Changes in interest rates are likely to affect the Taylor Wimpey (LSE:TW) share price in two ways.

Firstly, the base rate influences the amounts charged by lenders for mortgages. More expensive home loans means fewer sales for housebuilders.

Secondly, with a history of paying healthy dividends, the stock’s been a favourite of income investors. But higher interest rates means better returns can be achieved on savings accounts and government bonds. Investors may prefer these to riskier equities.

Should you invest £1,000 in Nvidia right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Nvidia made the list?

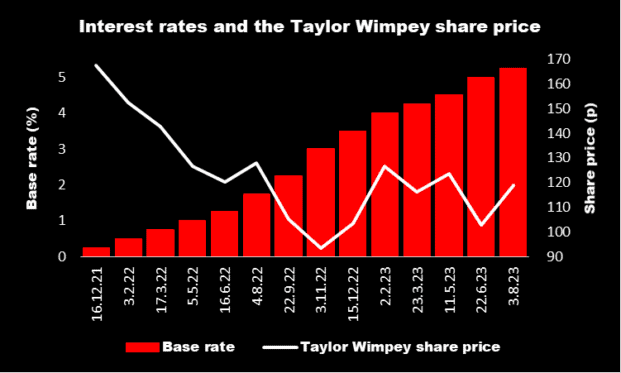

The chart below shows the last 14 increases in the base rate along with the Taylor Wimpey share price on the day the changes were announced. Broadly speaking, it shows that as the cost of borrowing has increased, the stock price has fallen.

Although the share price has stabilised recently, it’s still 25% lower than it was in April 2019. And it isapproximately 40% below where it was in February 2020, just before the pandemic started.

Where next for interest rates?

Economists appear to agree that interest rates have peaked. Indeed, city traders appear to be pricing in three 0.25% cuts this year.

However, I think there are reasons to be more conservative.

Those who disagree with me will quote the Governor of the Bank of England — a man with a reputation for being cautious — who recently said cuts were “in play“.

But at the last meeting of the Monetary Policy Committee, only one of the nine members voted to bring down the base rate. And on 26 March, one of its members said that three cuts in 2024 is “too many“. Citing potentially inflationary wage pressures, she suggested traders were being “complacent“.

Patience is a virtue

But even if we do see rate cuts soon, I think it will take a while before it has a significant impact on Taylor Wimpey’s share price. That’s because the FTSE 100 company doesn’t have lots of empty houses ready to be bought. Although it has many sites across the UK, it will only develop these when it knows the properties can be sold.

In 2023, excluding joint ventures, the company sold 10,356 units. In 2024, it expects to sell 9,500-10,500. Analysts are expecting adjusted earnings per share (EPS), in 2024, of 8.3p (2023: 9.9p). For 2025, the ‘experts’ are predicting EPS of 10.6p and sales of 10,866 properties. But this is still a long way short of 2019, when it completed 15,520 units.

However, now could be a good time to buy the stock. We have probably passed the worst of the current housing market slump.

And Taylor Wimpey remains committed to paying a generous dividend. It promises to return 7.5% of net assets or “at least” £250m annually to shareholders. Based on the current number of shares in issue and its balance sheet at 31 December 2023, that’s a range of 7.1p-9.6p. This implies a yield of 5.2%-7%. Even at the bottom end of this range, it beats all savings accounts. And — assuming the housing market recovers — there could be some capital growth as well.

Of course, dividends are never guaranteed. And as we have seen recently, the housing market can be highly volatile. However, if I didn’t already have exposure to the sector, I’d be looking to take a position in Taylor Wimpey.