Today I’m looking at one FTSE 100 share that suddenly dropped to a four-month low in the past two weeks.

Investor lore proclaims that ‘time in the market’ beats ‘timing the market’. The original quote implies that trying to catch price highs and lows is less effective than simply remaining invested for the long haul.

While that may be true, it’s always tempting to try and reel in a few cheap shares while the fishing is good.

Should you invest £1,000 in Tesla right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Tesla made the list?

So what’s the deal?

M&G (LSE:MNG) shares crashed 16% over the past few weeks despite the company posting positive results on 21 March this year. The impressive 2023 full-year report included net client inflows up to £1.1bn from £0.2bn last year, not to mention a 28% rise in adjusted operating profit before tax.

So why the sudden slump?

Sure, the £4.8bn investment manager barely bothered to raise its dividend yield but at 9.77%, can shareholders really complain? The company is still on track to pay a dividend of 13.2p per share on 9 May, 2024. That’s only a 0.2p decrease from April 2023 – hardly a cause for concern.

The dip could be a lagging fallout from the suspension of its property portfolio in October last year, funds from which were planned for distribution this February. But at the time the news broke, the share price only suffered a minor setback and recovered within weeks. The sudden decline now could be explained if there were an unexpected delay in fund distribution — or as a result of the distribution itself.

Can the charts reveal anything?

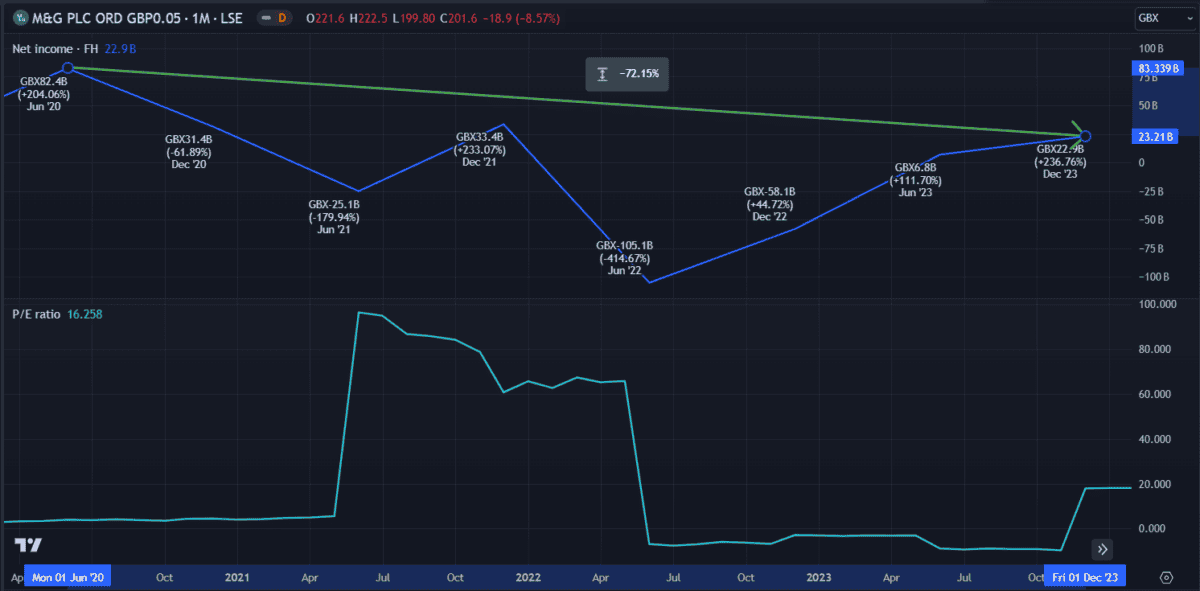

Using a discounted cash flow model, analysts estimate the £1.97 shares to be trading at 48% below fair value. But when compared to net income, the price seems accurately valued. M&G’s net income has declined 72% over the past three-and-a-half years, leaving it with a trailing price-to-earnings (P/E) ratio of 16.25 (slightly above the industry average but not particularly high for the financial services sector).

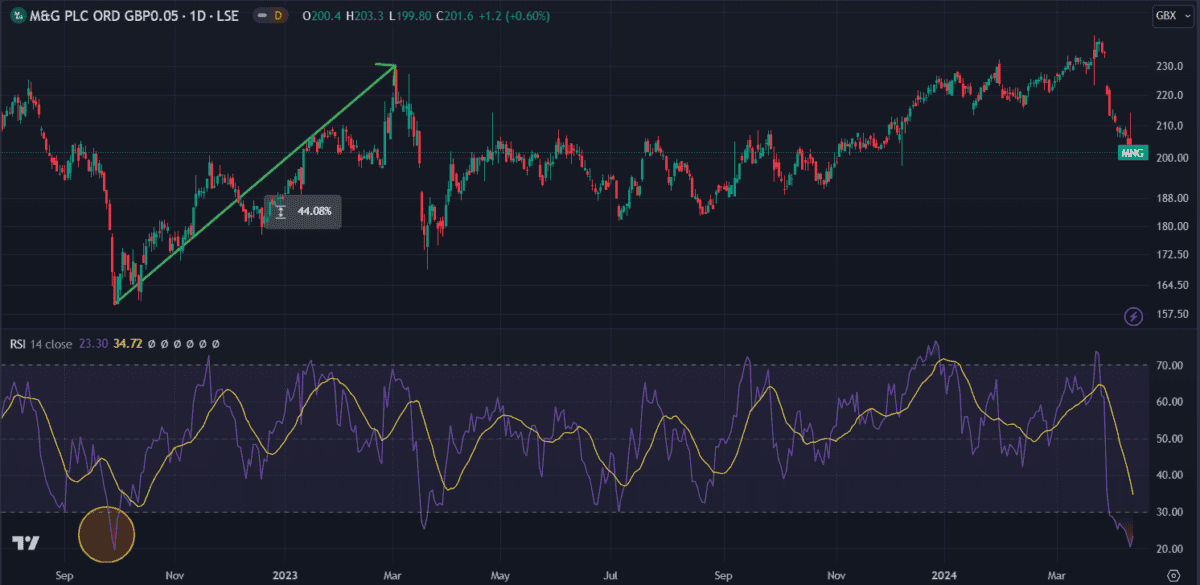

Looking at price forecasts from several analysts, consensus estimates are for a 17% increase in the coming 12 months. Considering how comparatively low the price is now, I would say that seems about right. It could be mimicking a similar price movement pattern that occurred back in early 2023. Last year, a big dip in March saw the price regain 23.35% in the following six weeks.

Having fallen to 20, M&G’s relative strength index (RSI) is now the lowest it’s been in over 18 months — usually a precursor to a price reversal. In September 2022, after the RSI dipped below 19, the price rose 44% in the following six months. RSI seldom stays below 30 for long, usually rising along with the price.

Overall, I can’t uncover any fundamental reason for the price decline. If it’s a one-off dip as a result of the property fund distribution, then it’s unlikely to fall further. And according to the charts, the price could start rising again in the coming days.

M&G remains a solid company with a great dividend. In the long run, I don’t think this dip is too serious. But at this point, I would keep my eye on the shares to be sure the sell-off has ended before buying.