Games Workshop (LSE:GAW) is one of my favourite investments in the FTSE 250, and I’m convinced it’s a company I will own a stake in for a very long time.

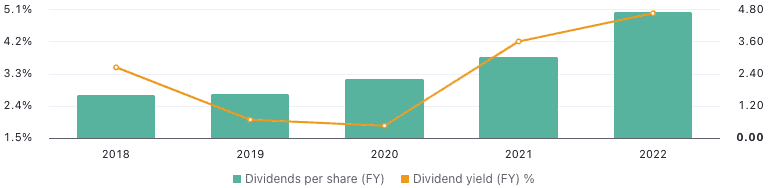

One of the elements I’m really fond of is its dividends, with a current yield of 4.3%. But I should note this is a company with periods of high growth and periods of slower growth. So, it has mentioned its willingness to cut the dividend periodically if need be.

However, it has a relentless focus on quality and care for its customers and brand. It is these kinds of businesses that I believe are almost perfect for my portfolio. That’s because, over very long time horizons, I believe these firms tend to outperform the fast-growing, short-term-focused companies.

What I love about the business

I always look for companies that have the right values. As I am a Games Workshop shareholder, I have researched extensively into the firm’s management, operations, and future strategy.

Some of the organisation’s customers have been fans for over 30 years. I think this speaks massively to the real value the investment offers.

Additionally, most of its stores are run by just one person. That’s not a cultural choice but a strategy for survival. With low operational costs, it describes itself as a business that can survive in good times and bad. I think this is very wise.

Understanding the financials

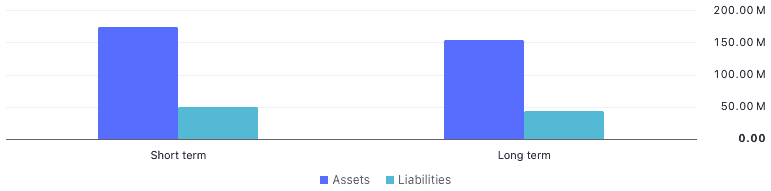

I love it when a balance sheet is strong. It shows me that a company cares about its financial health, and it also bodes well for the future. Too much debt leaves me feeling uneasy.

Thankfully, Games Workshop has a very strong balance sheet. It has 70% of all of its assets proportioned by equity. That is quite rare, and it is one of the foundational reasons I initially invested, alongside its strong operations.

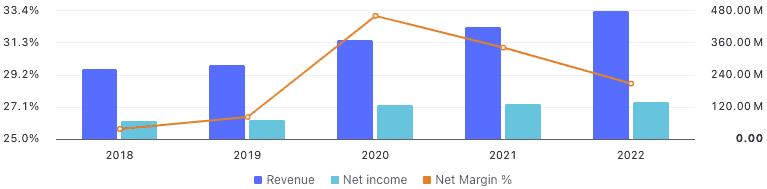

But I should also remember when evaluating my Games Workshop holding that it has one of the highest net income margins for its industry at over 28%. This is clearly a company that commands exceptional brand power.

While recently the business has delivered excellent growth, its management is honest. It says there are going to be periods of expansion and periods of stagnation. Its prime focus isn’t on growth. Instead, growth is clearly a by-product of its great products and services.

I like this. I don’t want to invest in a growth machine. I want to invest in a quality machine. If I can focus on investing in quality, over the long term everything else should fall into place.

What risks do I envision?

Now, while I love these shares and think I’ll own them forever, I have to be careful about the valuation. It’s not cheap. So, it might have a period where the shares grow more slowly in price than otherwise.

But also, the company is expanding to Asia now, and it might find itself struggling in the markets there. The company has mentioned it is aiming for world domination with its brand, and I think it can achieve it. But I hope it’s willing to change its products slightly to meet new market tastes. Otherwise, I think it could suffer in more diverse economies.