Whether investing for growth or passive income, putting all your capital in a handful of stocks is a high-risk strategy. Even the sturdiest of FTSE 100 stocks can endure bumps in the road that lead to disappointing shareholder returns.

Billionaire investor Warren Buffett is famous for not diversifying too much. When he sees a company he likes at a fair price, he piles in. Today, more than 60% of the capital in his Berkshire Hathaway fund is tied up in two stocks. Apple and Bank of America.

But the ‘Sage of Omaha’ knows the benefit of spreading risk (and realising investing opportunities) by owning a range of companies. His investment firm holds stakes in more than 40 different stocks.

That said, there can be value in pretending that I’ll invest in just one or two stocks. Doing this when choosing stocks to buy can improve the selection process and, in turn, improve the long-term returns I make.

2 top stocks

If I were to invest all my money in just a couple of shares, I would seek businesses with market-leading positions in defensive sectors and multiple revenue streams. They would also need to have robust balance sheets that they can use to invest for growth and pay dividends to shareholders.

Here are two such companies I think tick all these boxes.

Diageo

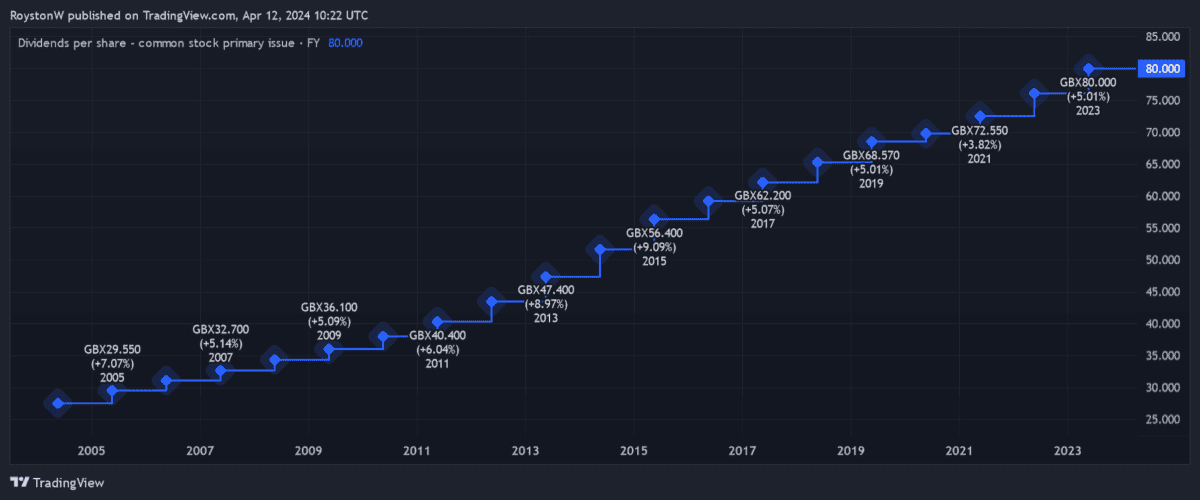

The first pick is Diageo (LSE:DGE). This is one of the Footsie’s true Dividend Aristocrats, with shareholder payouts having risen every year for almost 40 years.

The drinks maker’s proud dividend record is underpinned by consistent long-term earnings growth and reliable cash flows. At group level, revenues tend to remain steady at all points of the economic cycle, reflecting the stable nature of alcohol demand.

On top of this, Diageo owns some of the industry’s most popular brands including Smirnoff vodka and Captain Morgan rum. These labels have significant pricing power, allowing the company to raise prices without a significant loss of volumes, helping it grow profits even in tough times.

Competition’s fierce in the drinks sector and that’s a big risk. But thanks to its colossal marketing budgets — it spent £3.1bn in the last financial year alone on advertising – the Guinness manufacturer has so far been able to significantly mitigate this threat.

National Grid

Another FTSE 100 stock I’d choose for passive income is National Grid (LSE:NG.).

Like Diageo, earnings here stay brilliantly consistent most years. Electricity’s one of life’s essential commodities, and this business has a monopoly on keeping the power grid in good working order. This makes the company one of the most dependable blue-chip stocks out there.

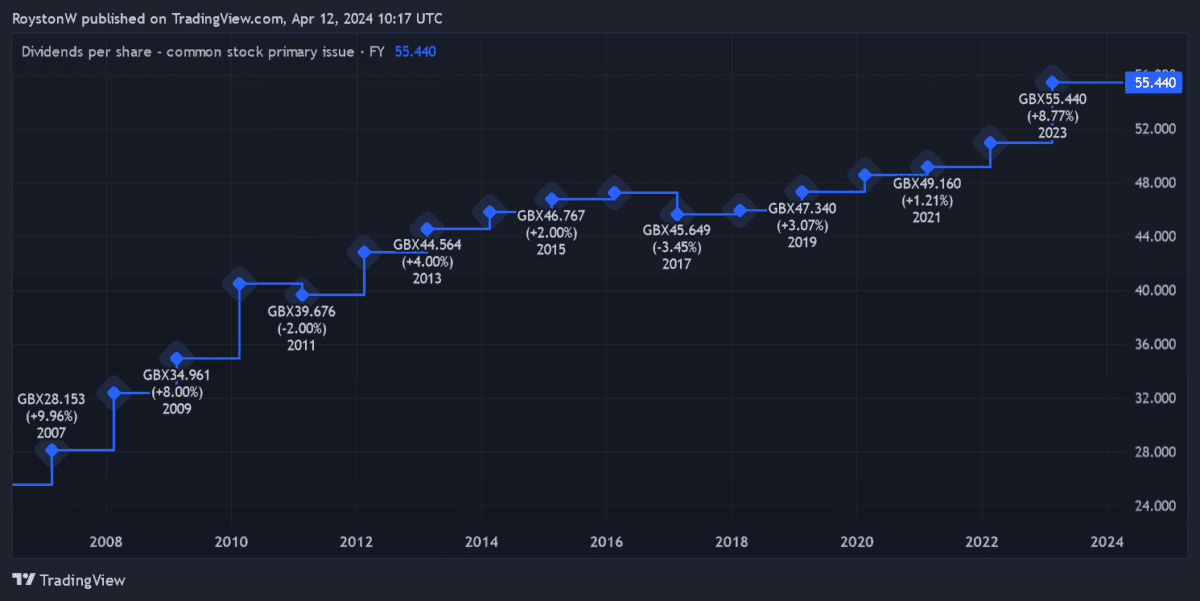

This is illustrated in National Grid’s strong record of dividend growth. As you can see, it’s raised cash payouts almost every year for the past two decades.

The drawback is that maintaining the power network and building for the green transition requires vast sums. And in November, National Grid raised its spending target to £42bn through to 2026.

But all things considered, I think this a top defensive stock to add to a passive income portfolio. As with Diageo, I’d happily invest a huge wad of cash in this FTSE 100 superstar.