HSBC (LSE: HSBA) shares have more than doubled since bottoming out at 283p during the dark pandemic days of 2020. However, they’re still down 2% over five years.

That’s worse than the return from the FTSE 100, which has hardly been setting the world on fire. Of course, these comparisons don’t include dividends and HSBC has been dishing out some decent income lately.

I’ve been adding this bank stock to my portfolio since February and intend to carry on doing so. Here are three reasons why.

Should you invest £1,000 in K3 Capital Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if K3 Capital Group Plc made the list?

Attractive valuation

For starters, the shares are cheap. And while that’s hardly surprising for a Footsie bank these days, it’s still reassuring to know that I’m not overpaying for a stock.

So how cheap is HSBC then?

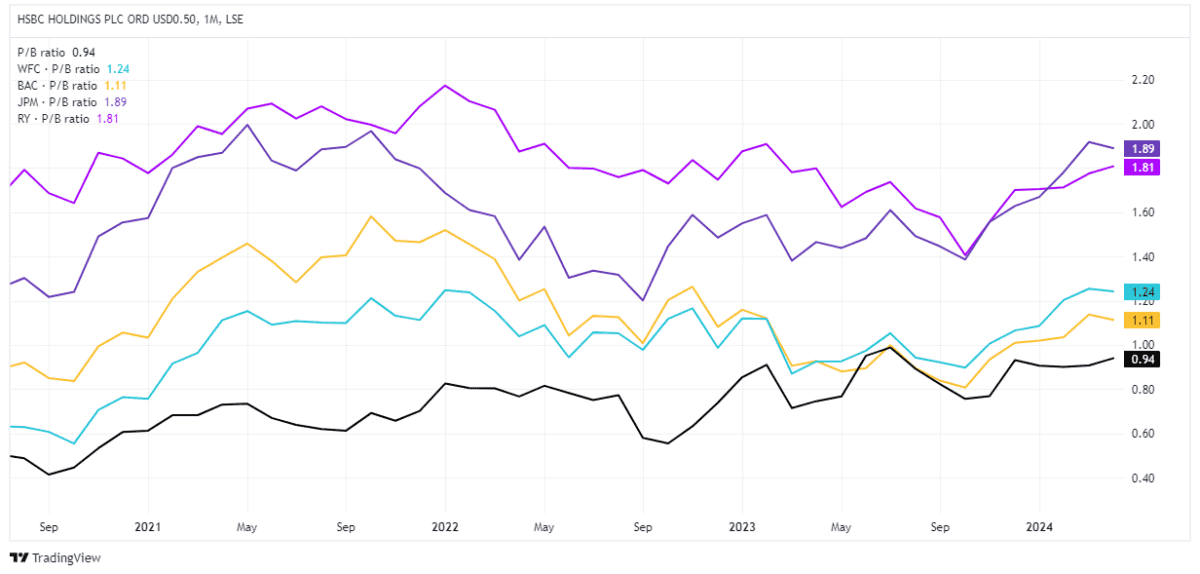

Well, on a price-to-book (P/B) basis — a valuation metric that compares a company’s market value to its book value (assets minus liabilities) — it is cheaper than international peers. The P/B ratio is 0.94.

Below, we can see that is lower than Wells Fargo (1.24), Bank of America (1.11), JPMorgan Chase (1.89), and Royal Bank of Canada (1.81).

Now, a large chunk of HSBC’s revenue (around 55%) comes from mainland China and Hong Kong. The ongoing economic slowdown and property crisis in China are causing concerns, as are geopolitical tensions with the West.

Meanwhile, interest rates are expected to trend lower this year. So earnings may have already peaked. These are all things worth bearing in mind.

Nevertheless, I think these challenges are reflected in the stock’s valuation today. And investors are being compensated for taking on these risks by a massive dividend yield. Which brings me to my second reason to consider investing.

Passive income

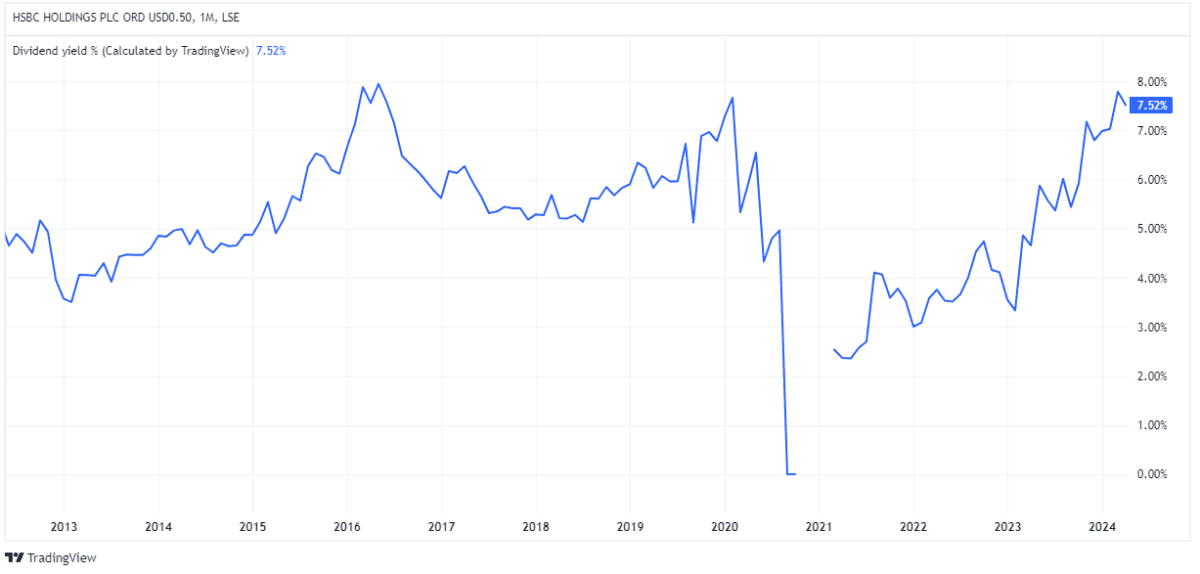

The FTSE 100 average dividend yield is currently 3.9%. In contrast, HSBC stock is carrying a 7.5% yield.

This year, however, the shares offer a massive prospective yield of 9.5%. This is partly because the bank is expected to distribute a special dividend after selling its Canadian operation for just under $10bn.

Even next year though, the forward yield is 7.4%. That’s higher than most other stocks, banks or otherwise.

Of course, no dividends are guaranteed. But I note the target dividend payout ratio is 50% of reported earnings per share. This means the company aims to distribute half of its earnings to shareholders as dividends. Therefore, the payout appears safe.

Asia growth opportunities

A third reason I’d invest relates to HSBC’s increasing focus on Asia. As well as Canada, it has sold off assets in Russia, France, Greece, and New Zealand in order to double down on the region.

It is targeting growth in wealth management and transaction banking. This seems to offer a great long-term opportunity because Asia Pacific has the fastest growing number of high-net-worth individuals.

Naturally, Asian economies aren’t growing as fast as they once were. But most analysts and economic forecasts predict that they’ll still experience faster growth than any other region in the coming decades.

This is due to a number of factors:

- Large and growing populations, with a younger demographic than the West

- Rapid urbanisation

- A growing consumer middle class

I think HSBC shares offer investors like myself a cheap and attractive way to gain long-term exposure to Asia’s growing prosperity.