There are several ways to earn a passive income. Many Britons have gone down the buy-to-let route, and personally I’m not a huge fan of it. It requires plenty of capital up front and the returns really aren’t much to shout about.

Unsurprisingly, I prefer to invest in stocks and shares. And that’s because it’s possible start with nothing and to make sizeable returns just by investing wisely.

How it works

If I’m starting with no money at all, I need to open an investment account and make a commitment to invest a proportion of my salary each month. These days we can start with as little as £50 a month. And while that might not sounds like much, it can add up over time.

Should you invest £1,000 in Restore Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Restore Plc made the list?

However, if I could afford a slightly larger figure, say £250 a month, I could really propel my wealth forward and achieve my passive income goals much sooner.

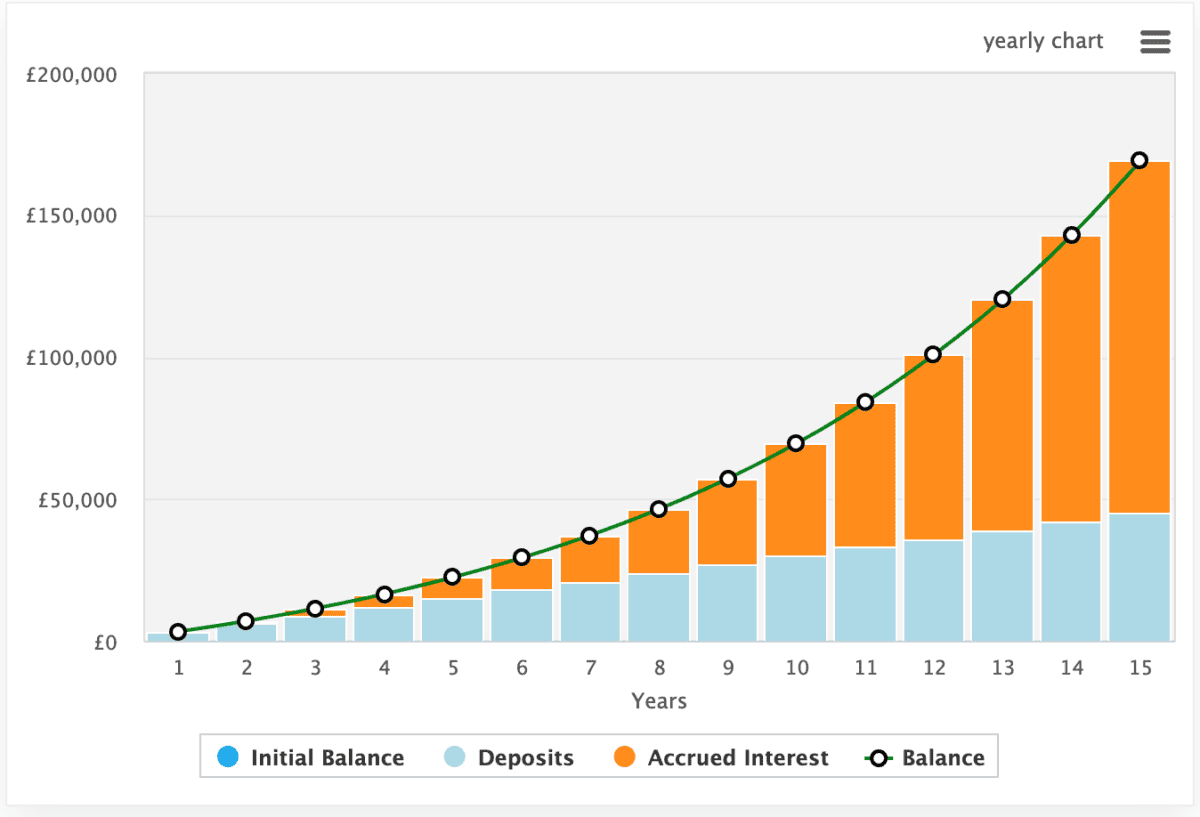

There are then two variables. The first is time. The longer I invest for, the faster my portfolio will grow and the more money I’ll have in the long run. As we can see below, the impact of compounding is huge.

And the second variable is the returns we can achieve. In other words, the success of our investments. A good investor may aim to see their investments grow by 10% a year. But we can do much better. For instance, my daughter’s portfolio is up 32% since I started it five months ago.

In the above example, I’ve been very bold. I’m aiming to average a 15% annualised return — as I do with my daughter’s portfolio. And here we can see that £250 a month has been transformed into £170,000 in just 15 years. If this were invested in stocks averaging an 8% yield, like Legal & General does today, I would be earnings £1,133 a month!

Achieving growth

The big question is how do I achieve an annualised return of 15%? Well, I need to start by recognising that if I invest poorly I could lose money. As such, I have a data-driven approach to help me invest wisely (although success isn’t guaranteed).

One company I’m continuing to invest in is Li Auto (NASDAQ:LI). The Chinese new energy vehicle (NEV) manufacturer is the first of its peer group to achieve profitability and its expected to grow earnings at more than 20% a year over the next three-to-five years.

That’s impressive growth, but it also means that Li’s all-important price-to-earnings-to-growth ratio is under one (0.8) indicating that the firm may be significantly undervalued.

Li has carved out a good chunk of the Chinese market and has earned itself a following through its focus on EREVs (Extended Range Electric Vehicles). The L7, L8, and L9, all have combustion engines and electric engines, providing some staggering ranges — in excess of 1,000km.

I’m wary that Chinese companies may struggle to make progress outside of China, however, I still think the future is bright for Li. It’s got sector-beating margins, and there’s a real buzz about the brand.