I consider Warren Buffett undoubtedly one of the world’s greatest investors, if not the best of all time.

However, one of Berkshire Hathaway‘s largest investments, namely Apple (NASDAQ:AAPL), was not included in the permanent holdings list in Buffett’s most recent annual letter to shareholders.

I have my own concerns about the long-term viability of Apple shares. While I think the company will continue to do well, and I love the products, I believe we are past its high-growth era.

Should you invest £1,000 in Apple right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Apple made the list?

Apple as it stands today

I recently listened to famous investor Chamath Palihapitiya break down Buffett’s recent letter a bit. He noted how Buffett had sidelined Apple in the text.

Additionally, Palihapitiya said that he thinks the company could grow in the future around the rate of the wider economy. To me, that makes sense, considering the size of the firm today.

In fact, Apple is seeking new emerging markets, as its American operations are already incredibly saturated.

But let’s make no mistake: these are products that many people around the world consider amazing — even fundamental to business and social life. Apple isn’t going anywhere. But what it might lack reliably over the next few decades is a term in investing we call ‘alpha’. In other words, can the investment beat the broader market index called the S&P 500?

Here’s what history has shown:

As we can see, over the past 10 years, this is an investment that has outperformed the broader market by leaps and bounds. But as the famous saying in investing goes, past returns are no guarantee of future results.

A closer look at the potential slowdown

Apple’s primary revenue generator is the iPhone, but the market for this is maturing significantly now. Most potential customers already have one of the devices, and many of the ones who do aren’t considering an upgrade every year or two because they just don’t see a need.

Also, Apple isn’t investing as heavily in generative AI as its peers, OpenAI and Alphabet. In fact, it’s even considering a partnership with one of these firms to build an AI smartphone.

But why I think this is concerning for Apple is that I believe AI infrastructure will be one of the crucial competitive moats for technology companies in the near future. If Apple doesn’t have its own leading AI tech, it could lose out on massive potential earnings.

The company is still strong

With my concerns stated, I need to admit that the company is still remarkably strong right now. If I’m honest, I think Apple will outperform the broader market over the next decade.

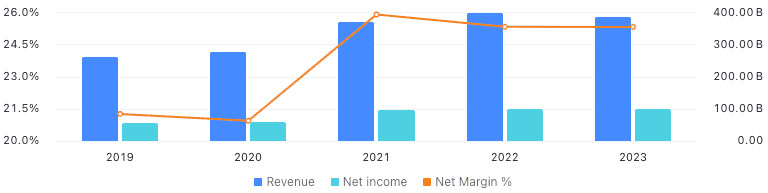

After all, its net income margin is 26%, which is way higher than almost all of its peers selling hardware. And its growth is high: 15.7% annually for revenue, and 23.2% annually for earnings, over the past three years.

I’m a shareholder

I own Apple shares, but based on my recent research, I won’t be adding to my position. However, I also don’t see a reason to sell.

I’m writing on an Apple laptop as I write this, and when I come to upgrade, I’m sure it will be a Macbook Pro with an M3 chip. The company’s growth may slow down, but the products remain supreme.