I’m on the hunt for the best FTSE 250 value stocks to buy today.

Both abrdn (LSE:ABDN) and The Renewables Infrastructure Group (LSE:TRIG) offer stunning all-round value for money today, at least on paper. But which would I buy for my stocks portfolio today?

Sleeping giant?

Asset manager abrdn comfortably beats the broader FTSE 250 when it comes to value. It trades on a forward price-to-earnings (P/E) ratio of 11.6 times, below the index average of 12 times.

Should you invest £1,000 in Chemring Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Chemring Group Plc made the list?

Meanwhile, its dividend yield for this year comes in at 10.1%, almost treble the 3.4% FTSE 250 average.

Fans of the company — which was recently relegated from the FTSE 100 — will say that abrdn has terrific long-term growth potential. As with other financial services companies, demand for its savings and investment products could soar as the UK population rapidly ages.

Big dangers

But I fear that abrdn could struggle to get its share price moving higher again. And not just because the uncertain economic and political environment may cause fund outflows to continue in the short term.

The firm — created through the merger of Aberdeen Asset Management and Standard Life in 2017 — hasn’t produced anything close to what had been hoped when the deal went through. This is reflected in its share price slump over the past five years.

And so far, the board doesn’t seem to be rich with ideas as to how to get the company moving again.

At the same time, a large chunk of its funds continue to underperform the market. And its product ranges aren’t anything to write home about, a potentially fatal problem in such a competitive industry.

It’s cheap. But I’m avoiding abrdn for the time being.

A better buy?

The Renewables Infrastructure Group’s a FTSE 250 stock I already own for my portfolio. But it doesn’t necessarily mean I’d buy more of its shares today.

The renewable energy stock has been under sustained interest rate-related pressure since I opened a position in 2022. This remains a threat going forwards too. Stubborn inflation could limit the Bank of England’s plans to cut rates later this year.

While significant, I think this danger is now more than baked in to TRIG’s share price.

All-round value

Firstly, the gap between the company’s share price and net asset value per share (NAV) continues to grow, as shown in the chart below.

As I type, TRIG’s current share price of 97.3p trades at a 23.1% discount to the estimated value of the firm’s assets.

To underline this point, the company also trades on a price-to-book (P/B) ratio of 0.8. Any reading below 1 indicates a share is undervalued.

And finally, TRIG shares also carry a whopping 7.7% dividend yield for this financial year.

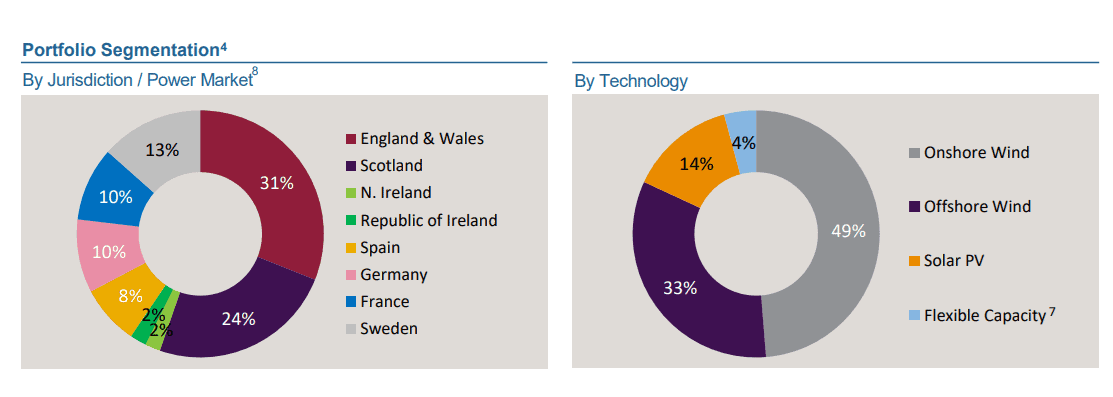

I think this FTSE 250 share has a very bright future. The business — which operates wind, solar and battery assets across Europe — will likely play a vital role in future energy policy as the continent steadily switches over from fossil fuels.

It’s why I’ll be looking to add more of its shares to my portfolio at the next opportunity.