When looking to make extra income from dividend stocks, many novice investors just look for the highest yield. It makes sense right? Why invest in a stock with a 4% dividend yield if I can choose one offering 8%?

However, there’s a lot more to it than that. I’ve found I often get better returns from reliable stocks with lower yields than those with high payouts.

How can that be?

It’s because dividend payments aren’t guaranteed – companies can reduce them (or cut them completely) as they please. And the higher the yield, the more chance of that happening if earnings decline.

Another thing about high yields is that they can be evidence of a failing stock. If the share price falls but the company still pays out the same amount of money in dividends, then the yield looks high by comparison. But if the share price keeps falling, the stock may end up losing more value than the dividend pays out.

So with all that in mind, I’m considering a dividend stock that at first might not seem like a smart pick. But with a solid track record of making reliable payments, I think it’ll be a winner in the long term.

Power to the people!

National Grid (LSE:NG) is part of the gas and electricity network that has been powering the UK in one form or another for over 70 years (although it was only privatised in 1990). Since its IPO, the share price has grown from £2 to almost £11, equating to annualised returns of a rather mild 4.5% – nothing to write home about.

But remember, it’s a value share, not a growth share. That’s where the dividends come in.

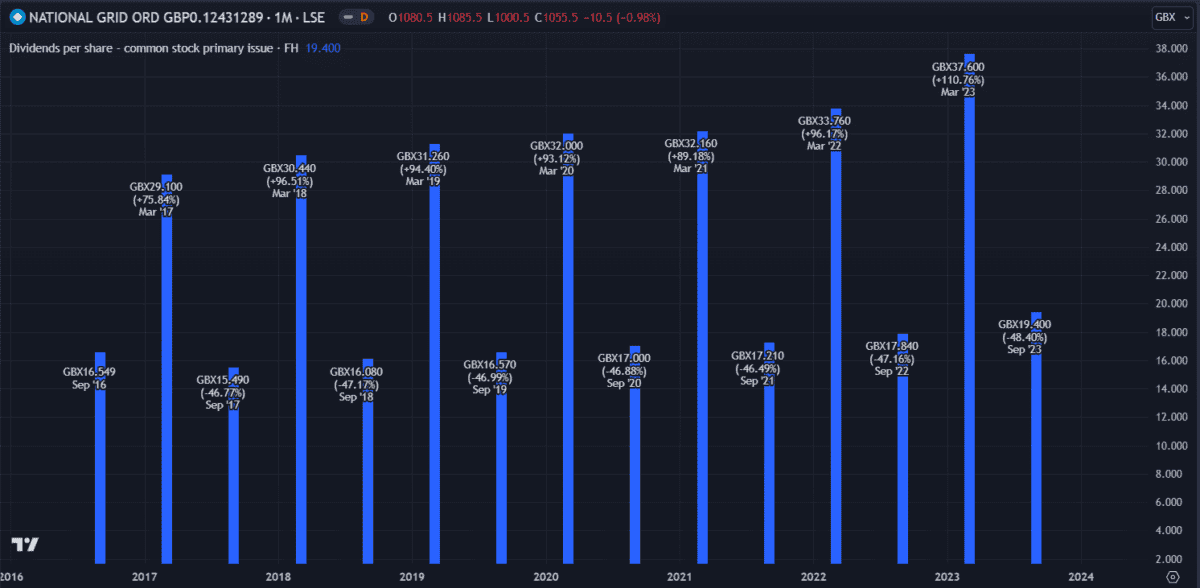

Its current 5.4% dividend yield has been increasing steadily over the years, up from 4.7% in 2014. It’s expected to increase to 5.8% in the next three years. Importantly, dividend payments have been surprisingly consistent. Even during Covid, when most companies cut their dividends, National Grid kept paying. Utility stocks are great like that – even during tough times they still turn a profit.

What’s the catch?

That said, the stock isn’t without risk. Currently, the dividend payout ratio is slightly high because the company isn’t earning as much per share as usual. This could be because of increasing costs associated with supplying gas and electricity as a result of the ongoing Russia-Ukraine war. Utility prices soared when the war broke out and continue to put pressure on UK consumers, with National Grid implementing initiatives to supplement high energy costs at its own expense.

There’s also the minor issue of debt, one that the company can hopefully improve soon. At £46bn, compared with only £29bn in equity, it has a worrying debt-to-equity ratio of 156%.

Still, the business isn’t expected to hit any snags in the next 12 months. A quick internet search reveals consensus among analysts saying the stock could increase 20% this year. This is reinforced by a discounted cash flow analysis that estimates it to be undervalued by 24%.

All in all, it seems like a great pick to me and one that I’ll happily add to my dividend portfolio when my next payday rolls around.