The Tesla (NASDAQ:TSLA) share price rose in extended trading after its earnings release from the first quarter of 2024. At first sight, that looks surprising.

It’s also a disappointment to anyone hoping to buy the stock at a bargain price. But with revenues and profits both down, why is the stock looking set to go higher?

Bad news

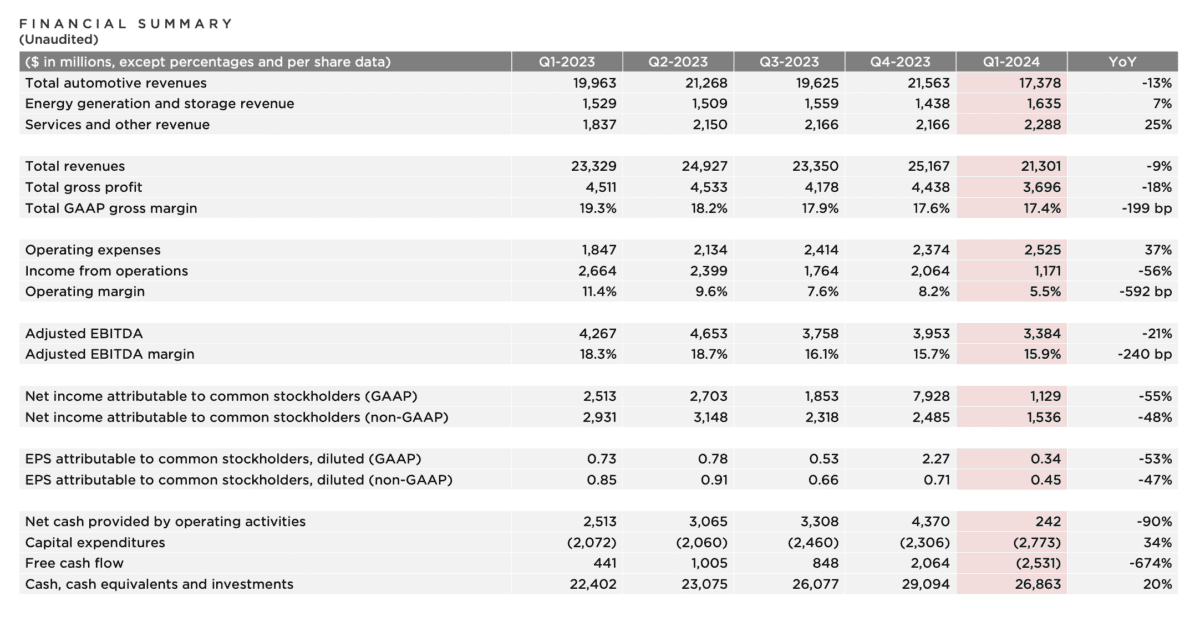

On the face of it, there wasn’t much for investors to feel positive about in Tesla’s earnings report. Car sales – which account for 82% of total revenues – fell by 13% due to lower prices and fewer deliveries.

Tesla Q1 2024 earnings

Source: Tesla Q1 update

At the same time, operating costs rose by 37%, leading to a 55% decline in earnings per share. But arguably the most worrying number wasn’t either of these.

Tesla registered a $2.5bn cash outflow, compared with a $441m cash inflow from the same period a year ago. The main reason for this was a $2.7bn inventory increase due to the company producing more cars than it sold.

The company covered the loss with cash from its balance sheet. There’s plenty of that, so there isn’t an immediate problem, but overproduction isn’t likely to be good for prices – and by extension, revenues.

Share price

All of this raises the question of why Tesla shares were up almost 15% in extended trading. The biggest reason seems to be the firm’s announcement that more affordable models are on the way.

Investors have been anticipating this for a while and the timing could hardly be better. With the company cutting prices to shift its growing inventory, a lower-priced offering might be just what’s needed to boost revenues.

Tesla stated that the new models would be produced using its existing facilities, meaning additional costs should be limited. On the other hand, the rollout is likely to offset savings from elsewhere in the business.

Going into the report, Tesla’s problems from the first quarter were largely well-documented. The announcement that more affordable vehicles are expected ahead of the advertised timeline is a welcome boost to the company.

Am I buying Tesla shares?

But I’m not buying. Paying the equivalent of $460bn for a company that has never pulled in more than $7.5bn a year doesn’t look like an attractive investment to me.

It’s not just Tesla. The car industry is in a cyclical downturn and the slow pace at which charging infrastructure has been appearing hasn’t been helping.

No doubt this will sort itself out eventually. But in the meantime, electric vehicles have been losing ground to hybrid cars and with interest rates above 5%, the cost of having to wait is real.

Whether this is the start of a rebound remains to be seen. But the value proposition doesn’t look attractive right now, even with more affordable vehicles on the way to boost revenues.

The bottom line

In the current environment, Tesla’s decision to prioritise affordable vehicles instead of robotaxis makes nothing but sense. The company isn’t immune to the cyclical shifts in demand any more than other car manufacturers are.

The trouble is this makes Tesla look like just another car company. The solution to its problems is to produce cheaper vehicles. And by car company standards, it’s hard to say the stock looks anything other than really, really expensive.