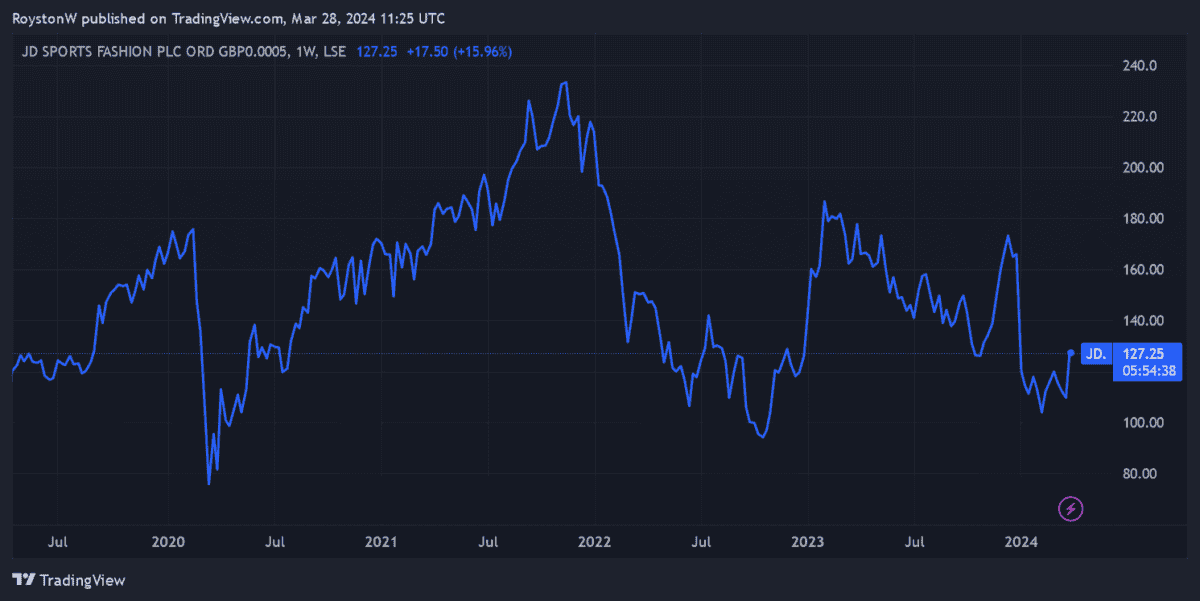

JD Sports Fashion‘s (LSE:JD.) share price has risen strongly in recent hours. Yet following heavy weakness at the start of 2024, it remains one of the FTSE 100‘s worst-performing stocks.

Could it be a brilliant buy for value investors to consider today? Let’s take a closer look.

Earnings

First, let’s consider JD’s share price in relation to predicted earnings using the price-to-earnings (P/E) ratio. For the current financial year (to January 2025) this sits at 9.7 times.

This is lower than the Footsie average of 10.5 times. But I’m not just interested in how cheap the company is compared to other UK blue-chip shares. I want to know how much value it offers compared with its industry peers.

| Stock | Forward earnings multiple |

|---|---|

| Frasers Group | 9.5 times |

| Foot Locker | 19.1 times |

| Dick’s Sporting Goods | 16.8 times |

| Nike | 26.3 times |

As the table above shows, JD’s P/E ratio is far below the industry average, with only Sports Direct owner Frasers Group beating it on this metric.

Interestingly, its earnings multiple is almost half that of (arguably) its closest rival Foot Locker. Like JD, this US stock has extensive operations across North America, Europe and Asia. And it has also been experiencing severe trading turbulence of late.

Assets

The next step is to assess how the retailer is valued relative to its assets. I’ll do this by analysing its price-to-book (P/B) value, which divides the total book value (assets minus liabilities) by the total number of shares outstanding.

Any value below 1 indicates a share is undervalued. And as you can see, JD’s shares — which carry a P/B ratio of around 3.4 — don’t fall into this category.

It also looks expensive using this metric compared with Foot Locker (0.84). That being said, the FTSE firm’s ratio sits around the industry midpoint.

Dividends

The final thing to look at is JD Sports’ dividend yield. The retailer has never set the world on fire with shareholder payouts, and this year promises to be no different.

At 0.7%, the yield on its shares falls some distance below the FTSE 100 average of 3.7%.

That said, the firm is at least expected to pay a dividend this year, unlike Frasers Group and Foot Locker. But you’ll also see from the table below that the retailer offers lower yields than Dick’s Sporting Goods and Nike.

| Stock | Forward dividend yield |

|---|---|

| Frasers Group | 0% |

| Foot Locker | 0% |

| Dick’s Sporting Goods | 2% |

| Nike | 1.5% |

My verdict

On balance, JD doesn’t seem to offer outstanding value right now, and certainly not compared with the broader FTSE 100.

That said, I still think it could be a brilliant investment for dip-buyers. This is despite the fact that spending remains under pressure. Tough conditions prompted the business to issue that share-price-smacking profits warning back in January.

But I’m expecting JD Sports’ share price to rebound strongly over the long term. The global athleisure market is tipped to resume its strong uptrend once the current economic landscape improves. And the UK company is expanding rapidly to exploit this opportunity (it opened 215 stores in the last year alone).

Given its excellent brand power too, I think the company could prove an excellent stock to consider.