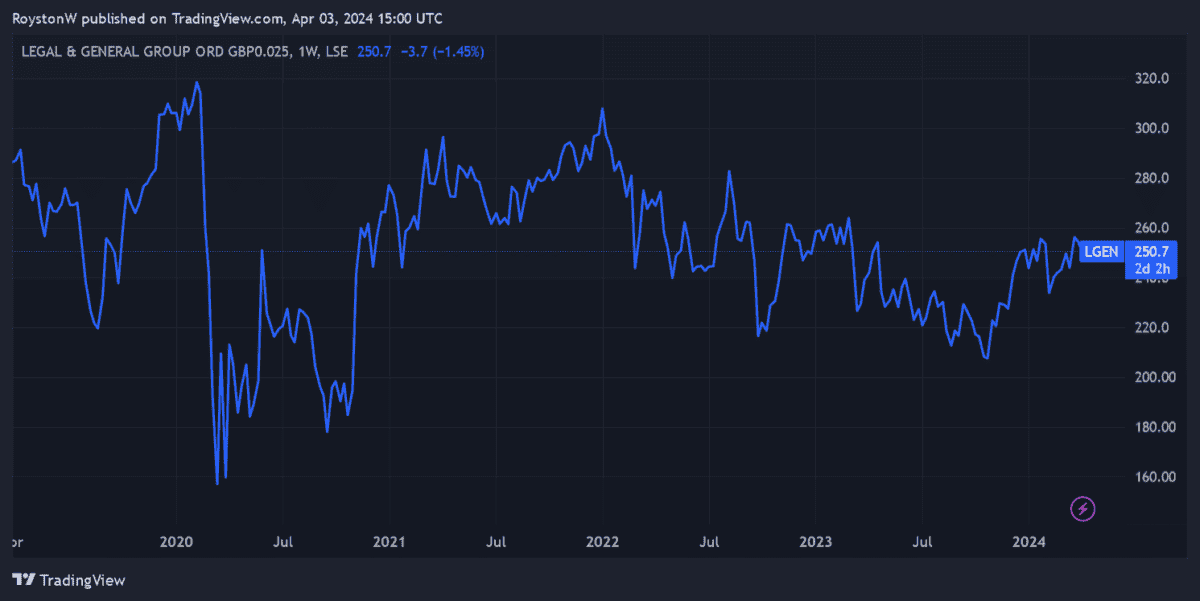

Legal & General‘s (LSE:LGEN) share price is rising rapidly again. But the financial services giant still trades well below its pre-Covid levels. Could it be one of the FTSE 100‘s best value shares to buy right now?

Earnings

The first thing to consider is how Legal & General shares are valued in relation to predicted earnings. I’ll do this with the price-to-earnings (P/E) ratio and price-to-earnings growth (PEG) ratio.

Today, the company trades on a P/E ratio of 9.6 times for the current financial year. This sits below the average of 10.5 times for FTSE 100 shares.

It’s also slightly below an average of 9.8 times for a peer group comprising itself, Aviva, M&G, Prudential, AIG and MetLife. The individual ratios for these firms can be seen below.

| Stock | Forward P/E ratio |

|---|---|

| Aviva | 11.3 times |

| M&G | 9.3 times |

| Prudential | 9.4 times |

| AIG | 11 times |

| MetLife | 8.4 times |

Low earnings multiples are common among businesses with poor growth potential. However, this isn’t a category that Legal & General falls into.

City analysts think the firm’s earnings will soar 254% year on year in 2024. This leaves it trading on a PEG ratio of less than 0.1.

Any reading below 1 indicates that a stock is undervalued.

Assets

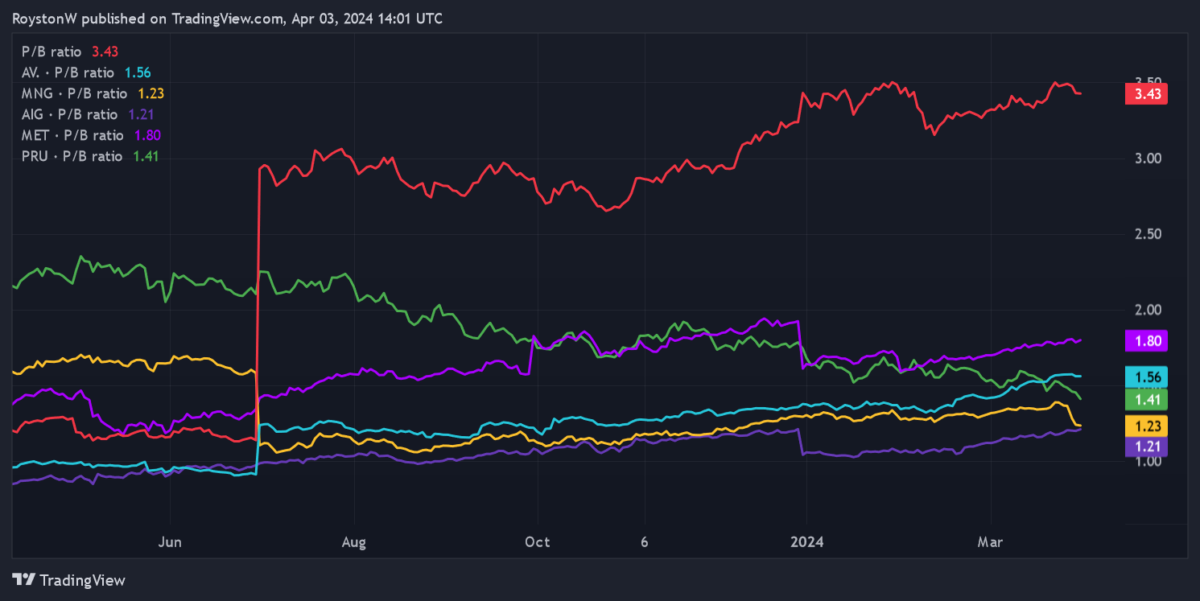

As we can see, Legal & General’s price-to-book (P/B) ratio has shot up since last summer. In fact, at around 3.4 times its multiple is way ahead of its 10-year average of 2 times.

We also notice that the firm’s P/B ratio is significantly higher than those of each of its industry rivals. The sector average comes in at 1.8 times.

Dividends

Next, I’ll look at the dividend yield, which illustrates the income provided by L&G’s shares relative to its price.

Here the company scores highly. Its reading of 8.5% for 2024 sails past the 3.7% average for FTSE 100 stocks.

Furthermore, its yield is also much higher than those of each of its rivals (bar M&G). The average yield for the six companies discussed here sits back at 5.4%.

| Stock | Forward dividend yield |

|---|---|

| Aviva | 7% |

| M&G | 9.4% |

| Prudential | 2.4% |

| AIG | 2% |

| MetLife | 2.9% |

Should I buy Legal & General?

Having considered these metrics, I think Legal & General’s an attractive value stock to buy today. In fact I have recently added it to my own portfolio in recent days.

Only M&G offers better all-round value right now. But I’m prepared to pay a slight premium for Legal & General’s superior brand strength and market-leading positions.

Financial services companies like this have terrific long-term growth potential, in my opinion. Legal & General may struggle to grow business in the near term if consumer spending remains under pressure. But I think it can grow revenues strongly in the years ahead, driven by demographic changes in the West.

It can use its strong balance sheet to capitalise on this opportunity. Its Solvency II ratio stood at 224% as of December. This financial robustness also puts it in good shape to continue paying big dividends to its shareholders.