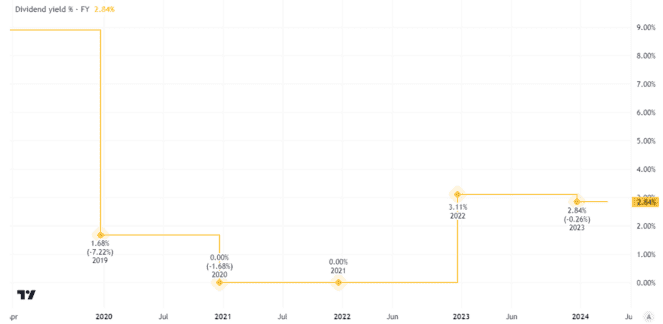

Over the past few years, shares In energy company Centrica (LSE: CNA) have moved around a lot. In just under four years, the price has quadrupled. The Centrica dividend has been growing, rising by a third last year.

The current dividend yield is around 3%. If I had bought the shares for pennies back in 2020 though, my investment would now be yielding over 9%.

Such is the power of a low share price. Not only can it increase, it can also mean a better future yield than buying the same shares at a higher price.

Dividend movement

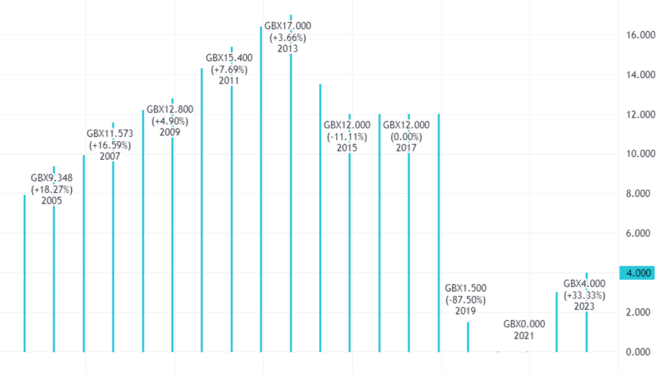

The Centrica dividend has been inconsistent though. We saw good growth last year, but after a period where there was no shareholder payout.

Even after last year’s strong growth, the current annual Centrica dividend of 4p per share is nowhere near what it used to be. It is not at even a quarter of what it was just over a decade ago.

Dramatically different business

Why would dividends move around so much? Some companies produce stable or generally growing income and cash flows. That helps them fund dividend growth. Shares like Diageo and Spirax-Sarco have raised their annual dividends for decades.

Not all businesses have such characteristics. So while global oil and gas giant Exxon has raised its annual dividend for decades, many energy businesses have cyclical earnings. High energy prices can lead to booming profits, while a weak market can see earnings plummet.

Centrica has not only had to contend with energy market price cycles. It is heavily exposed to a part of the energy market that has seen long-term structural demand falls, namely gas.

Government statisticians estimate that between 2005 and 2022, UK gas consumption fell 32.9% in total. It had been falling before that period and remains in decline.

But some large business sales over the past few years mean that Centrica is a different business to what it used to be.

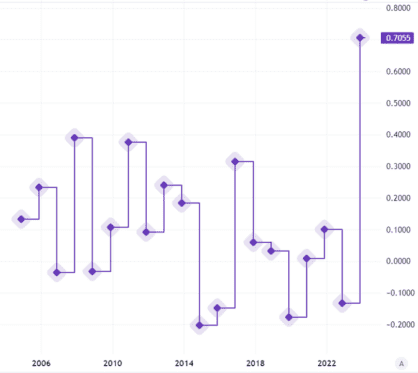

All of that has led the company’s earnings per share to move around significantly.

Strong balance sheet

That matters because earnings and cash flows are central to what happens to the Centrica dividend.

The asset sales, combined with high energy prices, have been a boon for the British Gas owner’s balance sheet. It ended last year with net cash of £2.8bn, compared to £1.2bn at the same point the prior year.

But although Centrica boosted its dividend, it also spent £1bn last year buying back shares. So increasing the dividend is only one of its cash spending priorities.

Dividend prospects

The FTSE 100 firm does have a progressive dividend policy, meaning that it aims to increase the payout annually.

In practice, though, that will ultimately depend on business performance.

Centrica is targeting a dividend that is around half of earnings per share. Such earnings, as we saw above, have moved around a lot in the past and could do so in future.

Its installed customer base, strong brands and high energy prices are all working in the firm’s favour for now. I do expect the Centrica dividend to keep growing in years to come.

But I do not like the risks in the business, especially its strong reliance on selling a commodity energy that is seeing long-term demand falls. I have no plans to buy the shares.