I consider generating a passive income quite tricky, primarily because shares that pay high dividends don’t often also provide share price growth. Luckily, this firm offers a nice balance of both, and it has a third benefit of being quite recession-resistant.

World-famous essentials

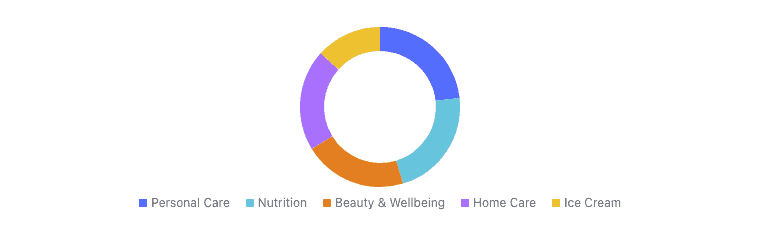

Unilever (LSE:ULVR) sells personal care, home care, and packaged food items in almost all regions of the world.

It breaks down its product sales into five segments, which are as follows:

Should you invest £1,000 in Hunting Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Hunting Plc made the list?

One element of the business which is incredibly compelling to me is that it is quite recession-resistant. Because it sells products that people generally consider essential, they are unlikely to cut them from their budgets when it comes time to tighten expenses.

That’s a very strong position for a business to be in, and it provides some security for shareholders during economic downturns.

Growing in price and highly profitable

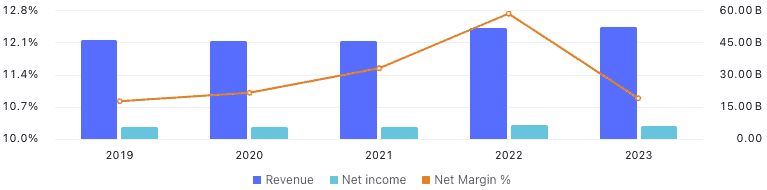

Over the past 10 years, Unilever has grown in price by almost 53%. That’s great news because it ticks my box as potentially being able to protect my initial investment value.

But that’s not all I love about this opportunity. It’s also highly profitable, with a net income margin of almost 11%. That’s right at the top of its industry. Now, while that’s gone down recently, it’s still roughly at the level it has been usually over the past decade.

It’s the dividends I really like

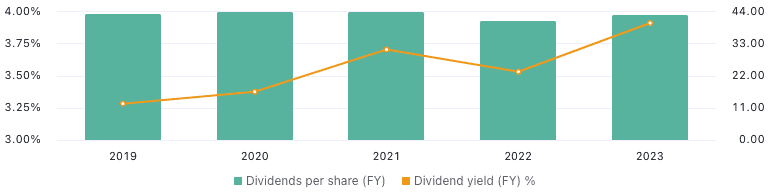

It’s great that the market keeps pricing Unilever shares higher. But the dividends it pays out are what really interests me. Those payouts provide me with money in my pocket each year that I can use to help me pay my bills or spend on leisure.

With a dividend yield of almost 4% at the moment, I’m quite happy because I consider the shares to be relatively low risk. That’s much more appealing to me than a 10% yield from an investment where I’m worried all the time that the shares are going to drop in price. I value being able to sleep well at night more than anything.

The balance sheet is concerning

While the investment looks generally strong to me, one area that I don’t like so much is the balance sheet. As it’s got 76% of its assets proportioned by liabilities, that leaves me a bit concerned.

While its revenue is quite recession-resistant, there are still problems that could arise with supply chains in the case of a natural disaster or war, for example. If that happens, the balance sheet could get even worse, and it could struggle to grow for a while longer than if it had lower levels of debt.

Also, if it does face one of the situations where its revenues drop, it could easily cut the dividend. That’s why I always have to remember when investing to diversify my portfolio. That will help protect me from anything going wrong in one company.

I’m considering it

I think this could be one of the best British investments for me to generate a strong dividend income. However, I’m not investing in it just yet. Over the next year, I might consider it. However, I have a few other opportunities higher up on my watchlist first.