In his 2022 letter to Berkshire Hathaway shareholders, Warren Buffett praised share buybacks. He wrote: “Gains from value-accretive repurchases … benefit all owners — in every respect”.

He went on: “When you are told that all repurchases are harmful to shareholders… you are listening to either an economic illiterate or a silver-tongued demagogue”.

To be fair, Buffett isn’t saying that all buybacks add value. But he’s definitely keener on them than I am. And at the risk of being accused of economic illiteracy, I’m going to explain my concerns, starting with a real-world example.

Putting the boot in

Between 14 July and 15 December 2023, Dr Martens (LSE:DOCS) decided to spend £50m buying 40m of its own shares. The average price paid was £1.25. During this period, the market-cap of the company fell from £1.26bn to £880m. The 3.9% reduction in the number of shares in circulation failed to offset the 27.4% fall in the share price.

In my opinion, the initiative didn’t increase the intrinsic value of the business because it had no impact on its operations. In fact, I’d argue that the directors have ‘wasted’ £50m.

The cash would have been better spent addressing some of the supply chain problems that have contributed to falling sales. And have resulted in a series of profits warnings issued by the company.

Due to these issues, analysts expect revenue for the year ending 31 March 2026 (FY26) to be the same as it was in FY23, with pre-tax earnings 16% lower.

Some are keener than others

But share buybacks are the perfect tool for directors who are under pressure from shareholders. That’s because they make it mathematically possible for a company’s profits to fall but its earnings per share (EPS) to increase.

Indeed, Dr Martens’ 2023 annual report confirms that part of the management team’s incentive plan is based on growth in the company’s EPS.

But I believe most rational investors will see the reduction in both shares AND cash, and adjust their valuation accordingly.

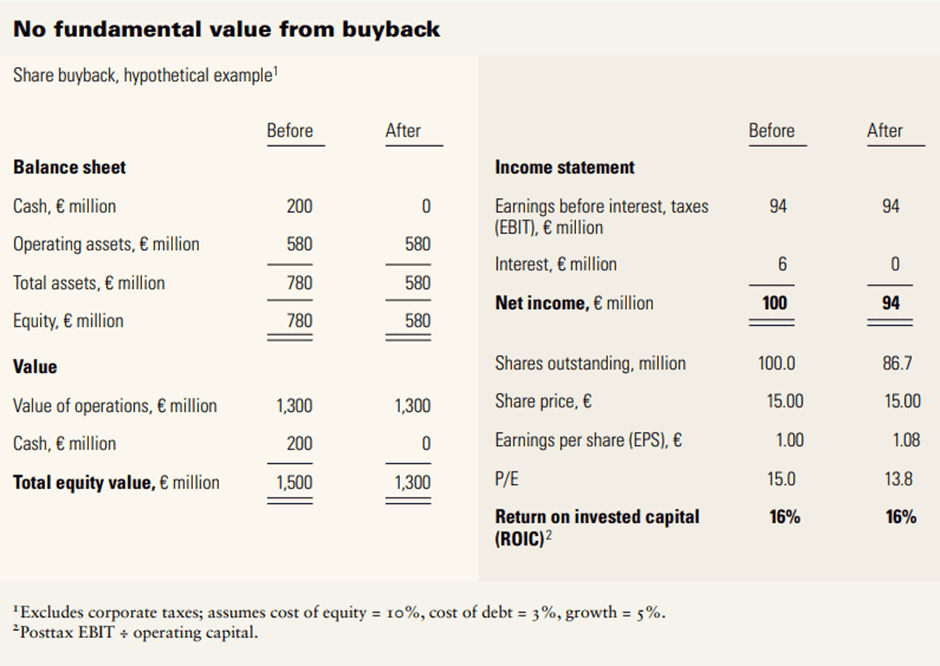

This is best illustrated by an example prepared by management consultants McKinsey in 2005.

It shows a hypothetical situation in which a company uses all its interest-earning cash (€200m) to repurchase 13.33m of its own shares, at €15 each. After the buyback, the share price remains unchanged — even though EPS increases — as the value of the business has fallen by €200m.

Based on a 2023 study of 345 S&P500 companies, McKinsey also claims it makes no difference to shareholder returns whether a company pays a dividend or undertakes a programme of share buybacks.

However, as an income investor, I’d rather have the cash in my hand. I can then choose whether to reinvest or spend the money on something else.

Final thoughts

Buffett has a strong preference for share buybacks over dividends. But we both agree that not all repurchases are good for shareholders.

When a company overpays for its own shares, he says the only beneficiaries are those selling. And the investment banker who oversees the transactions.

With the benefit of hindsight, I wonder if Dr Martens’ directors now agree.