Lots of us invest to earn a second income and support our lives accordingly. However, it can also feel unobtainable for some of us, especially if we’re not starting with a huge amount of capital.

So how can I turn £11,000 into a sizeable second income?

Creating a strategy

Opening a Stocks and Shares ISA is a smart first step. It’s essentially a wrapper that shields my investment from capital gains and income tax. This means when I come to take a second income, it’ll be tax-free.

Should you invest £1,000 in Rolls-Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce made the list?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

It also means my investments can grow at a fastest pace. Because if I’m started with a relatively small amount of capital, I need my investments to grow and compound.

I can also help my portfolio grow faster by making regular contributions. Even as little as £100 a month can significantly enhance the compounding effect, accelerating the growth of wealth over time.

Harnessing the power of compounding

The power of compounding is the true magic in wealth-building. By consistently reinvesting my earnings, each investment and its subsequent returns fuel a cycle of exponential growth.

As returns accumulate, they generate more returns, transforming the initial £11,000 and subsequent contributions into a snowball effect of increasing wealth.

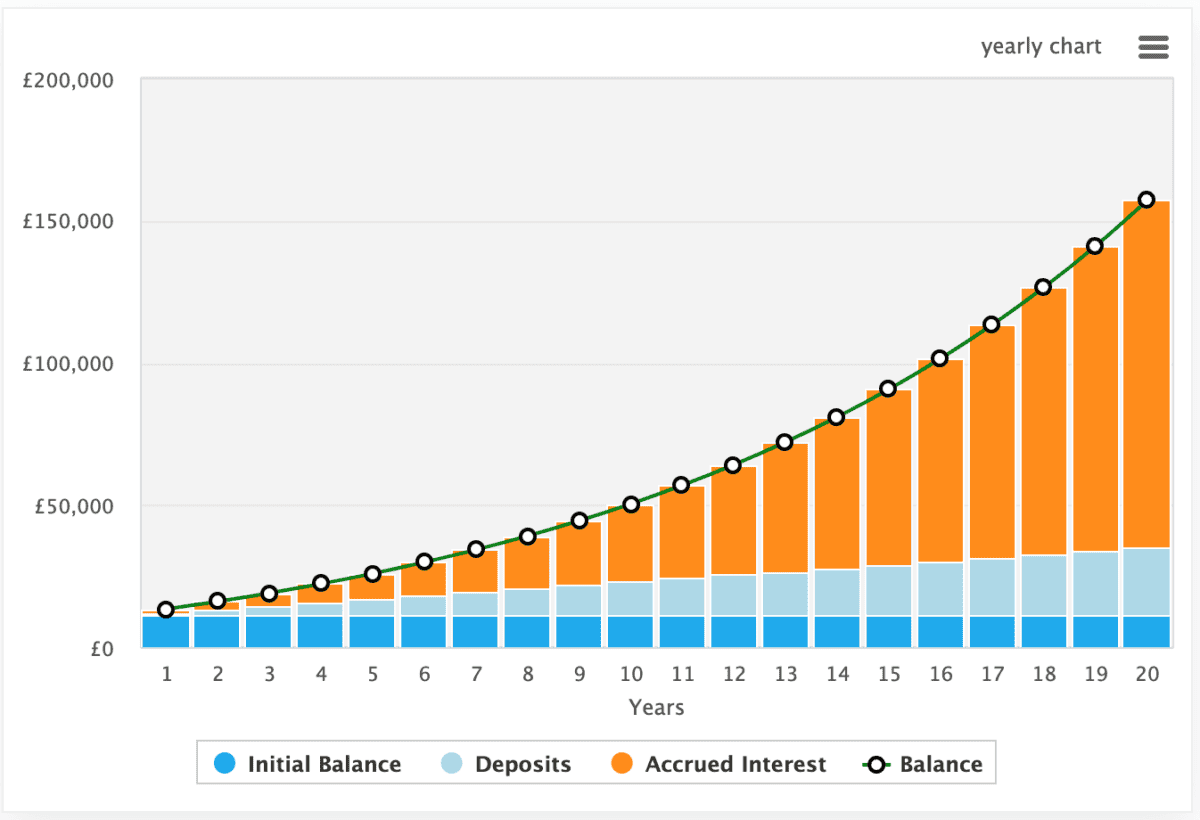

Here’s an example, using an annualised return of 10% and £100 of monthly contributions. As we can see, the speed of growth appears to increase over time. That’s because I’m earning interest on my interest.

After 20 years, I’d have £157k. That’s enough to generate £12,560 a year in passive income, assuming a dividend yield of 8% can be achieved.

Investing wisely

However, if I invest poorly, I’m going to lose money. It’s great to have a strategy where everything works out on paper, but I need to make wise investment decisions. So where should I put my money?

Well, my strategy revolves around finding companies with under-appreciated growth potential. One such company is AppLovin (NASDAQ:APP). It’s a technology firm that helps app and website developers and operators maximise advertising revenue.

The business hasn’t had the smoothest growth trajectory in recent years, and that does represent a risk. But the company appears to have turned a corner. In fact, it’s currently trading at 13.8 times forward earnings and has a price-to-earnings-to-growth (PEG) ratio of 0.69.

This PEG ratio suggests the company is significantly undervalued, driven by the success of its AXON 2 software. It’s also undertaking a shift towards the high-margin software segment, given the maturity of the app business. And this appears to be paying dividends, allowing for more stable growth versus historic averages and margin expansion.

Moreover, I appreciate some investors may be wary of a stock that’s up 381% over the past year. But momentum’s actually a great indicator of future performance. Equally, the growth has been driven by earnings beats. That’s a great sign.