Down 45% this year, NIO (NYSE: NIO) stock on paper looks like one of the best bargains available to investors right now.

But is that the case? Or, at $4.64, should I steer clear of the Chinese electric vehicle (EV) manufacturer?

A rocky road

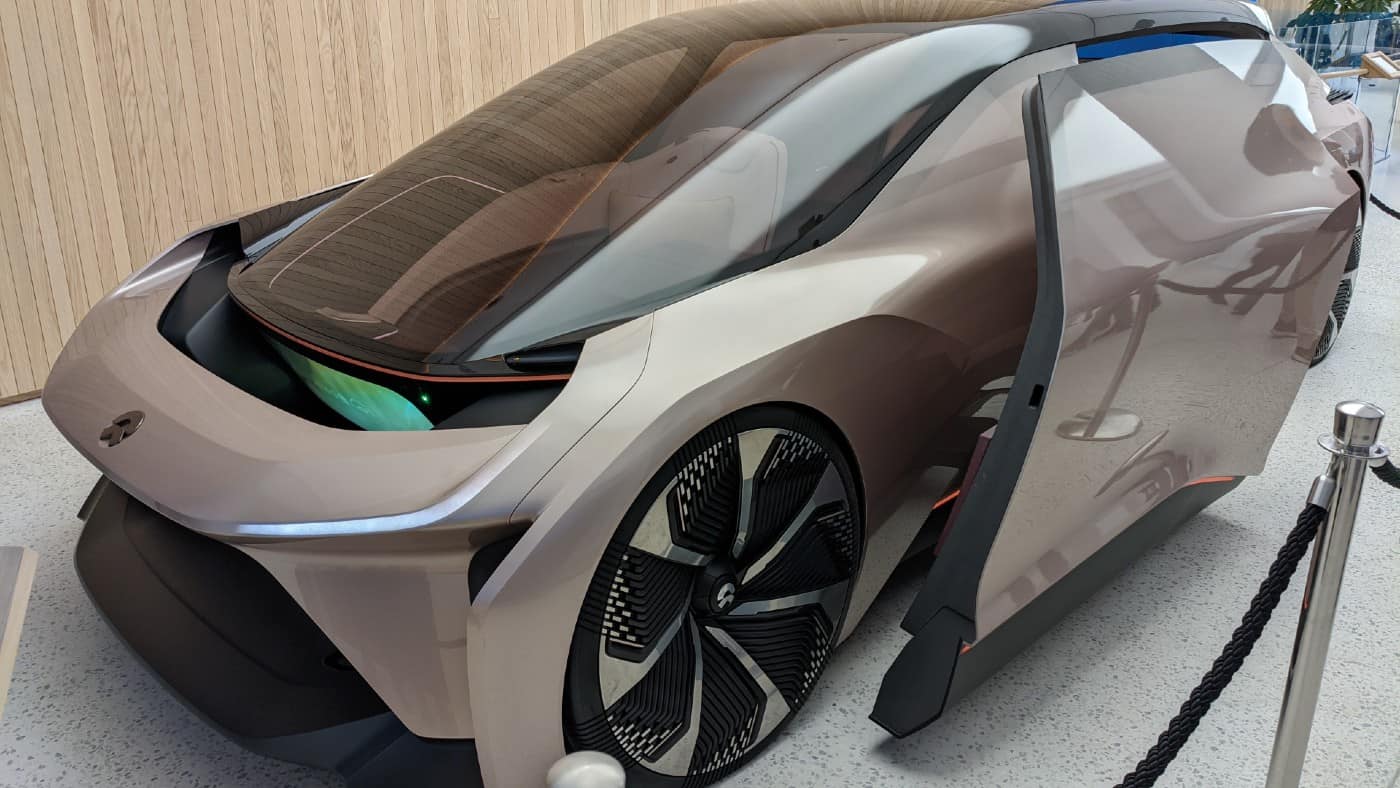

I still remember the hype surrounding NIO between 2020 and 2021. With it gaining traction through events such as its coveted NIO Day, investors simply couldn’t get enough of the stock. It rose 1,172.6% in 2020 alone. Given that, it’s fairly easy to see why the market was lapping it up.

However, it has been a rather quick comedown. Its share price has plummeted 92.5% from its all-time high. It was once labelled the ‘Tesla of China’. Shareholders will be severely disappointed with where the business has gone since then.

Too many roadblocks

I look at the business today and I see too many red flags. Firstly, its debt has grown significantly in recent years. Today, it sits at over $4bn. Interest rates are at highs not seen for decades. That doesn’t bode well for growth stocks such as NIO.

There’s also the US issue. Relations between China and the West remain tense. And while NIO has plans to sell its first car in the US next year, this is becoming increasingly unlikely.

There’s the potential that we’ll see Donald Trump regain his status as President later this year. No doubt this will complicate matters further. It’ll also have a massive impact on NIO’s growth plans going forward.

Not totally written off

Even so, I’m not completely disregarding the investment case. There are things to like about the business.

It operates in a space that’s forever growing and evolving. With that comes opportunities. China’s EV market is set to grow at an annualised growth rate of 17.2% between now and 2029. That’s a lot of demand for NIO to capitalise on.

It’s also beginning to expand its model range to attract new customers in the mass market. Later this year it’ll release a sports utility vehicle priced considerably below its current cheapest model.

The downside

But there’s also a downside to the above. With a growing industry comes more competition.

NIO previously stood out for its cutting-edge battery-swapping technology. Drivers can use NIO EV stations to swap empty batteries to a full one in just a few minutes.

However, as competitors have caught up and infrastructure has developed, this isn’t as impressive as it once was.

Not for me

NIO was previously labelled as the next big thing to emerge from the EV space. But it’s safe to say it hasn’t delivered on the hype yet.

Some investors may see this as an opportunity to snap up some incredibly cheap shares. But I disagree. The case of NIO stock is certainly interesting, so I’ll be keeping an eye on its performance. Will I be buying? Not today.