash it generates. That’s a good sign for other businesses that can do the same.