When a good growth stock has had years on years of stellar performance, it’s tricky to know if the profits will continue. However, I believe I know the telltale signs to look out for. Here’s a closer look at the details of Lululemon (NASDAQ:LULU) to see if it can keep it up.

Actively successful

The company is renowned for its long-term success selling clothing for running, yoga, and other activities. Customers describe its workout gear as high-quality and very comfortable.

Lululemon doesn’t manufacture its own products. Instead, it outsources this to companies in Asia and South America. However, it makes sure the firms it works with treat employees properly.

Currently, the business sells in the US predominantly. But it also generates revenue from Canada, China, and other parts of the world, like the UK.

Stellar track record

Over the past decade, Lululemon has had a total gain in share price of 849%. That means the investment has grown at a compound annual growth rate of roughly 25%.

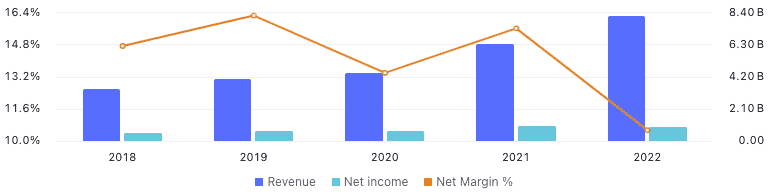

In part, its wonderful results for shareholders have been due to its exceptional net margin. Over the past decade, it’s been 13.3% as a median. That ranks at the very top of its industry peers.

One of the ways it achieves this is by selling its items at a premium due to strong brand positioning. By investing in research and development for fabric and clothing technology innovation, it has been able to command higher price points.

Also, over the past three years, the business has managed an annual 27.8% revenue growth rate. That’s way above the norm for clothes companies, and it indicates demand for Lululemon’s products is heavily increasing.

Risks if I invest

Astute readers will notice that in the above graph, its net margin has seen a bit of a nosedive recently. At the moment, the firm’s net income is slightly lower proportionally compared to its total revenue.

In part this has been the result of a looming recession in the US. But also, there have been financial implications of the firm’s 2022 acquisition of Mirror, a high-tech interactive fitness device for home use. While the purchase should be a net benefit for the firm over the long term, as of right now, it’s taking its toll.

Given that, another thing I need to be aware of is the valuation of the company. It certainly isn’t cheap, with a price-to-earnings ratio of 59. However, as earnings estimates indicate a compound annual growth rate of 16.75% over the next three years, I think the company deserves a premium valuation. But, based on my research, it’s essentially priced for perfection.

Why it’s on my watchlist

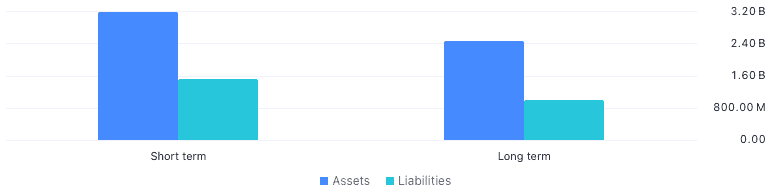

Lululemon is on my radar because I believe it has a very compelling business model that caters to a growing upper middle class in the US and other regions of the world. Additionally, to support its operational advance, its balance sheet is strong and stable, with a healthy amount more equity than debts.

It’s also a refreshing break from the success going on in the technology sector at the moment, and I believe it provides a really strong way to diversify my portfolio.

Therefore, it’s high up on my list when I come to make my next investments.