Warren Buffett is undoubtedly one of the greatest buy-and-hold investors in history. When picking stocks, he looks for firms with a durable competitive advantage (or moat), healthy cash flows, and longevity.

One stock that ticks all these boxes is payments processor Visa (NYSE:V). Buffett’s company, Berkshire Hathaway, today has a stake in Visa worth approximately $2.2bn (or 0.67% of its investment portfolio).

Here’s why I’d buy the stock today and hold it for at least a decade.

Should you invest £1,000 in BT right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BT made the list?

A massive moat

Visa operates a global card payments network connecting merchants and consumers through their banks and financial institutions. It earns a fee every time it handles a transaction flowing through its network.

In the firm’s fiscal 2023 (which ended 30 September), its network enabled $15trn in total volume from 276bn transactions. There are 4.3bn Visa cards globally with over 130m merchant locations accepting them.

These mind-boggling figures saw the company’s annual revenue grow to $32.7bn, up 11.4% from the year before. Net profit came in at a cool $18.3bn.

Visa’s formidable moat is built on its enormous scale, trusted reputation for reliability and security, and network effects, where the value of the service increases as more people use it.

This is a cash machine

Given that its network is simply moving data around, Visa has low capital expenditures. This means it generates buckets of free cash flow. Last year, that was to the tune of nearly $20bn.

That translates into an incredible 60% free cash flow margin. This indicates that for every £1 of revenue generated, the company retains 60p as free cash after covering operating expenses and capital expenditures.

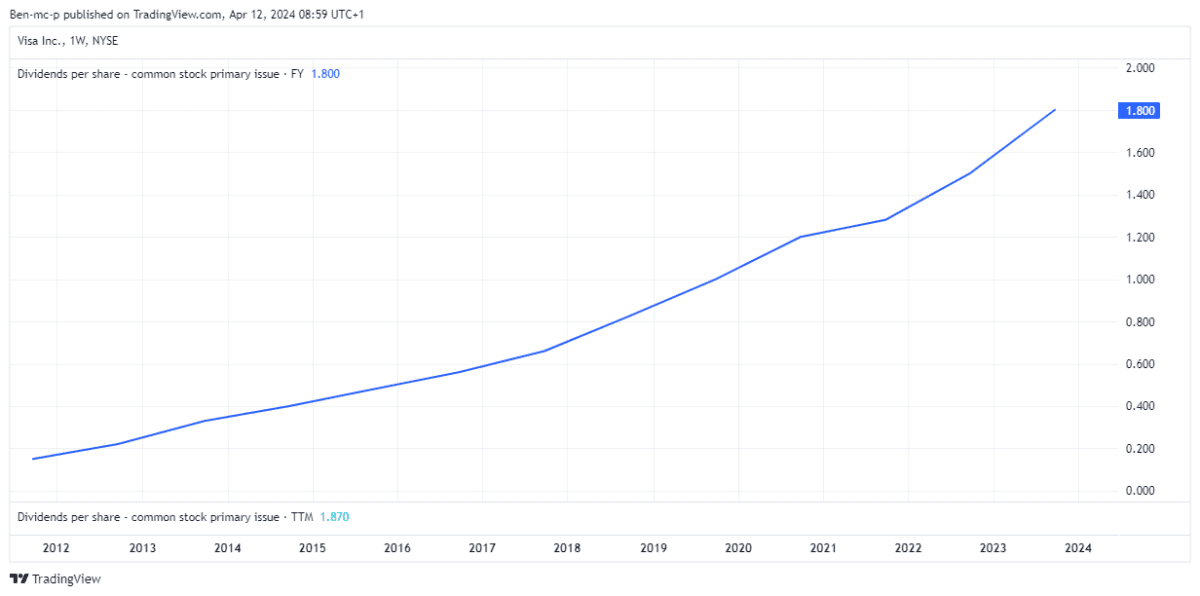

Warren Buffett also loves growing dividends and Visa’s financial prowess has supported these too.

Risk

Now, one issue I’d highlight here is regulation. The EU has long been working on reforms to try and open up the payments market to smaller fintechs that offer rival services.

This may one day threaten Visa’s dominance, though most fintechs today still partner with the payments giant rather than taking it on.

Another thing prospective investors might worry about is Visa’s future growth. After all, the company is already a global giant with a market cap of $553bn.

How much more growth is left? It’s a fair question.

The future

Well, I’d say easily enough to make it a larger business in future. As digital and contactless payments increase globally, including across borders, Visa is automatically set to benefit.

Indeed, many businesses (including most airlines) don’t accept cash these days, thereby compelling consumers to use cards.

Moreover, the number of unbanked adults globally in 2021 was around 1.7bn, according to the World Bank. This represents a vast potential customer base for Visa as these individuals gain access to financial services and start using cards.

I think the firm could even keep lowering its fees to appease regulators and still be a long-term winner due to the higher levels of payment volume.

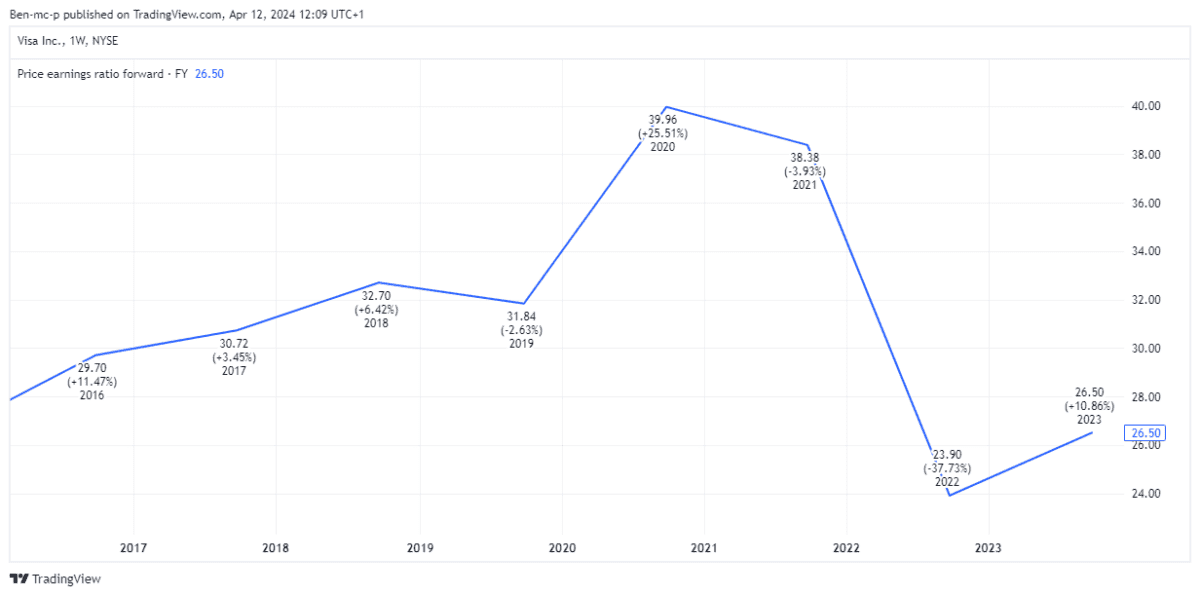

Finally, the stock’s forward price-to-earnings multiple (26.5) is lower than it has been for many years. It’s not overvalued, in my opinion.

As the world moves further away from cash, Visa’s transaction volume should only grow over time.

So if I wasn’t already a shareholder, I’d invest today for the long run.