I’ve been a perennial optimist when it comes to Lloyds (LSE:LLOY) shares. However, I’m up 18%, which isn’t a bad return, especially when you add a 5.3% dividend yield. While many investors might see this as an opportunity to cash out, I like to let my winners run, and I’m confident Lloyds has further to go. Spoiler alert, I don’t think it’s time to sell.

Price targets

The average Lloyds share price target is 57.9p, inferring the stock could be undervalued by 17.2%. The highest share price target is 77p, while the lowest is 41p. Of course, share price targets are by no means gospel. However, they do provide us with some important insight and, broadly speaking, they tend to be in the right ballpark.

On sale

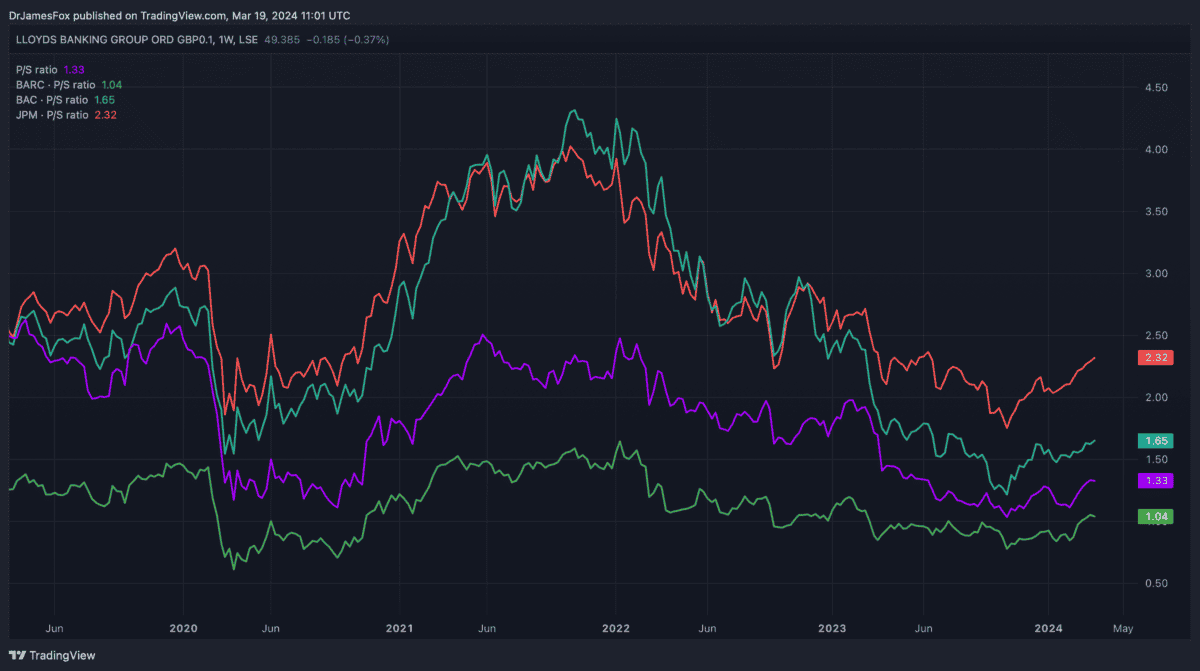

Lloyds doesn’t trade at high multiples. It hasn’t done for a while and the same goes for other UK-focused banks. In the chart below from TradingView, I used the price-to-sales ratio to highlight the premium valuation given to US banks JP Morgan and Bank of America versus UK-focused peers Barclays and Lloyds.

There is good reason for US banks to trade at high multiples than British banks. Lender stocks tend to reflect the health of the economy and the US economy is significantly stronger than the UK economy at the moment. However, I don’t think the size of the discount afforded to UK banks is deserved. After all, the UK is expected to be the fastest growing major economy in Europe over the next two decades.

Lloyds is currently trading around 7.4 times forward earnings. However, 2024’s likely to be the year during which the bank swallows a fine relating to malpractice in motor finance. It’s trading at 6.09 times expected earnings for 2025.

By comparison, JP Morgan’s trading at 12.06 times expected earnings for 2025. Lloyds is growing earnings over the long run, and doesn’t deserve the discount. It’s practically on sale.

Earnings will grow

Lloyds’ basic earnings are forecasted to come in as follows: 2024, 5.85p; 2025, 7.27p; and 2026, 8.74p. As noted, 2024 is likely to be an outlier, but the broad trajectory’s positive, and it’s likely to continue beyond the forecast period.

There are several reasons for this. As noted, banks are cyclical and the UK economy will get stronger towards the end of the decade. But it’s also the case that interest rates are likely to settle somewhere near the ‘Goldilocks Zone’ — around 2.5-3.5%. Coupled with a hedging strategy that’s expected to bring in around £5bn in revenue in 2025, things are looking up for earnings.

Nonetheless, it’s right to remain cautious about a hard landing or a double-dip recession in the UK. Lloyds is entirely UK-focused and its operations are heavily oriented towards the mortgage sector.

Despite Lloyds’ mortgage customers being wealthier than the average Briton, the bank could be more susceptible to a downturn than most of its peers.