The US market reacted positively this week to news that Google and YouTube owner Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) finally plans to start paying a dividend. It suggests that investors see the move as positive. But does it really make Alphabet stock more attractive – or could it suggest the end of the company’s golden growth years?

More cash than great growth ideas?

When a company generates a lot of spare cash it can invest it in continued growth, spend it on dividends, sit on it for a rainy day — or a combination of those.

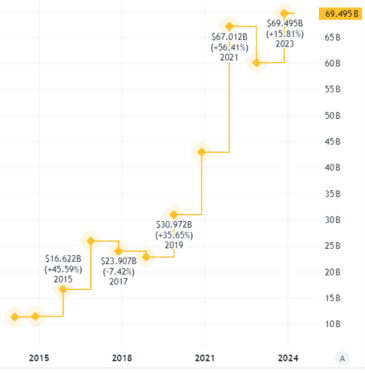

Alphabet is hugely cash generative. It has invested a lot in new product and service development, but has still been hoarding cash for years. It ended its most recent quarter with $111bn in cash, cash equivalents, and marketable securities.

In the latest quarter alone, the company had free cash flows of $17bn.

With its huge customer base, service ecosystem and low marginal costs in adding more customers, Alphabet is a free cash flow machine.

Source: TradingView

The initial quarterly dividend, 20c per share, is modest. That represents an annual dividend yield of well under 1%.

But could it suggest that the company now lacks sufficiently compelling business growth ideas on which to spend all of its spare cash?

Fine tuning a proven business model

I think it could. But that is not necessarily bad for Alphabet stock. The company generates so much cash it can easily pay a dividend and also continue investing substantially in growth.

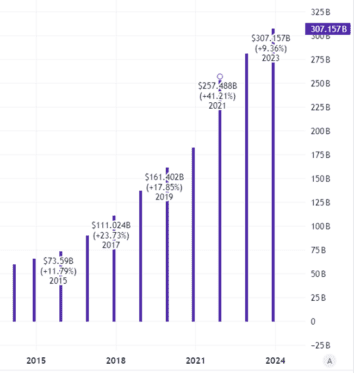

In the latest quarter, revenues grew 15% compared to the same period last year. Alphabet has an outstanding track record of revenue growth. I see no reason that cannot continue, even once it starts spending money on dividends.

Source: TradingView

In that sense, I do not think a dividend fundamentally changes the Alphabet investment case. Arguably, it makes it more attractive, as not only will the share now attract income investors, but the move also shows management is thinking about shareholders’ interests.

Long-term momentum shifts

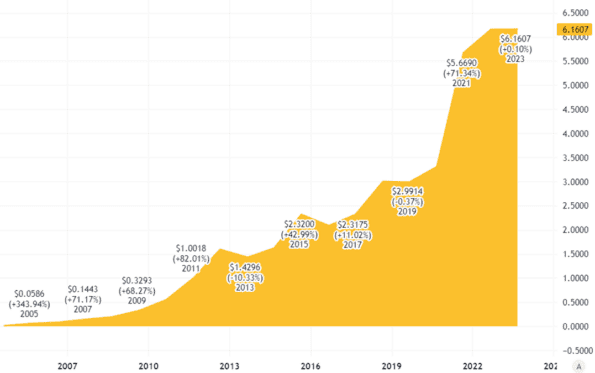

Then again, look at Apple (NASDAQ: AAPL). It brought back its dividend in 2012 after many years not paying one. Since then, the dividend has grown steadily. But, last year, both revenues and income at the tech giant were weaker than the prior year.

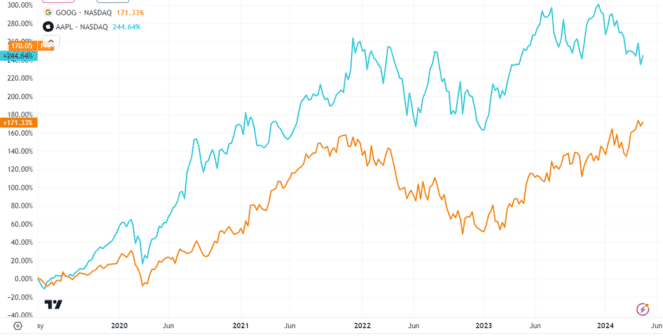

Still, Apple stock is up 4% over the past year – and 232% over the past five years.

That is a markedly better performance than the (very impressive) 148% gain recorded by Alphabet stock over the past five years (this chart shows Apple in blue and Alphabet in orange).

Although income fell last year, Apple using some of its spare cash to buy back shares means its basic earnings per share continued (just) to grow.

Source: TradingView

Alphabet has massive competitive advantages, from its proprietary technology to a vast user base. It does face challenges, such as competitors leading it on AI, eating into both revenues and profits for Alphabet.

Over time though, I expect it to continue generating huge cash flows. Paying a dividend need not slow its growth. I see it as either neutral or positive for the investment case.

That said, Alphabet stock’s price-to-earnings ratio of around 30 is higher than I am comfortable with, so I have no plans to invest.