There are few better things in life than receiving passive income. Especially when it’s tax-free. And in my view, the best way to earn passive income is through investing, and I do this through a Stocks and Shares ISA for the tax benefits.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Kicking things off

Lots of us have a little money set aside. But even in the high interest savings accounts we see today, the gains we’re making are nominal. That’s why I, and millions of other Britons, invest in stocks and shares where the returns can be much greater. More seasoned investors may look to achieve annualised returns around 10%, while a novice investor may look to obtain high single-digit returns over the long run.

Should you invest £1,000 in Applovin right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Applovin made the list?

So, to kick things off, I’d need to start by opening an investment account, and ideally a Stocks and Shares ISA. This can be done through any major brokerage. And if I were starting with £5,000, I’d be well within the maximum annual ISA allowance — currently £20,000.

And then, I’ve got to be realistic. I can’t turn £5,000 into a significant passive income immediately, and it’s not going to happen overnight. I need to take my time, invest sensibly, and if possible contribute some of my salary to help my portfolio grow.

Compounding

Many of us know about compounding. It the process of our gains or losses being amplified over time. However, sometimes we just need to be reminded as to how impactful it can be if we let our investment build up over time.

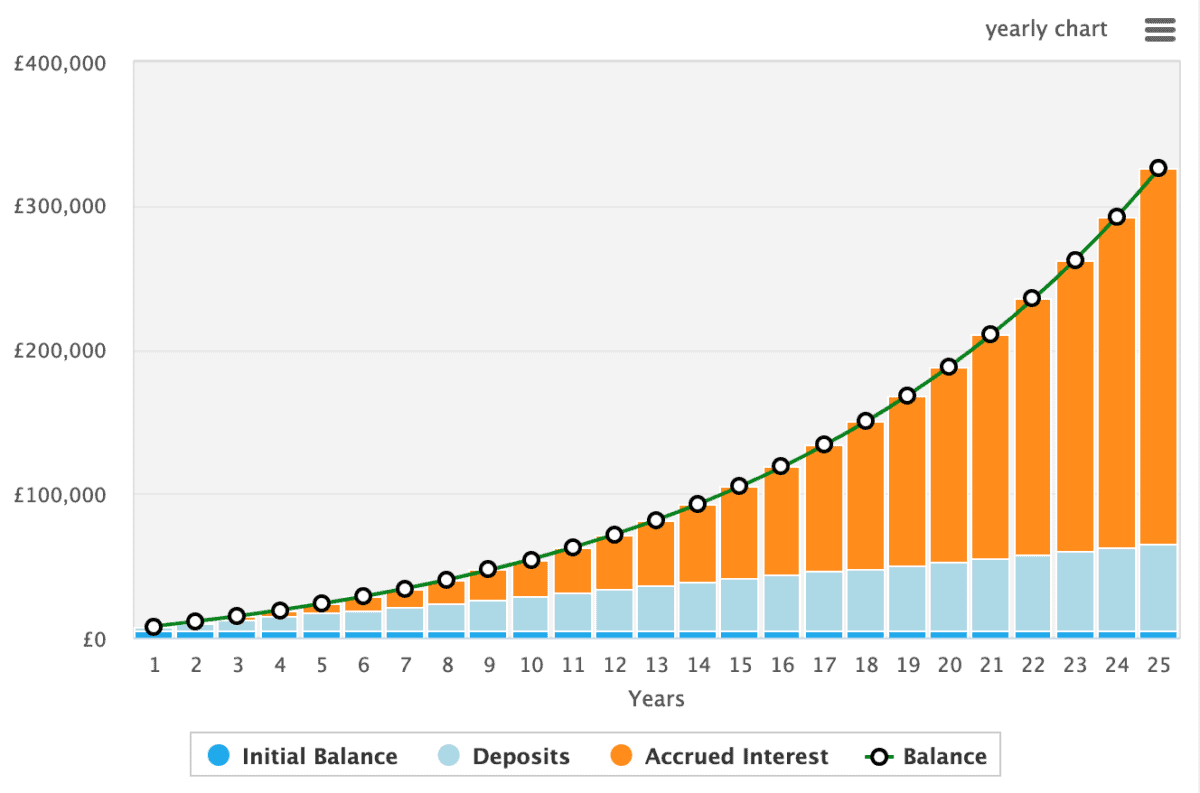

As we can see from the below chart, £5,000 of starting capital and £200 of monthly contributions compounds significantly at 10%. After 25 years, I’d have £325,651. Assuming I could obtain a 7% yield at the end of the period, which is possible in the current market, I could earn £22,795 annually as passive income.

Sensible investments

As noted, losses can compound in the wrong direction. So I need to make sensible investments. And contrary to popular opinion, sensible investments can see wild gains — just look at Super Micro, Nvidia, and AppLovin (NASDAQ:APP).

In fact, the latter is still one of my favourite sensible picks. And that’s because the metrics just look great. AppLovin stock has surged 400% over the past 12 months, but it doesn’t look expensive because the business is moving in the right direction.

AppLovin, which helps mobile app developers and operators maximise revenues, registered a 88% increase in revenue in its software platform in the fourth quarter of 2023.

In turn, this appears to be driven by AXON 2.0. It’s the firm’s latest AI tech that boosts revenues for its clients by recommending apps that users will like based on their user activity.

I’m wary that AppLovin’s growth story hasn’t always been steady. The company has registered negative revenue growth in two quarters over the past two years. However, with AXON leading the way, I think it’s turned a corner.

And other analysts do too. The company’s price-to-earnings-to-growth ratio is just 0.69.