If, like me, anyone has spent an unhealthy amount of time trying to figure out what’s going on with Rolls-Royce (LSE:RR.) shares, they’re probably as perplexed as I am.

The share price has been increasing in a way that I’m sure many people would agree seems unsustainable. It’s posted positive price gains for 15 out of the past 18 months and is now only 10% away from reaching its highest price ever.

Since early 2023, it has consistently outpaced analyst estimates. Back in February 2023, the average forecast predicted Rolls-Royce shares to be trading at around £1.50 today.

Yet here we are, with the shares at £4 and rising.

And I’m not talking about some meme stock pumped up by irrational fanaticism — this is a £33.5bn company with a share price that would take exceptional clout to nudge just a few points.

In any normal situation, the price rise would be something to celebrate. But I’m looking at a company that’s had negative shareholder equity for as long as I can remember, meaning its total liabilities are greater than its total assets.

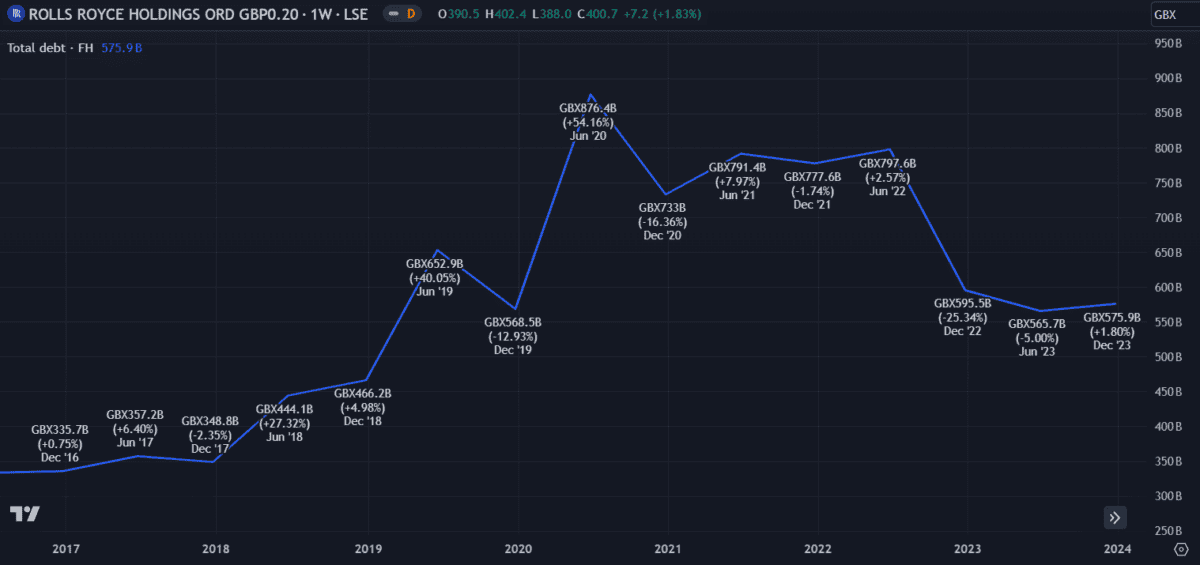

Although its overall debt has been decreasing, its still at £5.7bn, compared with only £3.7bn in cash.

So why are people throwing money into a company that should, on paper, be in a dire financial situation?

Well, because it’s Rolls-Royce. We’ve all heard the phrase, ‘too big to fail’. Yup, it could be one of them.

But is it?

Look, I’m on this ship with everybody else — the last thing I want is for it to sink. But I still want to know that the hull is intact, the tanks are full and the captain is sober.

It’s all fun and games until we hit an iceberg.

So let’s investigate.

Rolls-Royce has had a steady price-to-earnings (P/E) ratio for the past six months, indicating that earnings are growing in line with the share price.

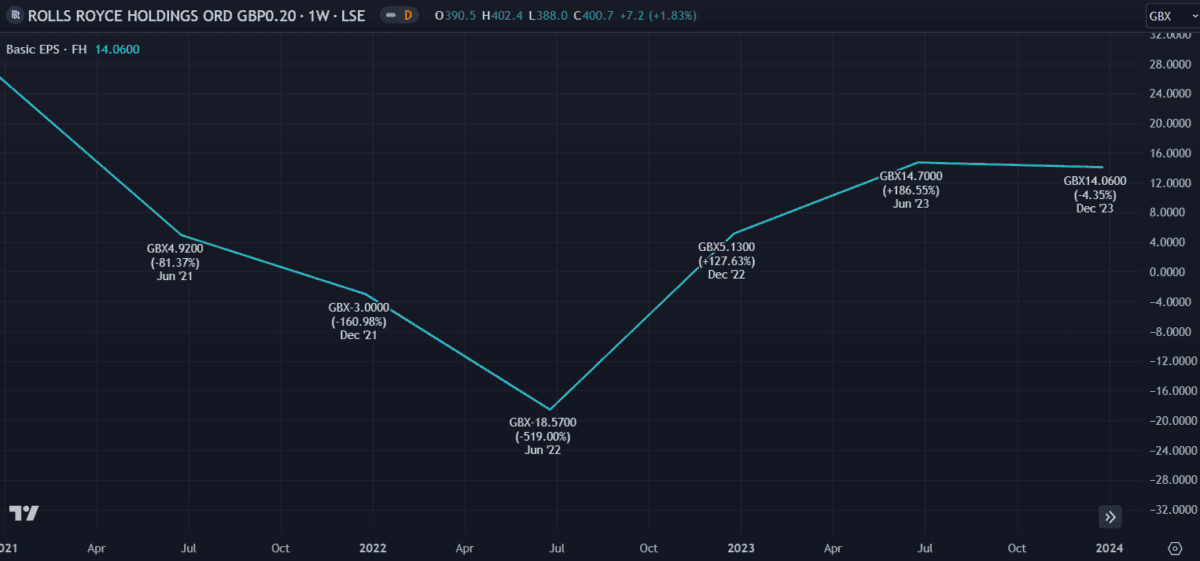

Net income is up to £2.4m from a loss of £1.18m in 2022. Both earnings-per-share (EPS) and operating profit have seen similar improvements, recording positive results after losses in 2022.

These latest figures were reported on 23 February and followed similarly positive quarterly results throughout 2023. With 45.3% earnings growth over the past year, Rolls-Royce has grown four times faster than the aerospace and defence industry.

Those results paint us a clearer picture.

Rolls-Royce is a big name that fell into serious financial trouble — the type that would have otherwise sent investors running for the hills. But rather than flee, investors have grasped this opportunity to buy cheap shares in a company that they’re confident will recover.

So let’s recap.

- An unusual and concerning debt situation.

- Industry-beating earnings growth.

- A P/E ratio that supports price growth.

- Key financial indicators have recently turned positive.

After crunching the numbers, I can only assume that other shareholders have reached the same conclusion as me. In the case of Rolls-Royce, the debt situation is not as dire as it would be for any other company. The high growth potential outweighs the risk and, barring any unforeseen developments, the company and its stock will likely continue to perform well while reducing debt.

Is it 100% risk-free? No company is. But I’m interested to see where this ship sails. I’ll be holding on to my shares for now.