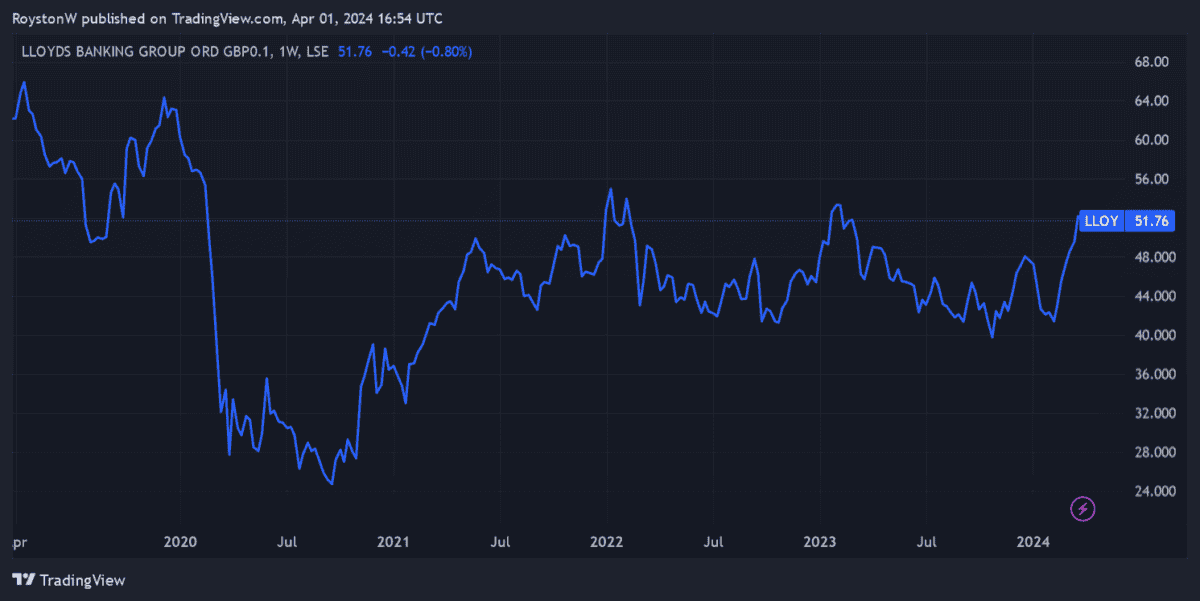

Lloyds (LSE:LLOY) shares have soared in value as confidence across the FTSE 100 has picked up. At 51.76p per share, the high street bank has risen an impressive 22% in just two months.

The bank’s a popular stock with value investors. But does Lloyds’ share price still look cheap at current prices? And should I buy the banking giant for my portfolio?

Earnings

As a starting point, let’s look at how cheap the bank’s shares are compared to the value of its predicted earnings. Today, its price-to-earnings (P/E) ratio sits at 8.1 times, a good distance below the FTSE 100 forward average of 10.5 times.

But I’m not done yet. I’m also keen to see how the share price stacks up compared to its rivals using this metric. The corresponding readings of the Footsie’s other major banks can be seen below.

| Stock | Forward P/E ratio |

|---|---|

| Barclays | 5.8 times |

| NatWest Group | 6.9 times |

| HSBC Holdings | 6.3 times |

| Standard Chartered | 5.8 times |

We notice that the Black Horse Bank trades at a premium to its competitors based on expected profits (Barclays and Standard Chartered both lead the table in this respect).

Assets

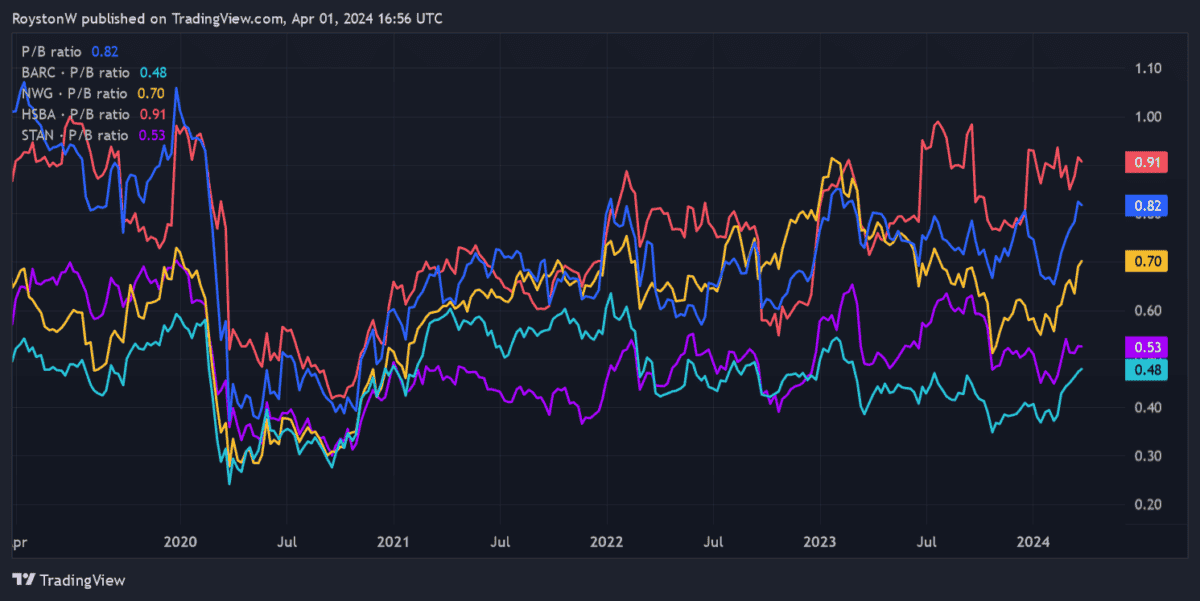

Next, I’ll consider how Lloyds is valued relative to its book value (total assets minus liabilities). With a price-to-book (P/B) ratio of 0.82, the company’s trading below the value watermark of 1. In other words, it’s trading at a discount to the value of its assets.

But Lloyds isn’t alone in this respect. Indeed, sub-1 multiples are common among UK-listed banks, as the chart below shows.

We also notice that Lloyds’ P/B ratio is higher than those of most of its rivals. Only HSBC has a higher reading. So while low, the bank’s multiple isn’t industry beating.

Dividends

The last thing to consider is Lloyds’ dividend yield, which indicates the potential income that investors could earn for each share. This year, this sits at 6.1%, far ahead of the 3.7% average for FTSE 100 shares.

The bank’s yield also beats those of Barclays, Standard Chartered and NatWest. Only HSBC surpasses it with its near-10% dividend yield.

| Stock | Forward dividend yield |

|---|---|

| Barclays | 4.2% |

| NatWest Group | 6% |

| HSBC Holdings | 9.7% |

| Standard Chartered | 3.5% |

Should I buy?

Aside from that dividend yield, Lloyds’ share price doesn’t seem to offer eye-catching value compared with its peers. But then again, the bank does look cheap compared with the broader FTSE. So what should I do next?

It’s my view that the shares deserve to trade at a discount to the Footsie. Its high exposure to the moribund UK economy provides little scope for solid earnings growth. It may also struggle to grow the bottom line as interest rates are likely fall from the middle of 2024, pulling on its net interest margin (NIM).

Signs of recovery in the housing market are a good sign for the bank. It’s the country’s largest home loan provider with a market share near 20%.

But I think the risks of owning the company outweigh any potential benefits. In fact, if I had cash to spend I’d rather invest it in rival HSBC’s shares. While this banking giant also has large exposure to the UK economy, I think it could deliver spectacular long-term returns as its core Asian markets grow rapidly.