If I were to begin investing in UK shares today, I’d do it by opening a Stocks and Shares ISA. These products are pretty much the same as any other trading account, and I’ve filled my own one with a wide range of FTSE 100 and FTSE 250 shares.

The main difference is that I don’t have to pay a penny to the taxman when I make any capital gains or receive any dividend income in an ISA. With the exception of a handful of securities, I’m able to basically buy and sell the same assets as I would in a general investment account.

The chief drawbacks concern the £20,000 annual allowance. This is the maximum I can invest across all of the ISAs I own. I’m also not able to roll over any unused allowances into the following tax year.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

2 top FTSE 100 shares

For this reason, I’m building a list of FTSE shares to buy for my ISA before this year’s deadline of April 5. I just need to deposit the cash in my account to make use of my contribution limit. But I don’t see any reason to wait before buying: right now, there are stacks of top blue-chip stocks trading below value.

Here are two at the top of my shopping list.

GSK

Purchasing pharmaceutical stocks could prove a lucrative long-term play as healthcare investment stomps higher. The theory is that a combination of rapid population growth and increasing health spending in emerging markets bodes well for drugs developers.

I think FTSE-quoted GSK (LSE:GSK) could be a great way for value investors to play this theme. Enduring concerns over its drugs pipeline mean it trades at a healthy discount to its major industry rivals.

As the chart below illustrates, the firm’s forward price-to-earnings (P/E) ratio of 9.55 times sits comfortably below those of (in descending order) Novo Nordisk, AstraZeneca, Roche and AbbVie, for example.

Created with TradingView

GSK still has a way to go to ease market fears over its pipeline. But heavy investment in recent years is yielding encouraging results: 71 vaccines and medicines were in clinical development as of December. And 18 of these were at the Phase III testing or registration phase.

Now could be a good time for me to buy in at the ground level.

Associated British Foods

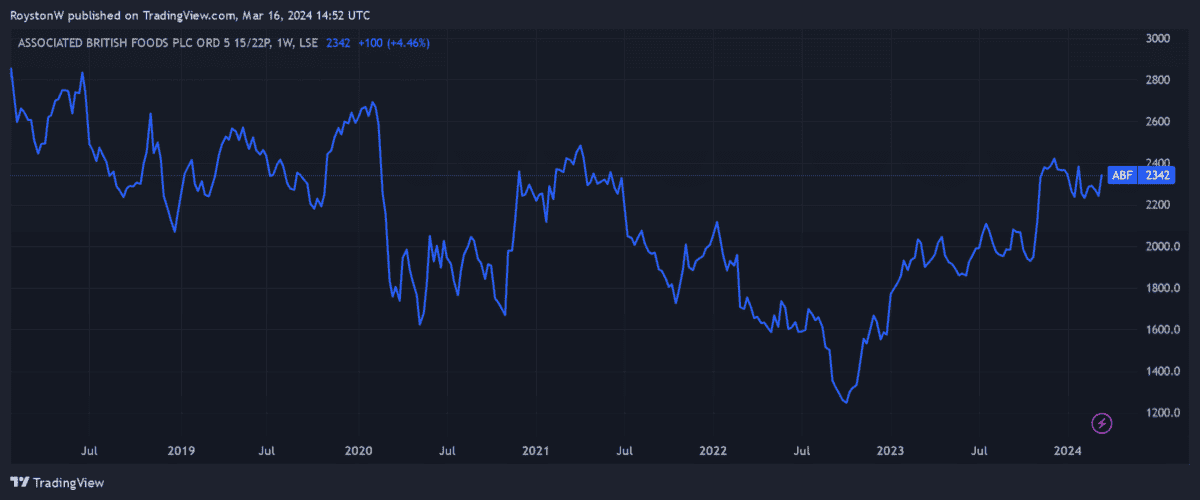

Associated British Foods‘ (LSE:ABF) share price has picked up significant momentum since the end of 2023. But with a price-to-earnings growth (PEG) ratio of 0.5, the Footsie company still looks like a bargain to me.

Any reading below 1 suggests that a stock is undervalued.

This cheapness reflects in part ongoing fears that retail spending may remain weak. But I believe the firm — which owns the Primark low-cost clothing chain — should be fairly immune to these pressures compared to its rivals.

It’s a share I’ve long considered buying to capitalise on its global expansion programme. The business opened another eight stores during the 16 weeks to 6 January across Europe and the US. And it has more store openings in the pipeline to capitalise on growing demand for value fashion.