Investing in dividend stocks can be a great way to build a substantial nest egg for retirement. One strategy I’m using to try and get rich is to invest in FTSE 100 dividend stocks.

Any dividends I receive are ploughed back into buying more UK shares. So as the number of shares I own grows, the amount of dividends I receive also rises which, in turn, gives me more money to buy shares… you get the idea.

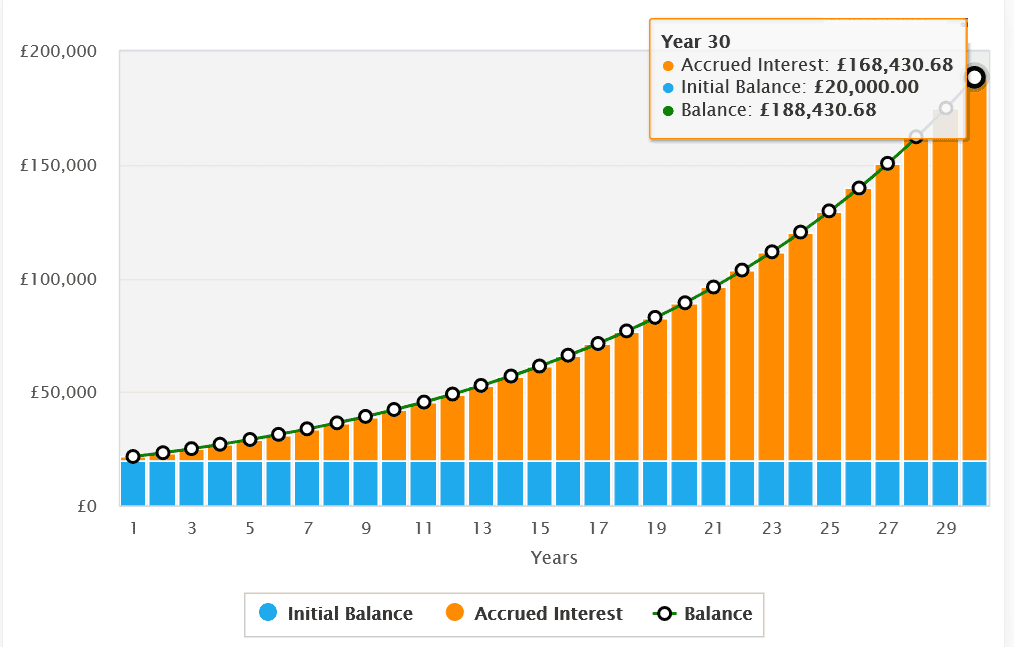

This concept of “earning interest on my interest” is known as compounding. It’s an effect that accelerates over time, and over a period of decades can turbocharge an investor’s wealth, as shown below.

In this example, a £20,000 lump sum investment could turn into £188,430.68 over 30 years. That’s based on the 7.5% average annual return of Footsie shares since 1984.

Millionaire stocks

Investing in FTSE 100 dividend shares is perhaps the best way to play the compounding theme.

Large-cap shares usually have better financial strength and earnings resilience than smaller companies. Combined, these qualities usually give them the firepower to pay large and increasing dividends over the long term.

Recent data from AJ Bell shows this is a common tactic with the ISA millionaires it has on its books. The 10 most popular UK shares with this set of investors all trade on the FTSE 100. And seven of these — including Lloyds, Legal & General and National Grid — all carry dividend yields above the 3.8% index average.

A popular FTSE stock

Shell (LSE:SHEL) sits at the top of this hallowed list. According to AJ Bell, some 39% of the ISA millionaires it services have the oil producer in their portfolio.

This is unsurprising at first glance. Shell — which sits in the top 10 alongside BP — has exceptional cash flows that enables it to pay solid dividends.

Demand for oil stocks has increased too, following the recent jump in energy values.

While oil prices may remain robust, I don’t plan to buy Shell shares for my ISA, even though they offer a 4.5% dividend yield. The long-term investment outlook here remains uncertain as electric vehicle sales and demand for renewable energy takes off.

The FTSE stock isn’t doing itself any favours by scaling back its green energy strategy either. It now plans to reduce the net carbon intensity of the energy it sells by 15% to 20% by the end of the decade as new fossil fuel projects come online.

This is down from a previous target of 20%.

A better buy

I’d much rather use any spare cash to increase the number of Aviva (LSE:AV.) shares I own. It has a far clearer route to generating long-term profits and, by extension, dividends in my portfolio.

The financial services space is exceptionally competitive so companies like this need to paddle extremely hard to win business.

But Aviva — which carries a 7.2% dividend yield — has shown it has the tools to thrive in this cut-throat environment. It’s the largest provider of general and life insurance in the UK, and has leading positions in Ireland and Canada.

And the company will have terrific opportunities to grow business across its protection, insurance and retirement lines as the elderly populations rapidly expand. This is why 28% of AJ Bell’s ISA millionaires currently hold Aviva shares.