The Stocks and Shares ISA deadline for the current financial year is 5 April. This will be the last day investors can contribute funds to their ISA accounts and still receive the tax benefits for that year.

If I had £5,000 of annual contributions left, that would mean I’d used up three-quarters of my £20,000 allowance. Here’s how I’d go about investing that remaining five grand.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

A high-quality stock

Stock markets from Japan and Europe to New York have recently hit new record highs. Yet the FTSE 100 hasn’t and remains cheap, so this is where I’d go stock-hunting. And the share I’d scoop up first is Diageo (LSE: DGE).

The booze giant owns category-leading brands such as Johnnie Walker, Tanqueray gin, Guinness, Baileys liqueur, Smirnoff, and Casamigos tequila.

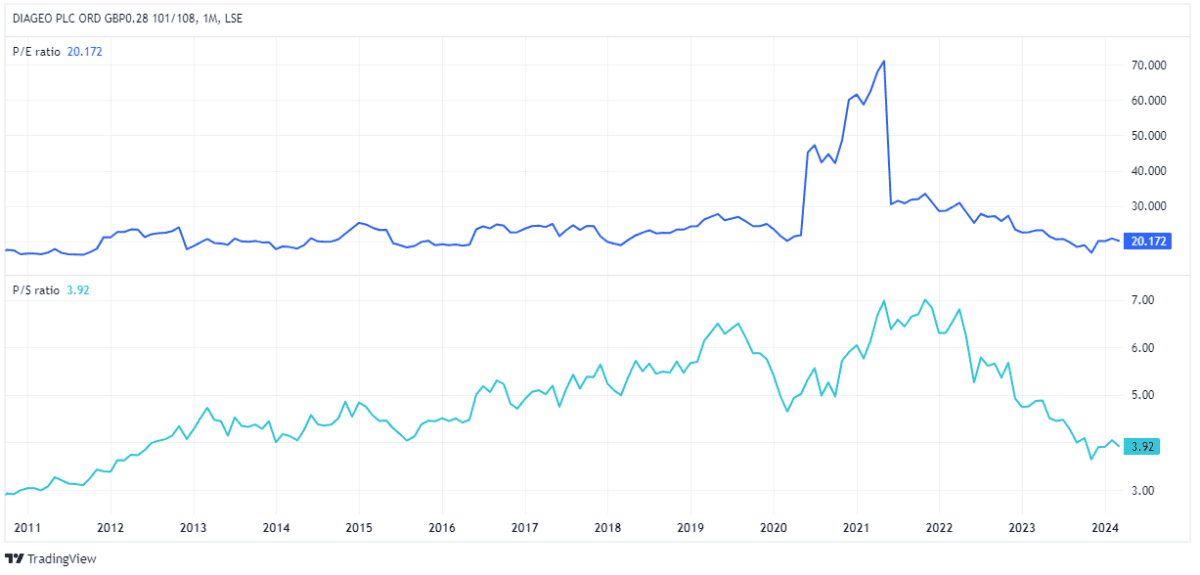

As we can see above, the share price has fallen 7.5% over the past five years. And this has left the stock trading on a price-to-sales (P/S) ratio of 3.8, a level not seen since 2012.

Meanwhile, the price-to-earnings (P/E) ratio is 20. Again, that’s cheap compared to where the stock has been. It was trading on a P/E multiple of 27 in early 2019 and 32 in late 2021.

Why’s the stock down?

Of course, I shouldn’t rush out to buy a stock just because it’s become cheaper. I need to know what the problems are.

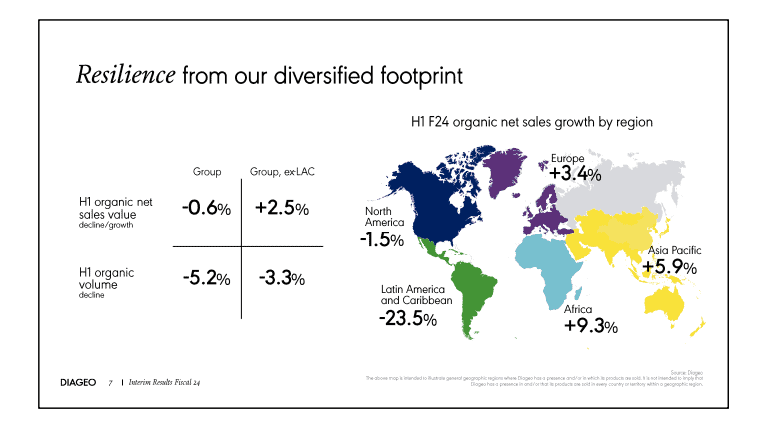

In the case of Diageo, there’s been a sales slowdown in a couple of key regions (North America and, more dramatically, Latin America and Caribbean).

North America provides the lion’s share of profits while Latin America and Caribbean accounts for around 25% of Diageo’s high-margin Scotch whisky exports.

So these are legitimate concerns, and I think the market’s a bit jittery about weakness spreading to other markets where sales have so far been resilient. This is a major risk here.

Stepping back however, I’d expect to see some drinks brands and markets dip during tough economic times (like today). But I’d also expect Diageo’s wide geographic footprint and deep portfolio to come to the fore. And that’s what I believe we saw in the interim results (covering the last six months of 2023).

Operating profit of $3.3bn was down 11.1% from the year before. Yet there was organic net sales growth in Europe, Asia Pacific and Africa. Meanwhile, Guinness remains hugely popular in the UK and Ireland.

Therefore, I actually think we’re seeing Diageo’s resilience in action here. The company has a long track record navigating economic volatility. And if these are the bad times, then I’m optimistic about the future when things start to recover.

Still ambitious

The company’s record of increasing its annual payout stretches back to the 1990s. The dividend yield on offer is only 2.9%, but I’d happily take that as I wait for a potential turnaround.

Looking ahead, Diageo is aiming to grow its share of the global beverage alcohol market, from 4.7% in 2022 to 6% by 2030.

If it achieves that, which is the equivalent of adding almost 30bn new serves, then I think today’s share price will look like a bargain in future.

I already hold shares, but I’d buy more before the ISA deadline with any spare cash.