I invest almost all of my spare cash at the end of each month in my Stocks and Shares ISA. It’s a strategy that, over time, could help me become one of those much-talked-about stock market millionaires.

It’ll take time, discipline, and maybe even a little bit of luck. But with the right strategy, making a fortune with UK shares is very possible — just ask one of the 4,000+ investors who currently have a six-figure sum (or more) sitting in their ISA today.

The mathematical miracle known as compounding means that even those with a three-figure sum to invest each month can eventually get a seat on Millionaire’s Row. Let me show you how this wealth-building trick works.

Compound gains

Many UK shares pay out dividends to their investors as a proportion of these profits. I can use these to help me with my everyday spending, or to splash out on a luxury purchase.

Alternatively, I can reinvest them to take my eventual returns to the next level. This is the approach I’ve chosen.

I use the dividends I receive to buy more shares in a particular company or range of companies. This reinvestment, over time, leads to a rise in the number of shares I own, which then increases the number of dividends I receive later on.

Over a long period — say a few decades — this ongoing cycle can create life-changing wealth. This is true even for those who only have a few hundred pounds a month to invest.

Wealth building in action

Let’s say I spread £300 a month across FTSE 100 and FTSE 250 shares. If the combined long-term average annual return of 9.3% remains unchanged I would, after 30 years, have £584,781 sitting in my ISA.

If I could bump my monthly investment up to £520 I’d have made an even better £1,013,621. I’d have become one of those famous ISA millionaires!

A top FTSE stock

With my own monthly investment I’ve built a solid, diversified portfolio dominated by FTSE 100 and FTSE 250 shares. This approach helps me to reduce risk by not putting all my eggs in one basket. It also allows me to capitalise on exciting growth opportunities.

Some shares also have highly diversified business models that offer the same benefit. Fast-moving consumer goods giant Unilever (LSE:ULVR) is one such stock I own; it has multiple levels of diversification by:

- Product category: the Footsie firm owns more than 400 brands spread across the personal care, household goods and food segments.

- Geography: Unilever sells its products into more than 190 countries across six continents.

- Brand: the company often has multiple product labels in one category (such as Walls, Ben & Jerry’s, and Magnum in ice cream).

- Supply chain: the business gets its raw materials and other essential products from a wide spectrum of global suppliers.

Unilever is unlikely to ever report spectacular earnings growth in any one year. What’s more, profits can decline from time to time, for example when consumer spending falls and/or input costs rise.

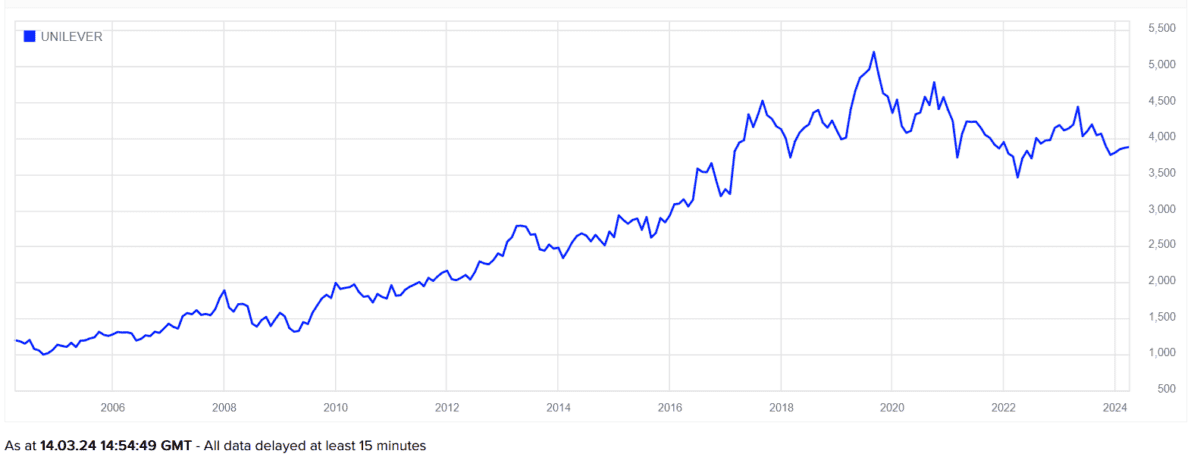

But helped by its diversified operations — not to mention its broad portfolio of heavyweight brands — the company is able to grow earnings almost every year. And over the long term, this has led to healthy share price growth (as shown above) and a steadily rising dividends.