The Alphabet (NASDAQ:GOOG) share price surged 15% in extended trading after the firm’s earnings report for the first three months of 2024. As a result, the stock’s up 29% since the start of the year.

Alongside a solid performance from the underlying business, Google’s parent company announced it was going to start paying a dividend. Should this make investors consider buying the stock?

Passive income?

Let’s start with the headline news – Alphabet’s going to start paying a dividend. Investors are set to receive $0.20 per share every three months.

Should you invest £1,000 in Anglo American right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Anglo American made the list?

This follows a similar move from Meta Platforms three months ago. And the reaction from the market means the two stocks have had similar results since the start of the year.

That amounts to a dividend yield of 0.44%. I don’t think that’s going to catch the eye of many income investors and I don’t really see the point of it – but there’s much more to Alphabet’s capital returns.

Far more significant is Alphabet’s plan to spend $70bn on share repurchases. Adjusting for stock issued to staff, this ought to provide a return of around 2.5% – much more than the dividend.

Sales and profits

Far more important than the dividend, in my view, is the performance of the underlying business. And I think there was a lot for investors to be encouraged by.

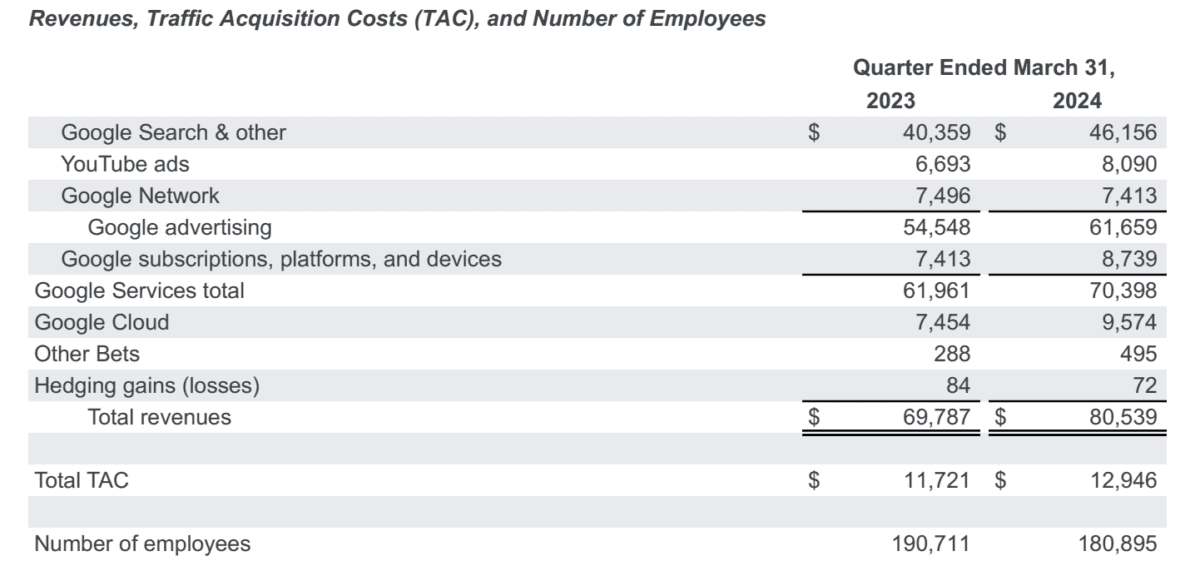

Alphabet reported revenues of $80.5bn – a 15% increase compared to the first quarter of 2023. And a closer look at the numbers reveals even more positive news.

Source: Alphabet Q1 2024 Results (numbers in millions)

Advertising sales increased by 13%, compared to 11% growth reported three months ago. With this making up 77% of overall revenues, it’s natural for attention to focus on this part of the business.

Google’s Cloud business also continued to grow strongly, with sales coming in 28% higher than a year ago. And wider margins meant earnings per share increased 62% – from $1.17 to $1.89.

An opportunity?

Whether the share price is reacting to the dividend announcement or the growth in the underlying business is neither here nor there. What matters is how the equation looks for investors right now.

Following the latest news, Alphabet’s shares trade at a price-to-earnings (P/E) multiple of 27. At that level, the company needs meaningful growth to justify its current share price.

The next big frontier for this is artificial intelligence (AI). And Alphabet has got off to a choppy start in this area, which makes me wary about buying the stock at today’s prices.

Over the last few years, one thing investors should have learned about Google is that opportunities do show up for patient investors. Right now doesn’t look like one of those times though.

The message for investors

Alphabet’s a terrific business. It has a strong balance sheet, generates huge returns on invested capital, and is growing at an impressive rate.

Despite this, there are times when the market worries about the business, whether it’s competition from ChatGPT or antitrust issues. And those are the times when investors should consider buying the stock.

At the moment, I think there are better opportunities available. And no – the dividend doesn’t change my mind about that.