I’m looking for the best FTSE 100 stocks to buy to boost my passive income. More specifically, I’m searching for dividend shares that trade on rock-bottom price-to-earnings (P/E) ratios and offer market-beating dividend yields.

Both Lloyds Banking Group (LSE:LLOY) and Rio Tinto (LSE:RIO) shares stand out to me right now. Their vital statistics — and how they stack up with the broader Footsie — can be seen in the table below.

| Forward P/E ratio | Forward dividend yield | |

|---|---|---|

| Lloyds | 7.9 times | 6.5% |

| Rio Tinto | 8.1 times | 7.3% |

| FTSE 100 | 10.5 times | 3.8% |

As you can see, both Lloyds’ and Rio Tinto’s share prices look magnificently cheap compared to the broader blue-chip index. But which would be the better buy for me today?

Tough times

Banks are able to pay regular dividends to their investors, thanks to the regular interest they receive from borrowers. Even during tough times, the essential products they provide like current accounts and credit cards remain in high demand.

This underpins those solid dividend forecasts for Lloyds. But I’m not just looking for large cash rewards today. I’m looking for a stock that will provide me with a strongly growing dividend over time. I’m also searching for a company that can deliver healthy share price gains.

And as the UK economy stagnates, I fear that the Black Horse Bank will deliver subpar returns compared with many other FTSE 100 stocks

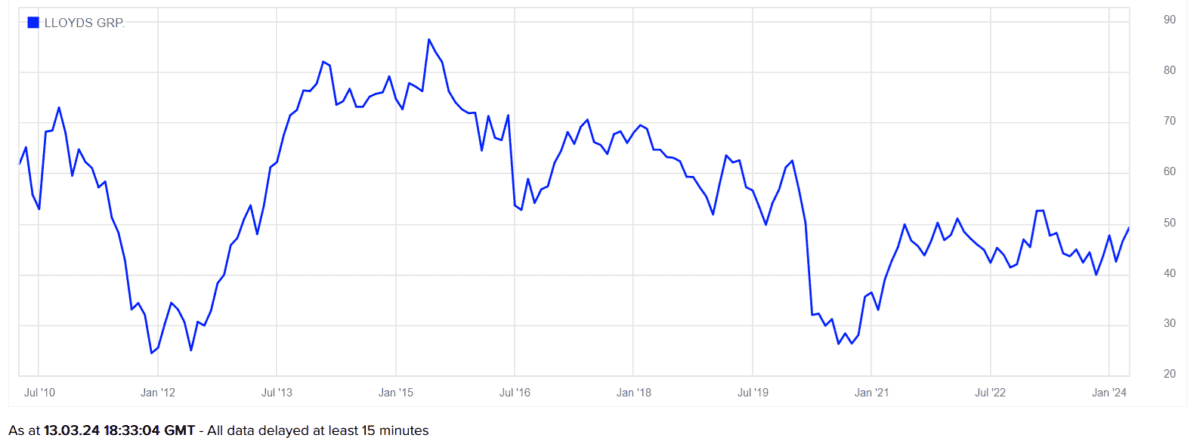

Barring some turbulence before and after the pandemic, British GDP growth has largely remained locked in low single-digits since 2010. And over that time Lloyds’ share price has failed to rise, as the chart below shows.

Worryingly for retail banks, a series of major structural challenges means Britain’s economy looks set to remain locked in this low-growth trend. And this could keep loan growth under pressure.

With the Bank of England expected to start trimming interest rates again, it’s tough to see a potential catalyst for Lloyds’ share price.

A superior stock to own?

Lloyds has a long list of potential obstacles right now. But it doesn’t necessarily mean that Rio Tinto is a better buy today.

Dividends at mining stocks like this are even more volatile during economic downturns. When conditions worsen, commodities demand often dries up rapidly, delivering a hammerblow to earnings and dividends.

And right now, the likes of Rio Tinto are especially vulnerable to problems in China, the world’s biggest metals consumer.

A great long-term buy

That said, I believe the Footsie miner has the capacity to grow profits strongly in the coming decades. This is because revenues here look set to rocket as the world embarks on a new commodities supercycle.

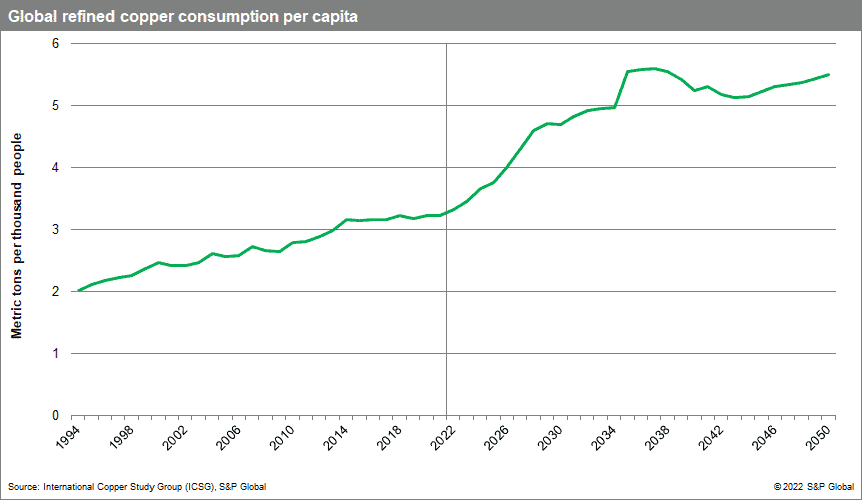

As we can see, copper consumption alone is tipped to rise strongly through to 2050. This is thanks to drivers like global decarbonisation, increasing consumer electronics sales, and rising infrastructure and housing spending across developing and emerging economies.

The demand picture is equally bright for other industrial metals like iron ore, lithium, aluminium and scandium. These are all commodities in which Rio Tinto’s a major player.

Unlike Lloyds, I think the mining giant could deliver excellent share price and dividend growth over the long term. So I’d much rather buy it for my portfolio when I next have cash to invest.