I was surprised to find Barclays (LSE:BARC) is up 30% since I bought the shares in early January. That’s some of the highest growth of any FTSE 100 stock over the past three months. By comparison, Lloyds is up only 20% and HSBC only 10%.

On reflection, NatWest Group would have been an even better buy, up 33%. But I was hesitant to invest in the shares after heavy losses in 2023. The only FTSE 100 stock that has done better in the past three months is major mining conglomerate Antofagasta, up 43%.

So can Barclays continue its winning streak?

Let’s check the charts.

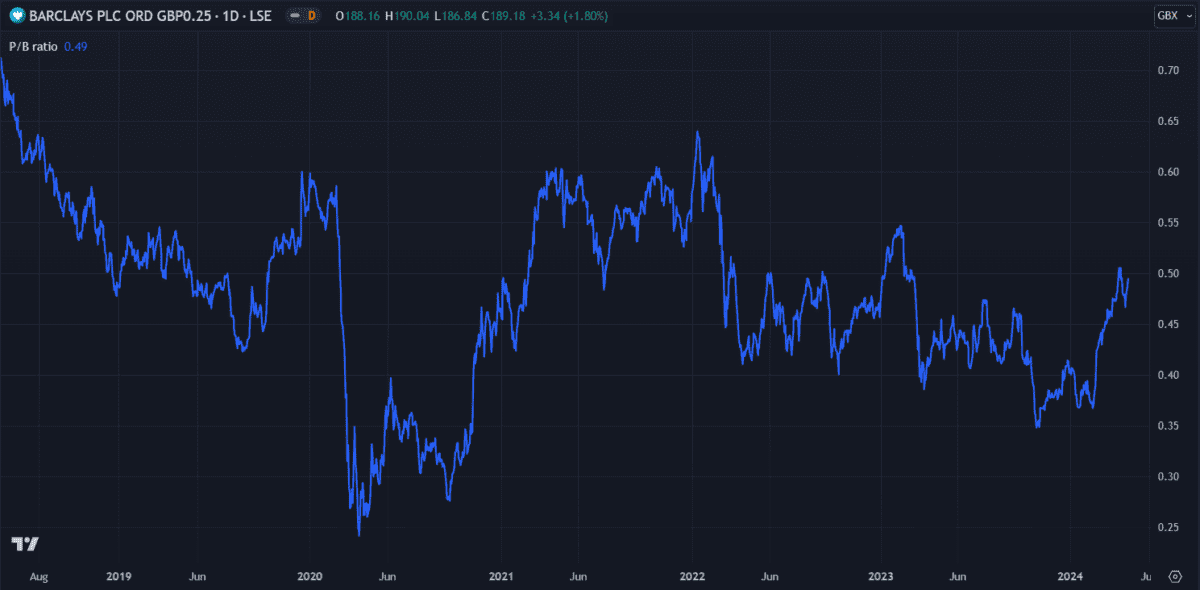

Price-to-book (P/B) ratio

The P/B ratio measures a company’s market cap against its book value – that is, equity divided by outstanding shares. It’s considered a more reliable valuation of bank shares than price-to-earnings. This is because bank earnings can fluctuate wildly due to factors not necessarily associated with performance.

A high P/B ratio usually means the company has been doing well but a value below one is preferable when considering investing. At 0.49, Barclays’ P/B ratio is still low even though it’s increased this year. By comparison, Lloyds’ is 0.81 and HSBC’s is 0.95. This reinforces my belief that the Barclays share price still has more space to grow.

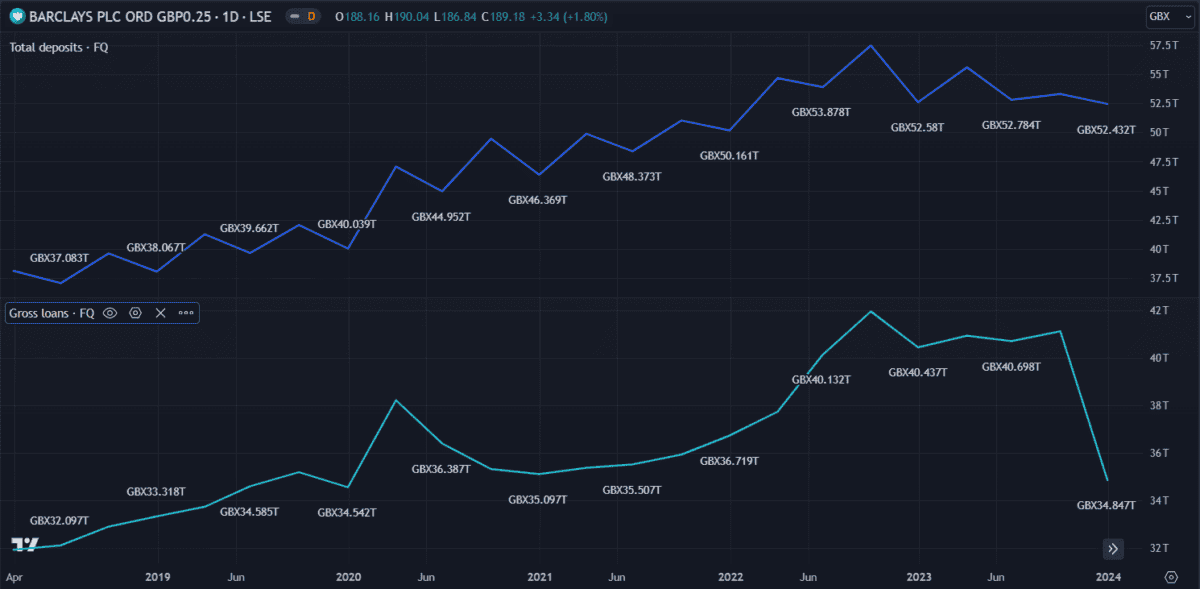

Loans vs deposits

When investing in banks, it’s good to get a clear view of the financial position. Checking how much a bank has loaned out against how much it holds in deposits helps in this sense. While loans bring in interest, a lack of loan coverage can put the bank in a precarious position. Particularly when the economy is as rocky as it is now.

Fortunately, Barclays is doing fine in this regard. With £524bn in total deposits, it more than sufficiently covers its 348bn worth of loans. But I also see that loans have decreased recently, which could affect future profits.

A challenging environment

In its first-quarter (Q1) earnings release this Wednesday (23 April), Barclays is expected to report pre-tax profit of £2.2bn – down from £2.6bn in Q1 last year. The bank appears to have pre-empted this when it announced a £1bn cost savings plan in February – a trend I’ve noticed elsewhere in the UK banking industry. This is likely due to the increasingly challenging economic environment.

In the past decade, consumer behaviour regarding finances has changed significantly. Trust in traditional banks has fallen while disruptive technologies have captured youth attention. App-focused digital banks like Wise and Revolut have taken off while high-street stalwarts struggle to compete.

Barclays is making some progress when it comes to innovation, exploring new technologies like blockchain and AI. More so than any external factors, this could be the key to its success. Fintech is advancing rapidly within an environment of evolving monetary sentiment and those resistant to change are likely to get left behind.

While it may be one of the few big banks making strides in this area, increasingly strict regulations make it costly for larger financial institutions to adapt. Adopting new tech while remaining profitable and compliant is the balancing act that will define the future of traditional banks.

For now, Barclays seems to be managing that balancing act well.