This FTSE company I’ve found has seen quite poor growth over the past few years. But I think that has primed the share price for me to invest.

After all, it was Warren Buffett who said: “I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

But I’m also torn between it and another stock. So which should I buy?

Should you invest £1,000 in Computacenter Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Computacenter Plc made the list?

An integrated IT company

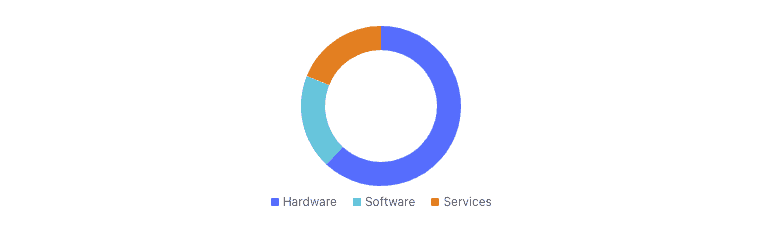

First, Softcat (LSE:SCT). It provides services in IT sourcing, solutions, and management. It also offers cloud computing, cybersecurity and digital workspace services.

Customers include Morrisons, EVRi, DFS, and Virgin Money Group, among others.

However, it faces significant competition from other UK enterprises like my other potential pick Computacenter, and firms with a global reach like CDW and Specialist Computer Centres (also known as SCC).

I think Softcat has a slim competitive advantage over these firms. I consider its strong industry relationships, particularly as it relates to IT sourcing, significant.

But other than this, its breadth of portfolio capabilities is easily replicated. Many other firms already directly compete.

It’s the financials that stand out

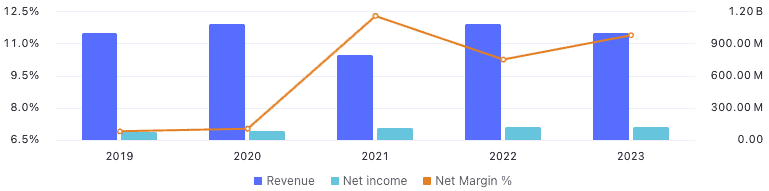

Yet what immediately struck me about Softcat is its profitability. For example, it has a net margin of 11.4%, which is in the top 20% of companies in its industry after growing considerably recently:

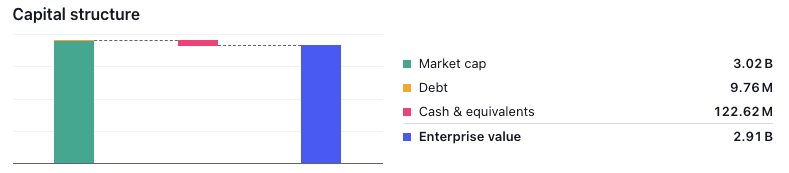

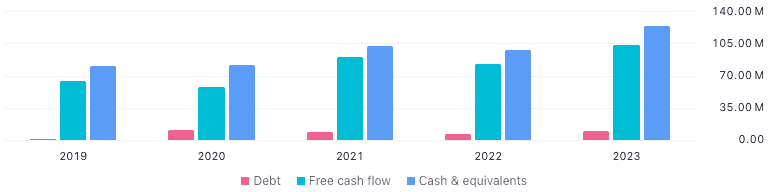

Also, I like that it has over 12 times as much cash on hand as debt, meaning it can easily cover its obligations. That makes expansion plans in the future somewhat more viable.

Now, its earnings growth has been a tiny 1.3% over the last year. But over the past 10, it’s been 18.8%.

And as I said, a temporary slowdown is a chance for me to buy in at a cheaper price. The shares are selling at 30% below their all-time highs as a result.

As analysts are predicting that its earnings growth will get back to normal this year for the indefinite future, I think that’s an opportunity for me.

Cost is good, but what about value?

From my research, Softcat shares look just about fairly valued as I write.

While the company has a price-to-earnings (P/E) ratio of around 27, which seems high, this is normal for the firm over the past 10 years.

It’s good for me to compare this to Computacenter, which has a P/E ratio of just 15.6, and CDW, on a higher ratio of 31.6.

Of the three, Computacenter looks like the best value to me, and it’s my favourite of the peers, beating Softcat

Risks versus rewards

Shrewd investors know how to mitigate the potential for losses. If I add Softcat to my holdings, it will be an addition to an already diversified portfolio.

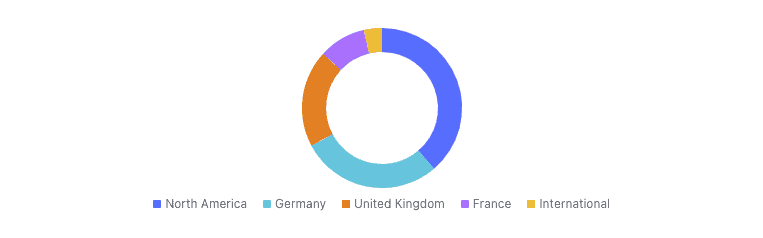

You see, Softcat’s revenue all comes from the UK. That means a slowdown in the local economy could bring Softcat shares down considerably with it. Compare that to Computacenter, which is diversified around the world, and I think it’s clear which is the winner.

But I still like Softcat and see its potential. I don’t own it or Computacenter yet, but I might buy both. First up will have to be the latter, though.