The London Stock Exchange is celebrated for being a great place to find passive income shares. While dividends are never guaranteed, investment in FTSE 100 and FTSE 250 companies can deliver significant dividend income over the long term.

Just look at the enormous shareholder payouts that Lloyds, Aviva, and Vodafone have delivered in recent decades. Other businesses like Diageo, Ashtead Group, and Bunzl provide lower dividends in relation to their share price. But they have long and terrific records of payout growth.

Not all dividend-paying stocks will prove to be wise investments. So how do investors decide which companies to pile into and which to avoid?

Should you invest £1,000 in Legal & General right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General made the list?

Five of the best

I’ve developed a checklist of things to consider when deciding which dividend stocks to buy. The list is long, but some of the key items I look at are:

1. Dividend history. Past performance is not a reliable indicator of future returns. But businesses that pay dividends consistently over many years often demonstrate financial resilience and commitment of returning cash to shareholders.

2. Dividend payout ratio. This measures the proportion of a company’s earnings that are paid out in the form of dividends. A low payout ratio can indicate that the business has room to continue increasing cash rewards.

3. Earnings potential. I’ll look for companies that could grow earnings over time, and often businesses that operate in defensive sectors. This gives them stability to pay dividends even if economic conditions worsen.

4. Financial strength. A robust balance sheet and solid cash flows can support consistent dividend payments over time. Debt levels, capital expenditure, and free cash flow are all worth close attention.

5. Dividend yield. A high yield can be a sign of an unsustainable dividend if not supported by profits or cash flow. But choosing big-yielding shares can enable investors to make significant compound gains over time by reinvesting the large dividends they receive.

A top dividend stock I’ve bought

A company may score highly on a number of these points. But this doesn’t necessarily mean that I’ll buy it for my portfolio.

When I invest, I look for passive income shares that have a chance to grow their share price over time. This way I can maximise my return by achieving solid capital gains along with dividend income.

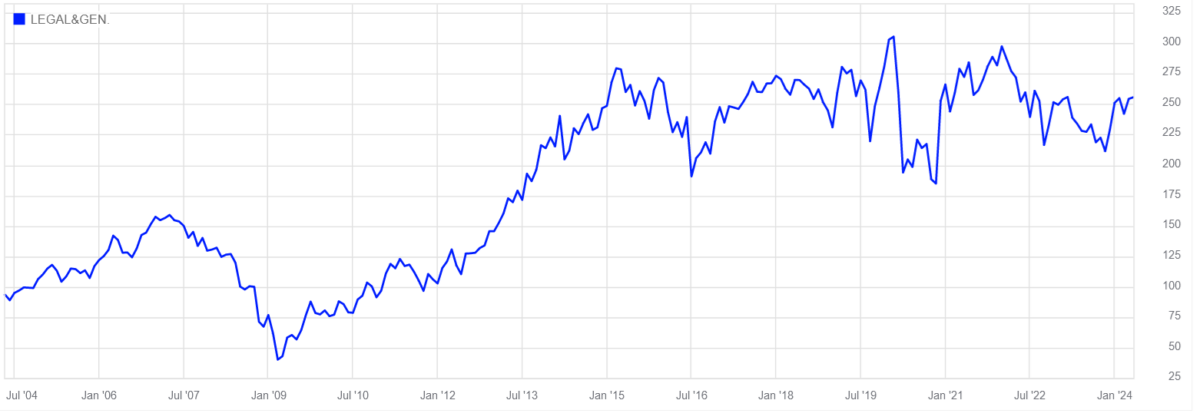

This is why I’ve bought shares in Legal & General Group (LSE:LGEN). Its share price hasn’t kicked on in recent years, but it remains 173% higher than it was 20 years ago.

I’m confident Legal & General’s share price will kick on again before too long, too. It has a terrific opportunity to grow its revenues as Western populations rapidly age and demand for pensions, life insurance, and investment products heats up.

There’s always a risk that sales could stagnate or even reverse in the near term if economic conditions remain tough. But I don’t expect this to impact dividends.

The FTSE 100 company is a brilliant cash generator, and at the end of 2023 had a Solvency II capital ratio of 224%. This underpins City expectations of further dividend growth through the next few years, and subsequently a giant 8.4% dividend yield for 2024.

I think a £1,000 investment in Legal & General shares right now could eventually turn into a £10,000 return.