Recently, I’ve been searching for the best-performing stocks on the FTSE 100 over the past 20 years.

The saying “Past performance is no guarantee of future results” is common in finance. It highlights to investors that a company performing well in the past won’t necessarily continue to do so. However, I find some comfort in knowing the stocks I invest in have a history of solid growth.

I measured the percentage of share-price growth from the lowest point in 2004 to today’s price. While I couldn’t manually check the performance of all 100 constituents, I found three that I’m sure are near the top.

Here are my results.

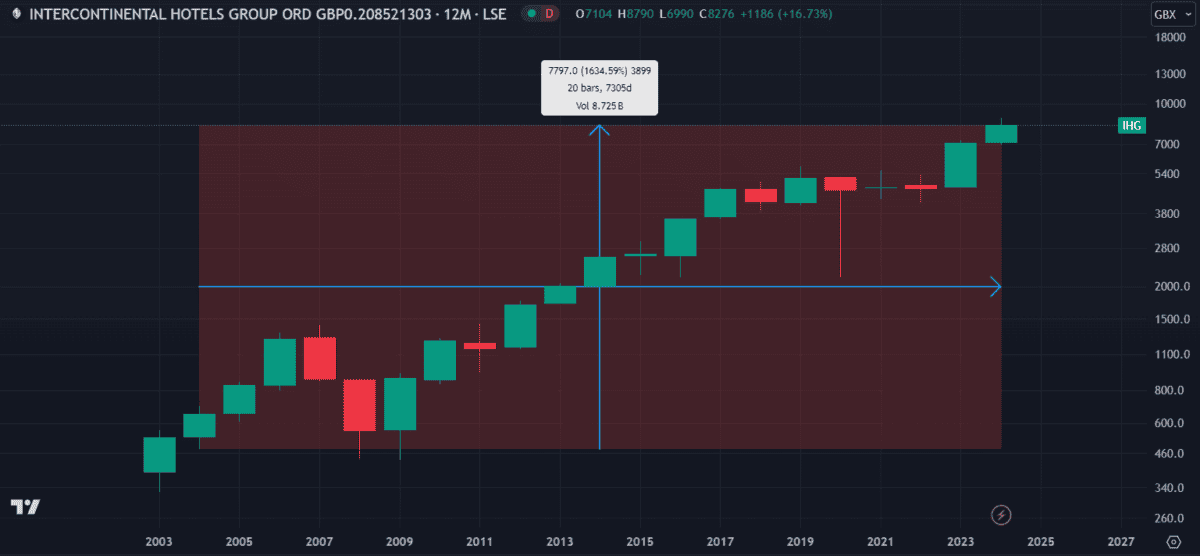

Five-star reviews

Intercontinental Hotel Group (LSE:IHG) could be the best-performing FTSE stock over the past 20 years, price-wise. It’s up a huge 1,634% since its lowest price point in 2004. As the parent company of Holiday Inn, Crowne Plaza and Regent hotels, it operates in 100 countries worldwide. Out of the past 20 years, Intercontinental Hotel Group finished higher in 14 of them. In just the past year alone, earnings grew 100% and the share price increased 60%.

But Intercontinental Hotel Group may be in a questionable position, financially.

It has $6.76bn in liabilities (of which $3.6bn is debt) and only $4.8bn in assets with $1.33bn in cash. This puts it in the precarious position of falling foul of loan defaults if operating income declines. If this situation improves I may consider it for my portfolio, but for now I’m erring on the side of caution.

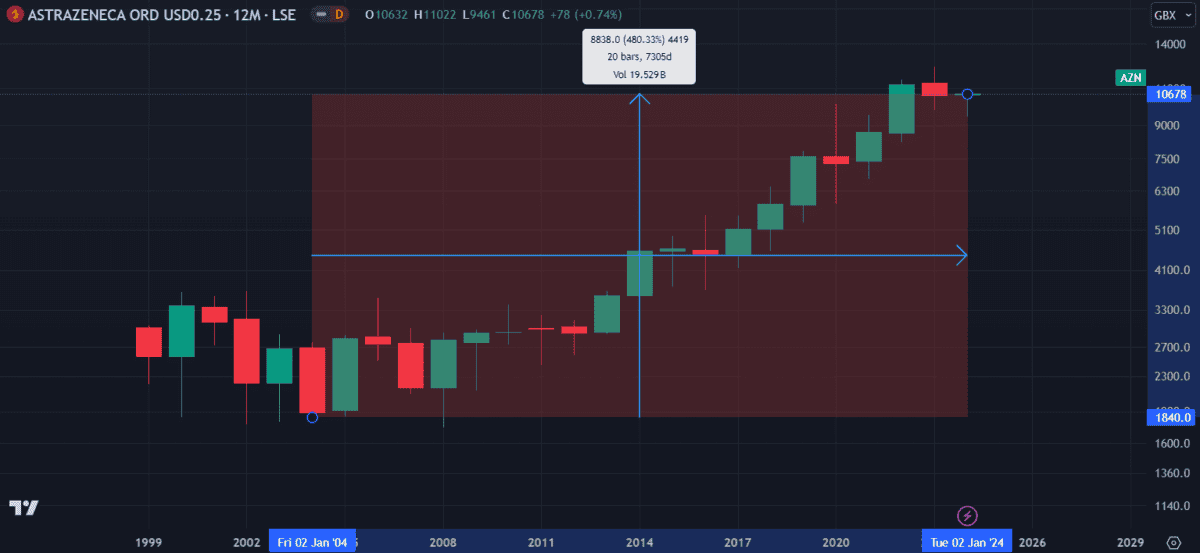

The pharma giant

As one of the first companies to develop a Covid vaccine, AstraZeneca (LSE:AZN) quickly became a household name during the pandemic. And yet, despite reaching a new all-time high in June 2020, it closed the year down. Pharmaceuticals is a highly competitive industry, prone to regulatory hurdles and delayed clinical trials that can run up debt. While AstraZeneca is doing well currently, the uncertain future of the industry could pose significant challenges.

Still, AstraZeneca has climbed 480% since 2004, with much of the gains made in the past decade. The share price closed in profit eight out of the 10 years between 2013 and 2023. Despite a huge £22.6bn debt bill, the pharma giant’s balance sheet is fairly solid. The £166bn company has $80bn in assets and $39.17bn in equity.

It’s been on my watchlist for a long time and is now solidly on my buy list for April.

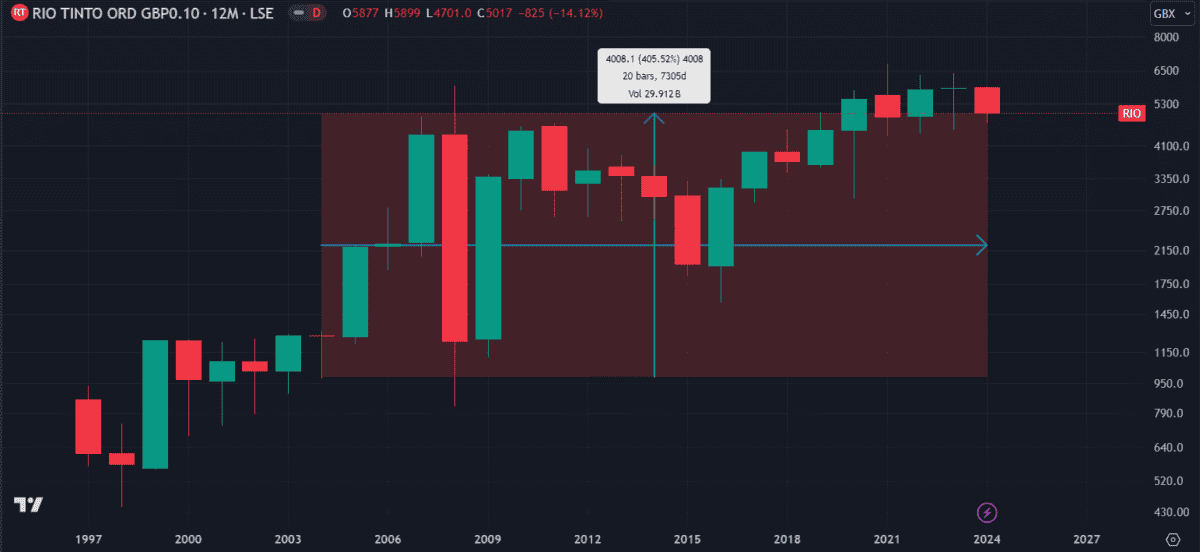

A global mineral miner

Major mining conglomerate Rio Tinto (LSE:RIO) operates iron ore, aluminium and copper mines worldwide. The shares fell 8.5% over the past year but since the 2004 low are up 405%. For 12 out of the past 20 years, the share price has closed higher.

But mining is a risky sector, prone to commodity price fluctuations, geopolitical tensions, and sustainability requirements. Rio Tinto operates in several areas with unstable governments, including South Africa, Guinea, and Madagascar. Furthermore, growing trade tensions with China threaten its iron ore business.

Still, analysts estimate the shares to be undervalued by 52% and predict an average 22% increase over the next 12 months. A low price-to-earnings (P/E) ratio of 10.1 reinforces these estimates. Add the 6.8% dividend yield and I think Rio Tinto is a no-brainer buy for my portfolio soon.