It’s been a couple of years since I last considered buying shares of Spotify Technology (NYSE: SPOT) for my ISA. Over this time, they’ve risen more than 100% and I’m regretting my decision not to invest.

Clearly, the stock is hitting all the right notes with investors. So I’m back for another look.

Why I didn’t invest

As a global leader in podcasts and music streaming, Spotify already has a lot going for it. But I like that it still has attractive adjacent market opportunities in films, events, audiobooks, e-commerce, as well as its targeted-advertising business.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

Crucially, it has smart leadership in forward-thinking co-founder and CEO Daniel Ek.

So why have I never owned its shares?

In a word, competition. Specifically, the tech juggernauts that have stuck ‘music’ after their name and offer the same service: Apple Music, Amazon Music, YouTube Music, TikTok Music. This worried me.

But the strange thing is, I don’t use any of those apps. I’m a Spotify Premium member, along with 236m other subscribers worldwide at the end of 2023. So I already know how sticky the platform is.

My original fear was that all this competition would prevent the company from having pricing power to expand profit margins over time.

In other words, I was worried that it would raise prices by a few quid and droves of listeners would jump ship to cheaper rivals. And of course, Spotify has a lot more to lose as a pureplay streaming firm.

Growing globally

As it turns out, I needn’t have worried. The company is looking to increase prices in several key markets for the second time in 12 months, and this hasn’t affected growth.

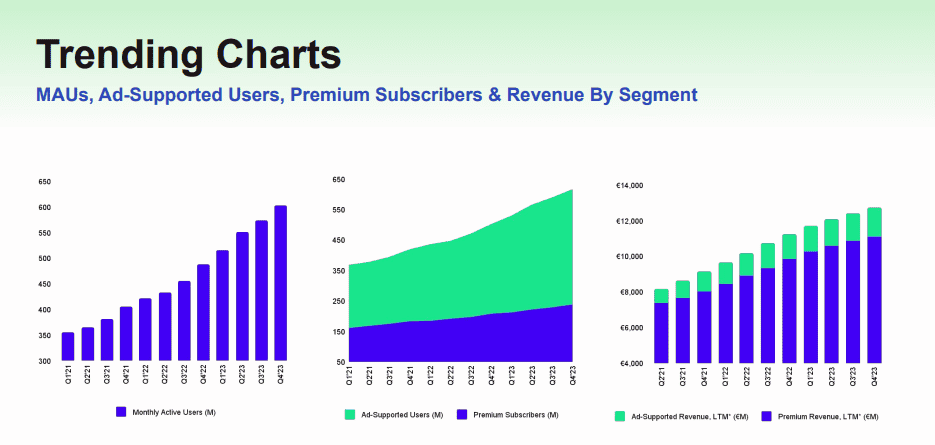

Last year, revenue grew 13% year on year to €13.2bn. And monthly active users (MAUs) reached 602m, up 23% from the end of 2022. The number of paying premium subscribers rose 13% to 236m.

It did post a €532m net loss though, and has lost money every year since going public in 2018. But now that the platform is reaching enormous scale, management is laser-focused on generating profits.

It has cut costs, raised prices and this year analysts see €1.4bn of free cash flow from €15.5bn in revenue. Next year, there’s a forecast €1.1bn net profit.

The fly in the ointment, however, is valuation. The stock is trading on price-to-free-cash-flow ratio of 40 for this year and 32 for 2025. This is a premium price, which adds an element of risk.

Innovation

Having said that, I think the firm has built a durable competitive advantage. Whereas music streaming is arguably an afterthought for Amazon and Apple, Spotify is ‘all-in’ on audio.

This means it continuously invests in innovative technologies to improve the user experience. For example, it uses algorithms to regularly curate personalised playlists based on user listening habits.

More recently, it has introduced AI-powered DJs and a ‘Merch Hub’, which recommends music-related merchandise.

With over 600m regular listeners on the platform, the long-term advertising opportunities appear significant. And Spotify could further increase its premium prices (and therefore profits) by bundling podcasts in with audiobooks and music.

As a result, I’ve promoted the stock to my watchlist to keep an eye on. I’d invest on any significant dip.