Nvidia‘s (NASDAQ:NVDA) shares have exploded in value as investor appetite for AI stocks has risen. At $895 per share, the graphics processing unit (GPU) maker is up a stunning 233% over the past year alone.

But can the company’s gigantic share price gains be justified? Let’s take a look at the charts.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

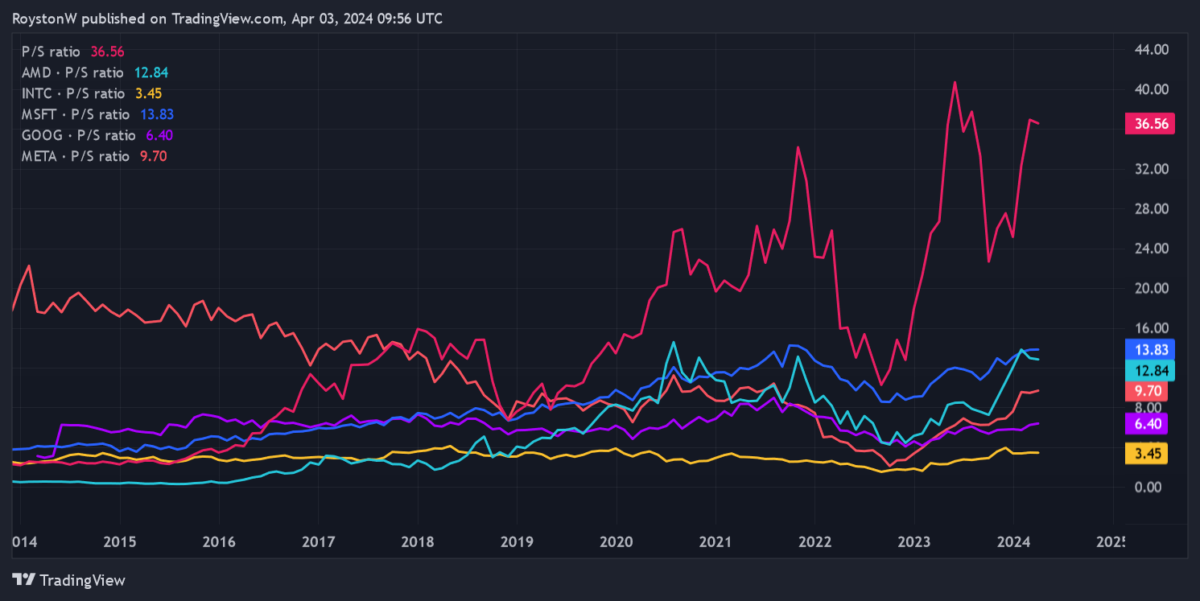

Sales

Firstly we’ll look at how Nvidia’s shares are valued relative to the revenues it has booked. We’ll do this using the price-to-sales (P/S) ratio, which is typically higher for tech stocks given their strong growth potential.

As you can see, Nvidia’s multiple comes out at an enormous 36.6 times. This is also eye-poppingly high when you compare it to those of other US tech and AI stocks (in descending order) Microsoft, AMD, Meta, Alphabet, and Intel.

You’ll also see that Nvidia traded close to the industry group before its share price took off in 2023. Could this be a sign that it its share price is too frothy?

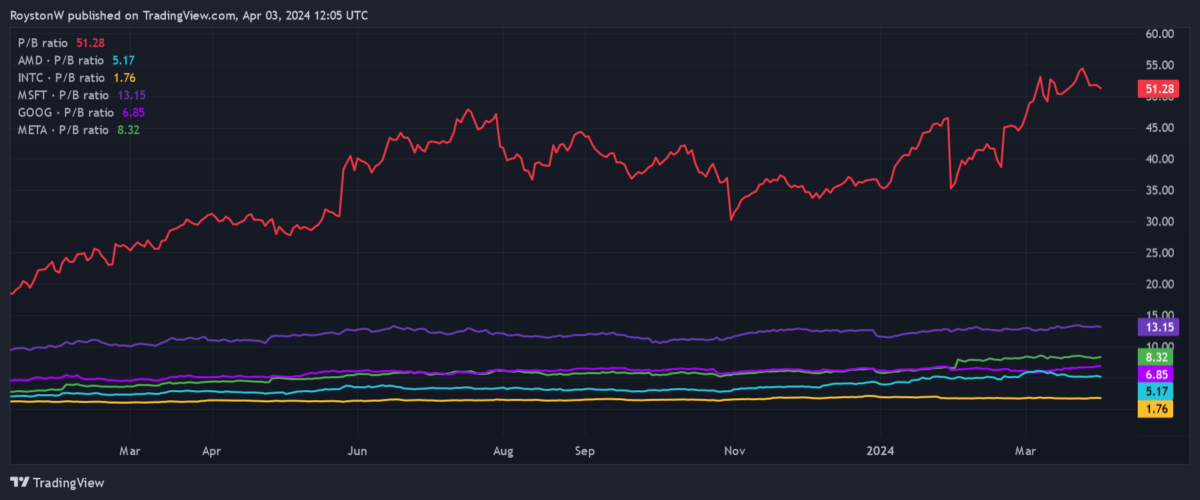

Assets

The next thing to consider is Nvidia’s share price relative to the book value of the firm’s assets. I’ll do this by calculating it’s price-to-book (P/B) ratio, which can be seen below.

You’ll notice that, at a 51.3 times P/B, the microchip maker trades at an even-wider margin to those aforementioned tech stocks. Microsoft is the closest, at 13.2 times, followed by Meta, Alphabet, AMD, and Intel.

Earnings

Finally, I’ll consider how Nvidia’s shares are valued relative to predicted earnings using the price-to-earnings (P/E) ratio. Today, this stands at 36.6 times.

On this basis, the gap between the chipbuilder and those other tech stocks narrows significantly. The average P/E ratio for the entire group comes in at 34.1 times.

| Stock | Forward P/E ratio |

|---|---|

| AMD | 49.3 times |

| Intel | 32.7 times |

| Microsoft | 36.2 times |

| Alphabet | 22.7 times |

| Meta | 26.8 times |

Using this metric, Nvidia shares look more attractive, though the chip builder still doesn’t smack of outstanding value.

Should I buy Nvidia shares?

Based on all of the above, I’m not tempted to buy the Nvidia’s shares today. Like billionaire investor Warren Buffett, I prefer to buy quality stocks at decent prices. And I’m afraid this tech stock look far too expensive at current prices.

That’s not to say that Nvidia’s share price won’t continue rising, of course. It has long looked overvalued in my opinion. But a series of strong trading updates — the latest of which showed it book record sales of $22.1bn in the last quarter of 2023 — have enabled it to sustain its momentum.

However, it may not take much to knock the tech giant from current price levels. And there are threats that it has to overcome to keep the market onside. Supply chain problems, economic turbulence in the US and China, and growing tensions between Washington and Beijing could all derail its recent impressive progress.

On balance, I’d rather buy more attractively priced US stocks to capitalise on the AI revolution. Microsoft is one I’m looking to add to my portfolio when I next have cash to invest.