With a share price that’s fallen 74.7% since a high of 427p in late May 2015, FTSE 250 constituent abrdn (LSE:ABDN) might not look like a great investment at first.

In August 2022 it unceremoniously lost its place within the FTSE 100 index and was relegated to the benches of the FTSE 250. A rapid recovery meant it soon rejoined the revered ranks but sadly, the highs didn’t last. In August last year, it was once again demoted from the leading index after the share price fell 30% in only two weeks. Subsequently, a swathe of FTSE 100 trackers sold their abrdn shares, resulting in further losses.

However, the collapse seems to have lit a fire within management. Last month, abrdn announced a major restructuring initiative aimed at revitalising the embattled firm.

Should you invest £1,000 in Burberry Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Burberry Group Plc made the list?

A powerful passive earner

A key benefit of investing in abrdn is the 10% dividend yield. This means shareholders could earn an extra 10% annually on each share they own.

Emphasis on the word ‘could’.

If restructuring efforts don’t improve earnings, abrdn may have to cut the dividend to reduce costs. Even if they do pay, the share price needs to maintain at least more value than the dividend yield to make it worthwhile.

The restructuring efforts include hundreds of job cuts to save £150m in costs. While this helps the recovery, it also strains staff relations. There’s no point saving all that money if everyone jumps ship, so management will need to tread carefully.

What do the numbers say?

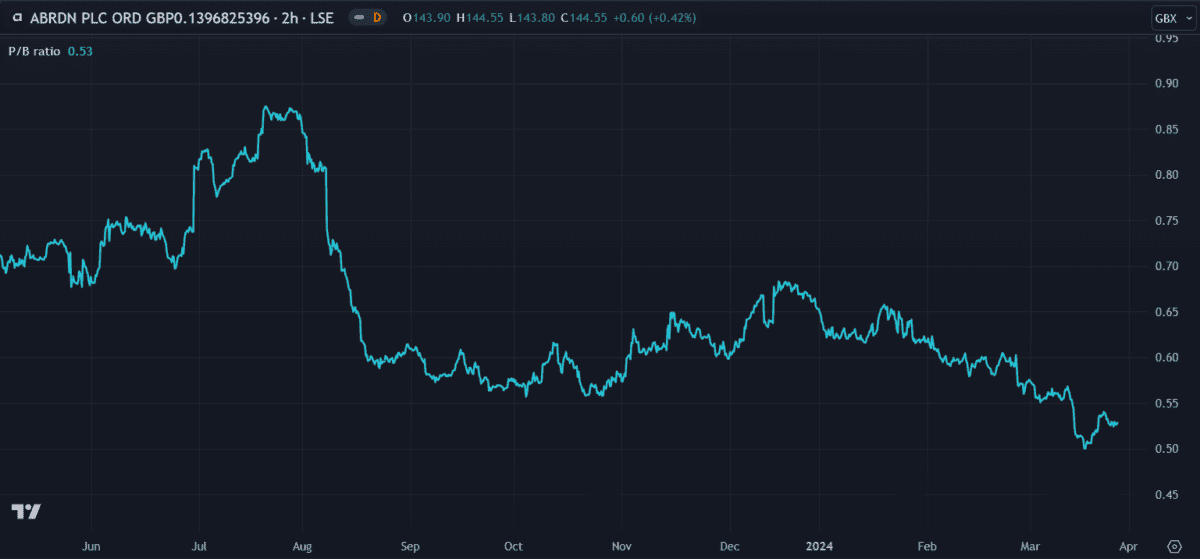

A key metric that indicates value is the price-to-book (P/B) ratio. If it’s below one, then the company’s shares are well-priced compared to the value of its assets. For abrdn, this metric has been decreasing steadily since late 2023, falling from 0.68 to 0.53. While this isn’t any guarantee of improvement, it does mean the shares could have sufficient growth potential if the company’s earnings improve.

The latest earnings figures released last December don’t exactly instil confidence. Despite £1.4bn in gross profit, the company was only left with £1m in earnings after expenses. This means earnings per share (EPS) are practically zero and net profit margins are 0.068%.

Fortunately, it has £8bn in assets and only £2.9bn in liabilities (of which £5bn is equity and only £822m is debt). But its market cap is only £2.6bn — almost half its equity. So its merit as an investment depends whether or not one believes it has intrinsic value.

A favourable forecast?

Financials aside, some forecasters remain positive about abrdn’s future. I found the average 12-month price target of nine independent analysts is 157p — almost 9% up from current levels. It’s not much but it shows there’s some degree of confidence in the company recovering.

Personally, I can’t say I feel the same way.

There’s a chance abrdn will recover as it’s done in the past. It has a solid balance sheet and the 10% dividend yield is a huge plus. But I’d need to see some definitive evidence of sustained earnings growth before I invest.

For now, it simply doesn’t impress enough.