No one definitively knows what’s around the corner. Unexpected events mean that even the most robust FTSE 100 and FTSE 250 stocks may suddenly turn into basket cases over a number of years.

The best we can do as investors is to research as much as possible before buying, and then to quickly react if/when things change.

As things stand, I believe this UK blue-chip share will deliver impressive shareholder returns. It’s why I hold it in my Stocks and Shares ISA right now.

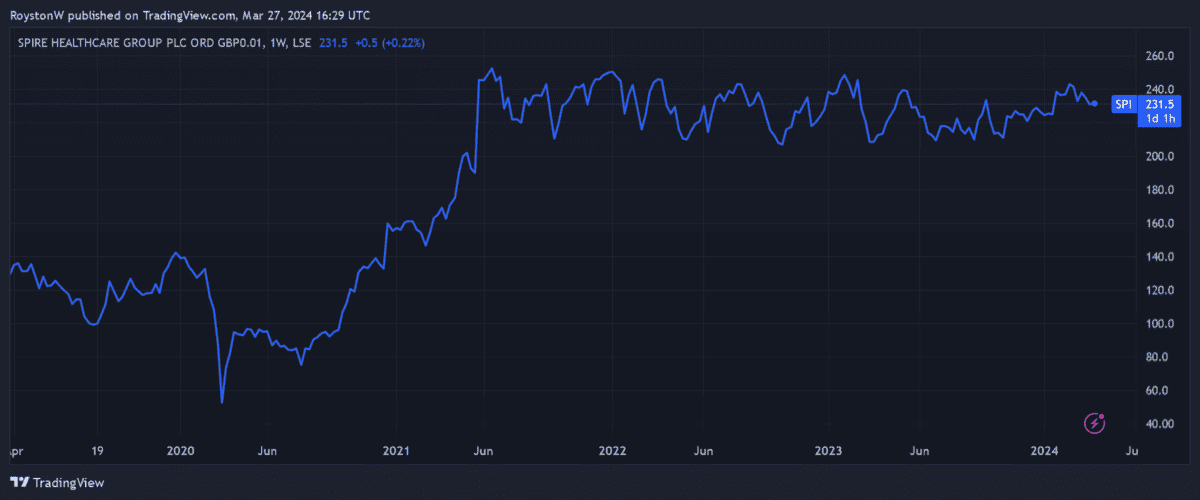

Here’s why I believe Spire Healthcare (LSE:SPI) is a top pick for me, especially at current prices.

Soaring sales

Years of underinvestment in the National Health Service (NHS) have decimated service levels and pushed waiting lists to record highs. According to researcher British Social Attitudes, fewer than one in four Britons are now satisfied with the service. This is the lowest figure since records began 41 years ago.

It’s no coincidence that, at the same time, demand for private healthcare — either through self-pay or private medical insurance — is rocketing. FTSE 250-quoted Spire is one big winner from this boom.

It’s one of the UK’s largest independent healthcare groups, with 39 hospitals in its portfolio and dozens more clinics and medical centres. Last year, it saw revenues soar 13.1% from 2022 levels, while operating profit jumped 32.3% year on year.

Cheap as chips

Changes to NHS funding could significantly curtail Spire’s profits potential. But as things stand, future governments (regardless of party) are still likely to struggle to improve the service as the UK’s rapidly ageing population balloons. So demand for private healthcare providers like this should remain robust.

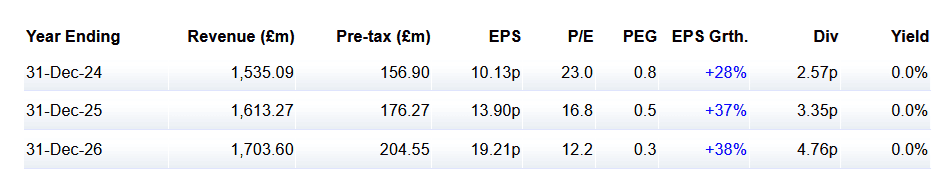

This is why, despite the threat of medical staff shortages, City analysts expect Spire’s earnings to keep soaring through to 2026 at least. This can be seen in the graphic above.

These predictions also leave Spire shares trading on a price-to-earnings growth (PEG) ratio below the value watermark of 1.

Dividend growth too

Spire is more than just an exciting value and growth stock too. Dividends here have rebounded strongly since the end of the Covid-19 crisis. And City analysts expect them to continue rapidly rising.

On the downside, the healthcare giant doesn’t offer especially large dividend yields at current prices of 231.5p per share. For 2024, the reading comes in at just 1.1%.

But this isn’t a dealbreaker to me. As a long-term investor, I’m also seeking companies that can grow the dividend over time to offset the impact of inflation. And Spire could be in great shape to grow cash rewards rapidly for the reasons I mention.

Indeed, its dividend yield marches to an improved 2% for 2026, almost double this year’s level.

I believe Spire could be one of the best all-rounders on the FTSE 250 today.