A Stocks and Shares ISA is one of the most tax-efficient ways to invest in shares. It offers tax-free returns on investments of up to £20,000 a year.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

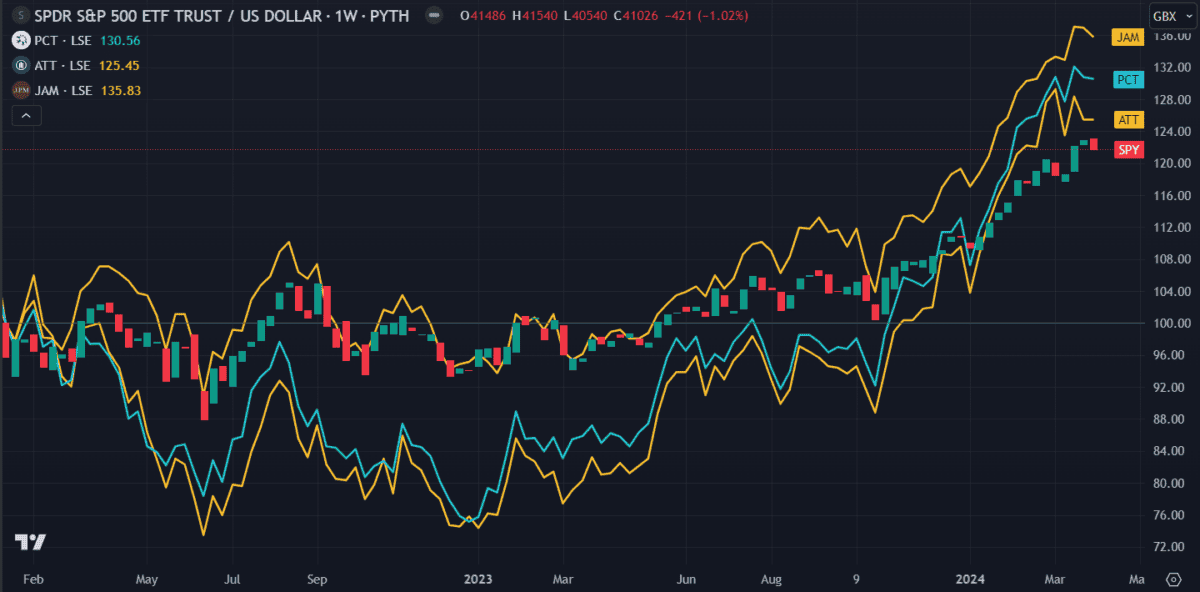

Investment trusts are a great way to gain exposure to a wide range of diversified shares, particularly US tech stocks. The following three investment trusts have outperformed the S&P 500 in recent years, so I think they would be worth considering for an ISA in 2024.

Should you invest £1,000 in ITV right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if ITV made the list?

The AI-focused high-flyer

Polar Capital Technology Trust (LSE:PCT) has risen 126% in the past five years — far higher than the S&P 500’s 79% gains. The trust recently pivoted towards the burgeoning artificial intelligence (AI) market, helping to boost its value. Investments in AI-reliant semiconductor stocks like Rambus and automation software like Synopsys have helped drive up its share price. Closer to home, it’s diversified into promising LSE-listed biotech firm Oxford Nanopore Technologies.

However, it’s still heavily weighted towards US tech stocks, with approximately one-third of its portfolio invested in Nvidia, Microsoft, Meta, Apple and AMD. This leaves it overly exposed to downturns in the US economy and underexposed to any upticks in the Asia Pacific region. Still, the promising future of AI makes me feel this stock could perform well long term.

An American equity-focused trust

Managed by experts at one of the largest financial institutions in the US, the JPMorgan American Investment Trust (LSE:JAM) is up 123% in the past five years. It includes a mix of growth and value stocks of companies with strong financials and solid balance sheets. With a 26% focus on tech, it also includes more diverse shares like Berkshire Hathaway, Mastercard, and Loews Corp.

However, the index could be affected by an economic downturn in the short term. A renewed likelihood of rate cut delays in the US due to unexpected job growth shook markets recently. Analysts fear this could lead to subdued US market performance in the second half of the year. Major tech stocks like Nvidia and AMD closed down last week.

In the long term though, I feel a JPMorgan-run trust is an investment I could rely on.

Top tech stock exposure

Allianz Technology Trust (LSE: ATT) is a great fund for those keen to gain exposure to the booming US tech industry. It’s headquartered in the heart of the action, Silicon Valley, where top tech firms like Apple and Google operate. The Allianz team brings a wealth of knowledge and experience to the fund, helping to craft a careful balance of the best-performing stocks at any time. The fund offsets mega-cap leaders like Nvidia and Microsoft with smaller upstarts like Monolithic Power Systems.

Up 120% in five years, the trust appears to have reliable growth potential. However, with a heavy weighting towards tech stocks, it’s vulnerable to the type of sudden price movements these stocks are prone to. In the first half of 2022, it fell 42% when US tech stocks plunged. This makes it prone to short-term volatility. However, in the long term, tech isn’t going anywhere and I think this trust can continue to grow.