I want to retire comfortably with a second income to complement my pension. With about 30 years left until retirement, I’m trying to figure out how I can do that with only £8,000 in savings.

Fortunately, the miracle of compound returns is on my side!

That, along with a few other tips and tricks, could net me a reliable second income of £1,000 a month – if I play my cards right.

Should you invest £1,000 in Unilever right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Unilever made the list?

Reduce my outgoings

Many people say the best way to save money is to reduce spending. Well, the same goes for investing – if I reduce my outgoings, I can maximise my returns. In this case, outgoings are tax.

I can minimise my tax by opening a Stocks and Shares ISA, which allows tax-free returns on investments of up to £20,000 a year. I think this is an excellent first step on the journey to achieving my goal.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Build a winning portfolio

There are several ways to invest my savings, some easier than others and some more lucrative than others. A standard savings account is the safest option but provides very little interest. A slightly more volatile government liquidity fund usually only returns 4% or 5% a year.

To aim for the best results, I’m looking to build a portfolio of 20 or more diversified shares with long-term growth potential. The UK’s leading index, the FTSE 100, has provided average returns of 7.75% since it began, so I feel 7% is a conservative average to aim for.

One example of a share I plan to buy is Unilever (LSE:ULVR).

Unilever is one of the largest multinational consumer goods companies, marketing products to over 190 countries worldwide. In its latest results released on 8 February 2024, Unilever reported a 2.6% increase in operating profit since last year. Its beauty and wellbeing division performed best, with underlying sales growth of 8.3%.

With €75.27bn in assets and €54.5bn in liabilities, Unilever has €20.76bn in equity. Compared with €28.23bn in debt, its debt-to-equity (D/E) ratio of 1.36 is down from 1.73 in early 2022. That’s still high but it’s a good improvement.

Unilever faces the risk of supply chain disruption following the ongoing conflict in the Middle East that’s led to attacks on shipping containers. Fluctuating currency exchange rates are another minor risk, contributing to a slight reduction in Unilever’s revenue this past year. Both these risks threaten the company’s overall performance.

Like many companies, Unilever’s share price has been subdued recently due to lingering affects of the pandemic. However, looking at a 30-year timeframe, I can see how Unilever recovered well following both the 2000 and 2008 market crashes.

Keep building my investment

I know that my initial savings alone are not enough to reach my goal of £1,000 a month in returns. I will need to make some additional monthly contributions for the next 30 years if I hope to do that.

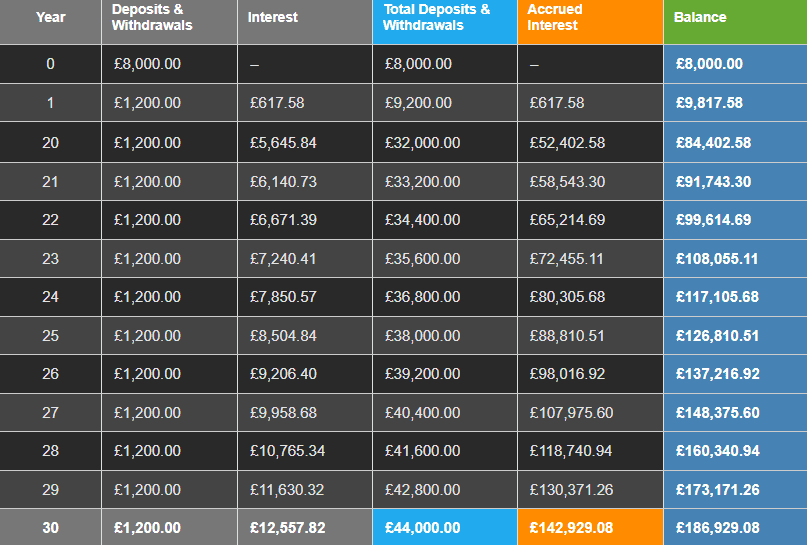

If I can maintain an average annual return of 7% and invest a further £100 a month, then my investment could grow to £186,929 in 30 years. That would net me returns of £12,557 a year – just over £1,000 a month.