When it comes to dividend stocks paying out passive income, I tend to believe that boring is better. That is, I don’t want some exciting tech firm whose business model is ultimately built on sand.

I’m after an established company that operates in a permanent sector. And I want to see a solid track record of rising dividends. So, boringly dependable, basically.

Here, I’ll highlight a FTSE 250 stock that ticks all my boxes.

Should you invest £1,000 in easyJet right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if easyJet made the list?

Low-risk dividends

BBGI Global Infrastructure (LSE: BBGI) is an investment company with 56 infrastructure assets in the UK, North America, Australia, and continental Europe.

First off, I like this global diversity, with the portfolio spread across developed countries with credit ratings between AA and AAA.

| Geographic split | |||

| Canada | 35% | ||

| UK | 33% | ||

| Continental Europe | 13% | ||

| US | 10% | ||

| Australia | 9% |

I also like the nature of these assets. We’re talking about motorways and bridges, schools, hospitals, police and fire stations, colleges, and more. Basically, things that are unlikely to disappear overnight.

In the UK, this includes Gloucester Royal Hospital, the M1 Westlink, and the M80 motorway in Scotland’s central belt.

Moreover, this is public sector-backed contracted revenue, resulting in predictable long-term cash flows that have inflation linkage.

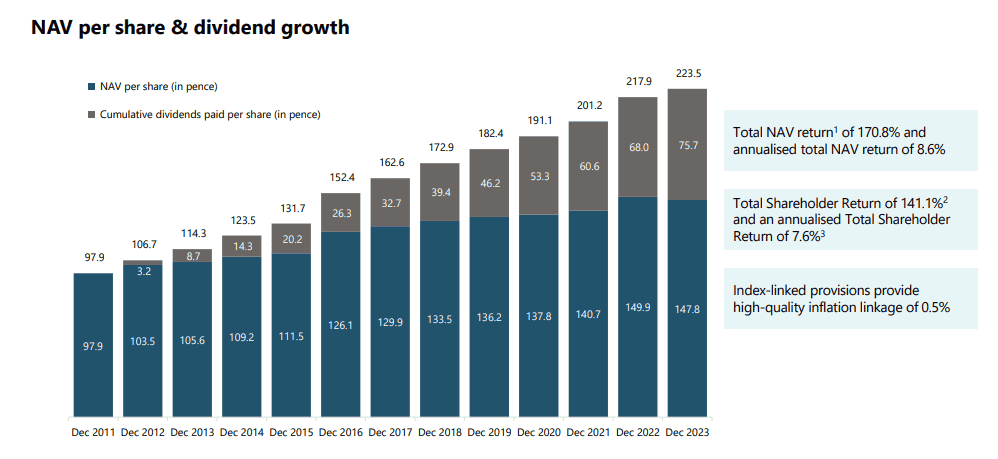

No dividend is ever totally safe, but this comes close, in my opinion. It has a consistent payout record stretching back to 2011.

So why on earth has the share price fallen 25% in three years?

Risks in perspective

The culprit has been higher interest rates. This has made other assets more attractive than shares, which carry slightly higher risk (and reward).

So one challenge here would be a return of inflation and a higher-for-longer rate environment. That could further dampen investor sentiment towards the shares.

Additionally, refinancing existing debt at higher rates can negatively impact cash flows due to the increased costs. However, 55 of its 56 assets have no refinancing risk.

Plus, BBGI now has no debt on the trust level after it fully repaid a revolving credit facility that it used in 2022 to fund two investments.

Those repayments were made entirely from surplus cash flows last year. This signals that it can continue to grow organically without needing to access equity markets for funding.

Indeed, BBGI estimates that even without further acquisitions, the portfolio could continue to generate a rising dividend for the next 15 years.

Last year, its dividend was covered 1.4 times by cash flows.

A grand a year in passive income

Speaking of the dividend, this increased 6% last year to 7.9p per share. And the firm has signalled its intent to raise this another 6% in 2024 (to 8.4p).

This gives the stock an attractive forward dividend yield of 6.46%.

At today’s share price of 130p, this means I’d need approximately 11,907 shares to generate £1,000 a year in passive income for this financial year. They would cost me around £15,480.

Now, that’s way more than I intend to initially invest in this dividend stock. But I plan to continue buying shares over time, especially while they’re trading at a 10% discount to net asset value (NAV).

Whenever the stock pays me dividends, I plan to reinvest them and generate higher passive income down the road.