With a trading statement for its retail venture published today (26 March), there was some good news for Ocado (LSE: OCDO). Retail revenues for the FTSE 100 company showed double digit percentage growth compared to the same period last year. Yet despite this, I would not dream of buying Ocado shares for my portfolio at the moment.

So why not?

Reading a company’s accounts

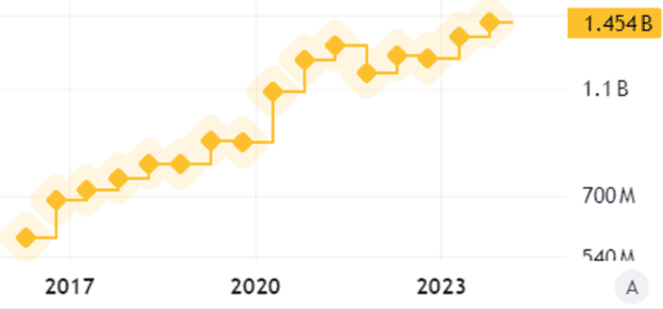

As an investor, knowing how to read company accounts is an important skill. On one hand, what is sometimes known as the top line is important. That is a company’s revenue.

If revenue is growing, that can prove a company is serving an ongoing market and that customers are willing to spend money on its products or services.

Ocado’s quarterly revenue growth in its retail division was strong. In fact, the whole company has shown strong revenue growth for a number of years.

Source: TradingView

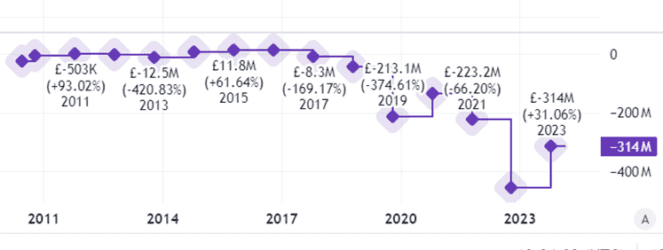

But revenue is only one part of a company’s accounts. Under the top line in the accounts are listed items such as operating costs, interest, rents payable, and so on. Once that is all deducted we get what is known as the bottom line. In other words, a company’s profit or loss.

Here, Ocado is less impressive. The company made a £387m loss after tax last year. It has been lossmaking for most years of its life as a listed company, so far.

This chart shows its net income.

Source: TradingView

Ouch!

What this means for the shares

Is such a loss unusual? Not necessarily. Ocado is still building its business model, both metaphorically and literally.

The cost of constructing distribution centres to service its grocery clients like US giant Kroger is expensive. But once they are built they can (hopefully) help the company serve clients for decades.

While Ocado’s retail partnership with Marks & Spencer may be helping fuel growth in that division, the company overall continues to plough money into selling its tech and logistics solutions to other retailers.

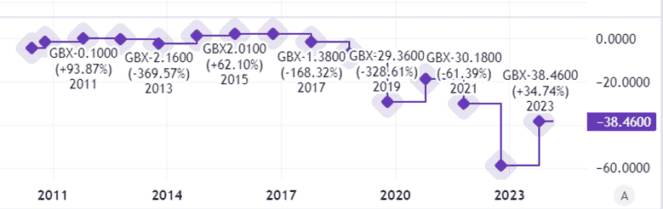

When it comes to Ocado shares, that has translated into sizeable losses per share in recent years.

Source: TradingView

Ocado shares have collapsed 65% in the past five years but the company still has a market capitalisation of £4bn.

Lots to prove

Is it worth that? Possibly. Ocado’s technology is world class, as is shown by its client list of leading global retailers. If it can reduce spending once its infrastructure is in place, the large losses could yet be left behind. Meanwhile, the retail business has the wind in its sails.

For now though, Ocado still feels a long way from profitability. It remains to be proven whether the business model can ever turn a consistent profit.

Although the retail arm is growing revenues strongly, Ocado and Marks & Spencer have been in a dispute about payment. I fear that suggests the working relationship is far from smooth. That could be problematic for the future development of the business.

It has yet to prove its overall business model, in my opinion. I have zero interest in investing until it does.