The boohoo (LSE:BOO) share price reached an all-time high in June 2020. Since then, it’s fallen over 90%. And looking at the company’s recent results, it’s easy to see why.

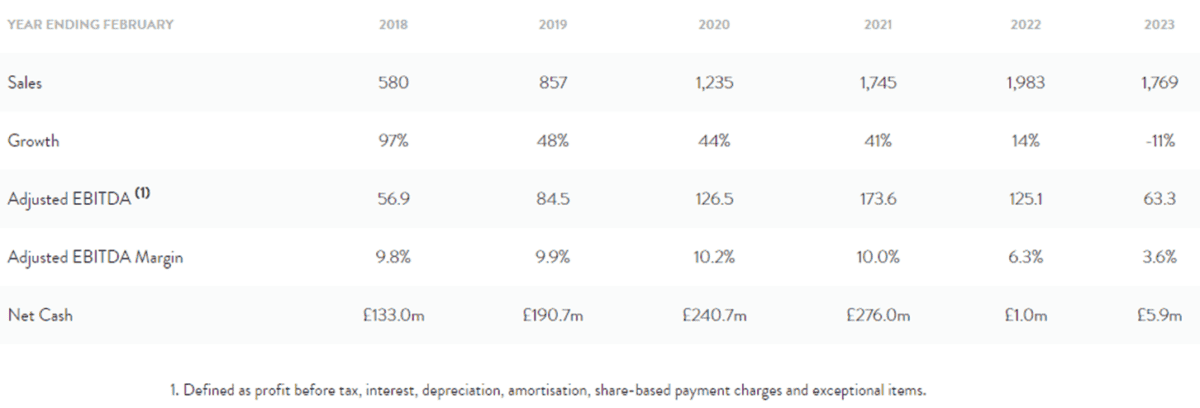

The online fashion retailer was one of the few winners from the pandemic. Between 2018 and 2021, it trebled its turnover and earnings.

But then inflation started to erode its margins and intense competition affected its sales. This double whammy resulted in adjusted EBITDA (earnings before interest, tax, depreciation, and amortisation) of £63.3m during the year ended 28 February 2023 (FY23), compared to £173.6m in FY21.

However, a company needs to pay interest on its borrowings and although depreciation and amortisation are non-cash charges, most of the capital items to which they relate will need to be replaced at some stage. It’s therefore post-tax earnings that really matter. The company recorded a loss after tax of £75.6m in FY23.

Of concern, analysts are forecasting that the company won’t be profitable again until FY26. Even then, their consensus prediction is for earnings of only £6m.

What does this mean for the share price?

Next is currently valued at 16 times its 2024 profit after tax. Using this as a benchmark, boohoo is worth £96m. That’s approximately a fifth of its current market cap.

But I don’t think the share price will fall much further. That’s because I suspect many investors are sitting on some large paper losses. And I know how difficult it is to sell even though — deep down — you know you are highly unlikely to get your money back.

However, as Warren Buffett famously once said: “Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.”

If the share price has stabilised, five city institutions will be disappointed. That’s because, according to the latest figures from the Financial Conduct Authority, nearly 5% of the company’s shares have been borrowed by these short sellers, in the hope that their value falls further.

Existing investors will be hoping that Mike Ashley launches a takeover bid. However, although Frasers Group has been quietly building a stake in the company, it hasn’t increased its 22.1% holding since 7 February.

Final thoughts

Based on its earnings potential, boohoo appears overvalued to me. I know share prices are supposed to reflect future earnings. But how many years will investors have to wait for the company to make the level of profit needed to justify its current stock market valuation?

It’s a similar story when it comes to looking at its balance sheet. At 31 August 2023, its net assets were £380m. That’s approximately 18% lower than its market cap. If all the company’s assets were sold for their book value, and the proceeds used to clear its liabilities, there wouldn’t be enough cash left over to give the shareholders the current value of their holdings.

That’s why if I did have a stake in boohoo, I’d be sobbing uncontrollably.